What are your favourite mid-term S&S ISA funds?

Discussion

Firstly, I appreciate that no fund should ever be set and forget, as the markets go up and down etc etc

However, if you were looking for a fund that you believe in, and would be happy to invest in, what are you go to funds?

The objective being that you don't want to have to actively buy and sell and you'd like to try and beat the interest available.

However, if you were looking for a fund that you believe in, and would be happy to invest in, what are you go to funds?

The objective being that you don't want to have to actively buy and sell and you'd like to try and beat the interest available.

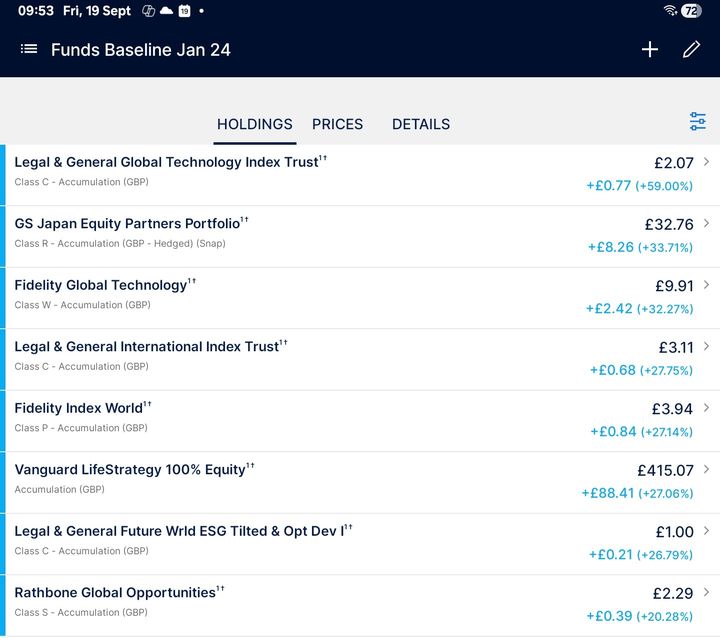

These are mine, baselined at Jan 2024 when I last did a major review. They all have equal money in them...

L&G Global Tech has been the star fund for me.

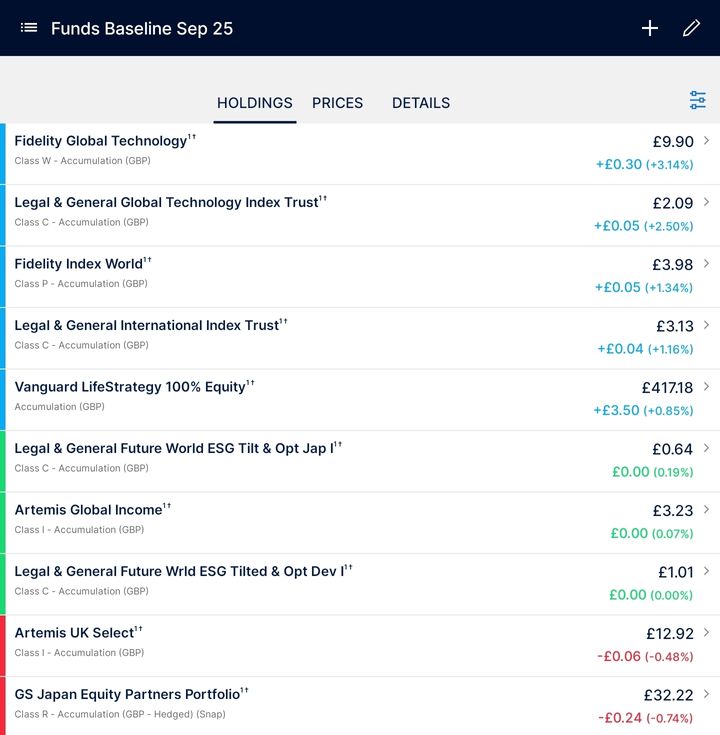

I've just done another review and ditched Rathbone and added 2 new Artemis funds...

My SIPP and ISA hold the same funds.

The screen shots are from my watch lists so ignore the cash figures, they just show 1 unit of each fund. I create a watch list every time I review my funds, so that I can easily track the relative % growth performance from that point in time.

L&G Global Tech has been the star fund for me.

I've just done another review and ditched Rathbone and added 2 new Artemis funds...

My SIPP and ISA hold the same funds.

The screen shots are from my watch lists so ignore the cash figures, they just show 1 unit of each fund. I create a watch list every time I review my funds, so that I can easily track the relative % growth performance from that point in time.

Edited by 98elise on Sunday 21st September 13:24

I’m 90% VHVG and 10% VFEG. You’re basically getting what VWRL offers, but splitting it into two lets you tweak the growth mix and save a bit on fees.

I’ve also got a few speculative stock picks outside of that. Set-and-forget is the goal, and the extras stop me fiddling with the core too much.

Some people swear by just the S&P 500, but I prefer global diversification. At the end of the day, there is no right or wrong with this stuff. What you do really depends on your goals, attitude to risk, and preferences.

I’ve also got a few speculative stock picks outside of that. Set-and-forget is the goal, and the extras stop me fiddling with the core too much.

Some people swear by just the S&P 500, but I prefer global diversification. At the end of the day, there is no right or wrong with this stuff. What you do really depends on your goals, attitude to risk, and preferences.

Everything stocks in my wife’s name is VWRP and everything in my name is now VAFTGAG.

I am employed by an S&P500 Tech firm with significant equity which provides plenty of excitement with its sporadic nature, but when they vest I generally dump into the boring funds.

I am fully bought into the cheap index method of investing, and nearer to retirement age I’ll likely add a bit more of a cash holding. I’ve been doing this for now almost 5 years and have learned a fair bit, but crucially I’ve not sold a single penny in all that time and have just carried on investing. So far the returns look alright (circa 55-65%).

I am employed by an S&P500 Tech firm with significant equity which provides plenty of excitement with its sporadic nature, but when they vest I generally dump into the boring funds.

I am fully bought into the cheap index method of investing, and nearer to retirement age I’ll likely add a bit more of a cash holding. I’ve been doing this for now almost 5 years and have learned a fair bit, but crucially I’ve not sold a single penny in all that time and have just carried on investing. So far the returns look alright (circa 55-65%).

Do these Vanguard funds everyone recommends make most sense held on the vanguard platform?

Reason for asking is that they have fees in the 0.22% range when it’s easy to get the same type of tracker at another reputable provider for 0.14% or maybe less.

I know it’s not loads but I don’t understand why people are happy paying getting on for twice the fee they need to.

Reason for asking is that they have fees in the 0.22% range when it’s easy to get the same type of tracker at another reputable provider for 0.14% or maybe less.

I know it’s not loads but I don’t understand why people are happy paying getting on for twice the fee they need to.

trickywoo said:

I know it s not loads but I don t understand why people are happy paying getting on for twice the fee they need to.

It's a fair point. My (platform) fees are capped and whilst I could get the same for less, I think it's low enough to not worry about. And my second largest fund holding is 0.05%. The other issue is I'm at the point where a transfer to another provider could easily cost me 10,20,30k etc being out of this bull market. Starting from scratch though I think it might be wise to look outside of Vanguard.

Phooey said:

trickywoo said:

I know it s not loads but I don t understand why people are happy paying getting on for twice the fee they need to.

It's a fair point. My (platform) fees are capped and whilst I could get the same for less, I think it's low enough to not worry about. And my second largest fund holding is 0.05%. The other issue is I'm at the point where a transfer to another provider could easily cost me 10,20,30k etc being out of this bull market. Starting from scratch though I think it might be wise to look outside of Vanguard.

For the conveniance of ISA and GIA in one ( feels safe) place ....I'd never chase the pennies

I think the key thing is getting off of the platforms and provides that charge multiple percent first!

I like the vanguard platform and committed to it a while back, it’s not the absolute cheapest and in hindsight I’d have done more analysis of other platforms but I’m happy enough with it as it houses all of our investments and children’s investments and the app works and the support has been good too.

I like the vanguard platform and committed to it a while back, it’s not the absolute cheapest and in hindsight I’d have done more analysis of other platforms but I’m happy enough with it as it houses all of our investments and children’s investments and the app works and the support has been good too.

I'll ask on here as this place seems to have very knowledgeable people.

Are these any good :

https://www.etfstream.com/articles/fidelity-unveil...

if not why ?

Are these any good :

https://www.etfstream.com/articles/fidelity-unveil...

if not why ?

honest_delboy said:

I'll ask on here as this place seems to have very knowledgeable people.

Are these any good :

https://www.etfstream.com/articles/fidelity-unveil...

if not why ?

Impossible to say if they're any good, really, given that they were only launched earlier this month. It's an interesting concept, though.Are these any good :

https://www.etfstream.com/articles/fidelity-unveil...

if not why ?

ooid said:

I have these three, invest and forget style.

MXWS (Invesco MSCI World) - 90%

WLDS (iShares MSCI World Small Cap) - 5%

EMIM (iShares Core MSCI Emerging Markets) - 5%

I rebalance it every 6 months. 3 years annualised return just over 12%.

With such small % in the second two, I'd personally let things run a year or two before worrying about rebalancing.MXWS (Invesco MSCI World) - 90%

WLDS (iShares MSCI World Small Cap) - 5%

EMIM (iShares Core MSCI Emerging Markets) - 5%

I rebalance it every 6 months. 3 years annualised return just over 12%.

I have Aviva Pension Global Equity as my main one, looks similar to MSCI World (looking backwards

).

).Also like (but don't have on my platform) L&G Global 100 Index Trust.

My others are in Aviva Pension North American & BNY Mellon Multi-Asset Balanced....the latter being the tamer part of things.

I sometimes tweak things a little, and am also drawing down, so don't have a handy number of performance over 3 years, although I know it has gone up 32% over those 3 years, having also had those chunks of drawdown out. Feels 'good enough'.

Gassing Station | Finance | Top of Page | What's New | My Stuff