Road tax within the first year cost

Discussion

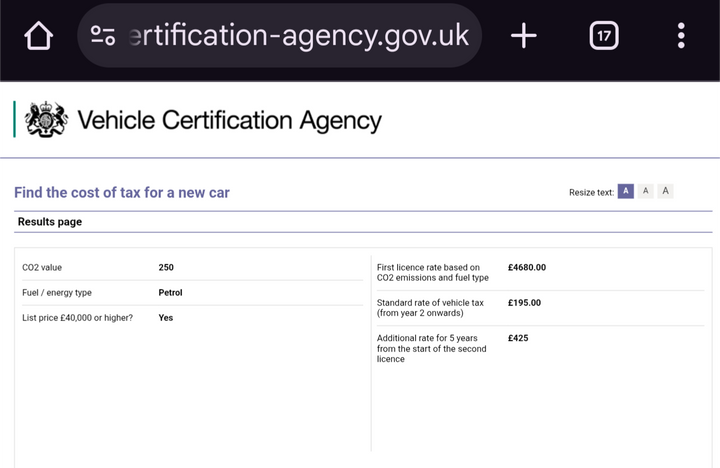

New cars over £40k are hammered with a tax. I understood this to be for the first owner. I've not been told by ChatGPT that even as a second owner on a car which is less that 12months old, will also be subject to the heavy tax. In this case near £6,000. And you'd pay the full 12months (even though that'll take the car beyond 12 months old).

Has chat got it right?

Has chat got it right?

Metric Max said:

IIIAC the heavy tax which i think is tapered applies for about 5 years which is one reason that I have not replaced my 10 year old E Class with a 2/3 year old one

The first year has jumped up for ICE it can be £000's. Year 2-5 is then higher if the car is over £40k new. Luxury cars of course.TX.

The 1st registration is the only one based on emissions and lasts up to 1 year, subsequent taxing of the vehicle is either £195/year or £620 if list price is over £40k, from when the vehicle is 1 month to 6 years old.

E.g.

https://carfueldata.vehicle-certification-agency.g...

E.g.

https://carfueldata.vehicle-certification-agency.g...

Thanks.

I'm still not sure my question has been answered or I'm just not seeing it.

The car in question is 2 months old. I'll be the second owner. The road tax was £5490 for the first owner. My understanding is that when I come to tax it I'll also have to pay £5490. First owner will get a rebate on whole months.

Have I got this right?

I'm still not sure my question has been answered or I'm just not seeing it.

The car in question is 2 months old. I'll be the second owner. The road tax was £5490 for the first owner. My understanding is that when I come to tax it I'll also have to pay £5490. First owner will get a rebate on whole months.

Have I got this right?

From https://www.pistonheads.com/gassing/topic.asp?h=0&...

samoht said:

On the refunds section it says

i.e. they don't refund the first-year surcharge to the first owner.

Combined with the fact that the higher rate is described as "First tax payment when you register the vehicle" and the subsequent rates as "Rates for second tax payment onwards", I would infer that

(a) you won't need to worry about paying any of the initial £1600 again, and

(b) you'll be paying the 'second tax payment onwards' rate plus the luxury surcharge if applicable on the new price, as described above.

gov.uk said:

Refund for the first tax payment on the vehicle

The amount you get back will be based on whichever is lower of:

the first tax payment when you registered the vehicle

the rate for the second tax payment onwards

https://www.gov.uk/vehicle-tax-refundThe amount you get back will be based on whichever is lower of:

the first tax payment when you registered the vehicle

the rate for the second tax payment onwards

i.e. they don't refund the first-year surcharge to the first owner.

Combined with the fact that the higher rate is described as "First tax payment when you register the vehicle" and the subsequent rates as "Rates for second tax payment onwards", I would infer that

(a) you won't need to worry about paying any of the initial £1600 again, and

(b) you'll be paying the 'second tax payment onwards' rate plus the luxury surcharge if applicable on the new price, as described above.

SuperPav said:

No. If you buy it at 2 months old you will only pay the standard rate tax plus the luxury supplement (so £600 ish in total or whatever it is this year) not the co2 based registration VED which is due at point of registration only.

So does the person who bought it new get any rebate?TX.

Terminator X said:

So does the person who bought it new get any rebate?

TX.

They get a pro-rata rebate of the same standard rate.TX.

Nobody gets the first year big bill refund back. Registration sunk cost.

Note it works the other way round on BEV's as well.... first year rate is £0, if you sell within first year you get £0 back. 2nd buyer would (even at 2 months old) would be paying ~£600.

They've got the system sorted

(P.S. I discovered all this as i've purchased both a £10 1st year RFL PHEV, as well as a £3k 1st year RFL diesel, both at ~1 month old from registration. Both had to be taxed at the standard annual rate when I bought them)

SuperPav said:

They get a pro-rata rebate of the same standard rate.

Nobody gets the first year big bill refund back. Registration sunk cost.

Note it works the other way round on BEV's as well.... first year rate is £0, if you sell within first year you get £0 back. 2nd buyer would (even at 2 months old) would be paying ~£600.

They've got the system sorted

(P.S. I discovered all this as i've purchased both a £10 1st year RFL PHEV, as well as a £3k 1st year RFL diesel, both at ~1 month old from registration. Both had to be taxed at the standard annual rate when I bought them)

Quite so. Nobody gets the first year big bill refund back. Registration sunk cost.

Note it works the other way round on BEV's as well.... first year rate is £0, if you sell within first year you get £0 back. 2nd buyer would (even at 2 months old) would be paying ~£600.

They've got the system sorted

(P.S. I discovered all this as i've purchased both a £10 1st year RFL PHEV, as well as a £3k 1st year RFL diesel, both at ~1 month old from registration. Both had to be taxed at the standard annual rate when I bought them)

I have never understood the 5 year additional premium though. If within the following year a car is sorned or the road tax refunded does the five year premium tax stop the clock or not?

Not clear on any site but I believe it stops the clock and you or whoever taxes the car finds out 5 years might be indeed be many more. Anyone know?

Winston Wolf said:

Quite so.

I have never understood the 5 year additional premium though. If within the following year a car is sorned or the road tax refunded does the five year premium tax stop the clock or not?

Not clear on any site but I believe it stops the clock and you or whoever taxes the car finds out 5 years might be indeed be many more. Anyone know?

5 years starts from registration. Tax refund and SORN shouldn't make any difference so no stopping the clock. Export and re-import might cause a system meltdown but we're into really niche use cases here....I have never understood the 5 year additional premium though. If within the following year a car is sorned or the road tax refunded does the five year premium tax stop the clock or not?

Not clear on any site but I believe it stops the clock and you or whoever taxes the car finds out 5 years might be indeed be many more. Anyone know?

SuperPav said:

5 years starts from registration. Tax refund and SORN shouldn't make any difference so no stopping the clock. Export and re-import might cause a system meltdown but we're into really niche use cases here....

It actually starts from the date the car is taxed for the second time so normally year 2 to 6.However, if the car is resold or SORNed within the first 12 months it will be 5 years from retaxing so the period is reduced accordingly by up to 12 months.

Gassing Station | General Gassing | Top of Page | What's New | My Stuff