House Insurance Disproportionate - Why?

Discussion

Anyone know any helpful online tools or brokers who can help me identify why the house I am buying is expensive to insure? I'm getting quotes starting at £1500+ and the vendor thinks that's normal. My current place costs £300 ish to insure, and is worth 80% as much and otherwise fairly similar. No serious claim history on the place. Low crime area.

The only issue I can identify is it's just over 100m from a large stream, though the flood risk map (for Wales - seems pretty good on the whole https://flood-risk-maps.naturalresources.wales/?lo... shows no risk to 'my' property from the stream. However it does show significant surface water risk, but for this I believe the map is wrong/outdated as it predates a recent estate built nearby which will have altered how surface water is handled (hopefully for the better). And the vendor says he's had no issue with surface water in his 40 years there anyway (and I believe him).

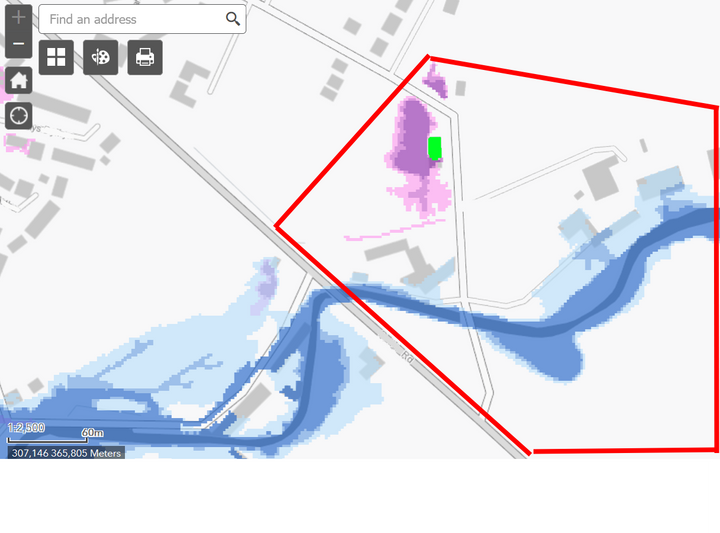

I suspect my issue could be that the postcode covers the stream itself, and a couple of properties at greater risk, so perhaps I'm lumped in with that? Map shows 'my' house in green, and the postcode area (as in Axx xYZ) shared with the house shown outlined in red. There are now numerous houses to the west of my house (inc a couple inside the surface water 'risk' area) whereas it was a grazing field when the map was created. I doubt the insurers' risk database is sophisticated enough to know my house is right next to the (perceived) surface water risk, but it would explain why it's expensive if they do - so how to challenge that if so, or when will the risk map be updated/revised/corrected?

The only issue I can identify is it's just over 100m from a large stream, though the flood risk map (for Wales - seems pretty good on the whole https://flood-risk-maps.naturalresources.wales/?lo... shows no risk to 'my' property from the stream. However it does show significant surface water risk, but for this I believe the map is wrong/outdated as it predates a recent estate built nearby which will have altered how surface water is handled (hopefully for the better). And the vendor says he's had no issue with surface water in his 40 years there anyway (and I believe him).

I suspect my issue could be that the postcode covers the stream itself, and a couple of properties at greater risk, so perhaps I'm lumped in with that? Map shows 'my' house in green, and the postcode area (as in Axx xYZ) shared with the house shown outlined in red. There are now numerous houses to the west of my house (inc a couple inside the surface water 'risk' area) whereas it was a grazing field when the map was created. I doubt the insurers' risk database is sophisticated enough to know my house is right next to the (perceived) surface water risk, but it would explain why it's expensive if they do - so how to challenge that if so, or when will the risk map be updated/revised/corrected?

The place I'm trying to buy, insurance came up quite dear on a comparison site I tried.

I'm currently with LV, they have quoted me something reasonable for the new place.

I do go for high excesses and all that, I regard insurance as 'for disasters not mishaps'.

I think the comparison sites rule out a lot of insurers as soon as you answer yes to questions about trees or rivers?

Is the place listed? That's a world of pain.

I'm currently with LV, they have quoted me something reasonable for the new place.

I do go for high excesses and all that, I regard insurance as 'for disasters not mishaps'.

I think the comparison sites rule out a lot of insurers as soon as you answer yes to questions about trees or rivers?

Is the place listed? That's a world of pain.

If the seller thinks that new quote is "normal " then perhaps it is and simply reflects the Insurers assessment of Flood risk.

You are also "falsely" comparing it to your previous premium for a house that presumably is nowhere near any form of Flood exposure and is also in a different post code etc ?

Having said that errors are sometimes made and the risk isn't what they think so might be best to find a local Insurance Broker and let them do the work ?

You are also "falsely" comparing it to your previous premium for a house that presumably is nowhere near any form of Flood exposure and is also in a different post code etc ?

Having said that errors are sometimes made and the risk isn't what they think so might be best to find a local Insurance Broker and let them do the work ?

ChocolateFrog said:

Jeez. Mine is £110.

Don't buy near streams or rivers, noted.

We looked at a stunning cottage with loads of garden, but was effectively this: (used the OPs photo but the layour is almost identical) - river ran alongside the garden. HIGH risk of surface flooding.Don't buy near streams or rivers, noted.

The garden lawn was soft under foot - in June, this year. We thanked them and ran. Uninsurable I imagine.

Griffith4ever said:

We looked at a stunning cottage with loads of garden, but was effectively this: (used the OPs photo but the layour is almost identical) - river ran alongside the garden. HIGH risk of surface flooding.

The garden lawn was soft under foot - in June, this year. We thanked them and ran. Uninsurable I imagine.

As a market of last resort ( although it is supposedly "affordable" ) that's why Flood Re was set up although whether they insure "everything " I know not. The garden lawn was soft under foot - in June, this year. We thanked them and ran. Uninsurable I imagine.

blueg33 said:

OutInTheShed said:

Is the place listed? That's a world of pain.

In my experience it isn't. I have a grade 2 listed barn conversion parts of its are over 400 years old, its £500 pa including cover for being left empty for long periods of time and for occasional holiday lets.OutInTheShed said:

blueg33 said:

OutInTheShed said:

Is the place listed? That's a world of pain.

In my experience it isn't. I have a grade 2 listed barn conversion parts of its are over 400 years old, its £500 pa including cover for being left empty for long periods of time and for occasional holiday lets.Proper stone mason work is expensive.

Big oak timbers don't come cheap.

You need real craftsmen not jobbing trades, and there's a lot of blokes in suits involved.

And it all takes a long time, during which insurers can be paying for hotels or whatever.

Relatively minor incidents can be big claims on some listed buildings. It's not just fires or other events which completely trash the building, it's minor stuff which on a 60's ordinary house you might not even claim for, 'listed building' can make a claim of 10's of £1000s a lot more likely.

Big oak timbers don't come cheap.

You need real craftsmen not jobbing trades, and there's a lot of blokes in suits involved.

And it all takes a long time, during which insurers can be paying for hotels or whatever.

Relatively minor incidents can be big claims on some listed buildings. It's not just fires or other events which completely trash the building, it's minor stuff which on a 60's ordinary house you might not even claim for, 'listed building' can make a claim of 10's of £1000s a lot more likely.

Thanks for the replies. The place is 1910s but not listed and has pretty conventional construction. Rebuild cost significantly under £1m.

I've now spoken to one of my future neighbours in one of the new builds immediately behind 'my' house (not shown on the flood map, but inside the pink 'surface water risk' area). Their insurance is very reasonable. But their postcode suffix is different. So I guess I need a good broker who I can convince that my position within my postcode suffix is less risky than the houses next to the stream which share the postcode. Any recommendations would we welcomed.

I've now spoken to one of my future neighbours in one of the new builds immediately behind 'my' house (not shown on the flood map, but inside the pink 'surface water risk' area). Their insurance is very reasonable. But their postcode suffix is different. So I guess I need a good broker who I can convince that my position within my postcode suffix is less risky than the houses next to the stream which share the postcode. Any recommendations would we welcomed.

The address is 'Brookhouse'?

It's not quite 'Floodsville' but it's on the spectrum isn't it?

I have friends with significant (coastal) flood risk, their insurance is not bonkers expensive.

Are you sure the flood risk is the only thing pushing up the premium?

Is there any claim history?

Regarding the true flood risk, when I bought a house on fairly flat ground, I bought myself a large scale OS map of the area and took a very good look at the contours.

If you do that for your place, how does it compare with say Boscastle?

A stream is not a problem if the route to the sea from your place is much more open than the route from the hills to your place.

But these days you have to imagine several inches of rain dumping on any few sq miles of hill in maybe six hours and it all wanting to drain at once.

At least the sea goes away when the tide goes out.

Inland, you have to assume rivers and ditches etc will either be mismanaged by idiots, or actively managed to protect bigger towns at your expense.

It's one thing to negotiate an affordable insurance premium, but actually living with true flood risk is another.

Having your house flooded is probably in the top dozen unpleasant things that can happen to you.

If you are not convinced there is negligible true flood risk, it might be good advice to walk away.

It's not quite 'Floodsville' but it's on the spectrum isn't it?

I have friends with significant (coastal) flood risk, their insurance is not bonkers expensive.

Are you sure the flood risk is the only thing pushing up the premium?

Is there any claim history?

Regarding the true flood risk, when I bought a house on fairly flat ground, I bought myself a large scale OS map of the area and took a very good look at the contours.

If you do that for your place, how does it compare with say Boscastle?

A stream is not a problem if the route to the sea from your place is much more open than the route from the hills to your place.

But these days you have to imagine several inches of rain dumping on any few sq miles of hill in maybe six hours and it all wanting to drain at once.

At least the sea goes away when the tide goes out.

Inland, you have to assume rivers and ditches etc will either be mismanaged by idiots, or actively managed to protect bigger towns at your expense.

It's one thing to negotiate an affordable insurance premium, but actually living with true flood risk is another.

Having your house flooded is probably in the top dozen unpleasant things that can happen to you.

If you are not convinced there is negligible true flood risk, it might be good advice to walk away.

Out… has raised some good points not least of which is his “ warning “.

Irrespective of the size of stream etc that zoned out Flood map would start to raise questions of any Insurer - not necessarily painful questions but I can see why the premium will be higher than perhaps you had envisaged.

As I had said previously a good local to you Insurance broker would be where I would start - Howdens ( the old A Plan ) if they have a close enough office maybe ?

Irrespective of the size of stream etc that zoned out Flood map would start to raise questions of any Insurer - not necessarily painful questions but I can see why the premium will be higher than perhaps you had envisaged.

As I had said previously a good local to you Insurance broker would be where I would start - Howdens ( the old A Plan ) if they have a close enough office maybe ?

Gassing Station | Homes, Gardens and DIY | Top of Page | What's New | My Stuff