Investment funds given local and global economic outlook

Discussion

I think it would be fair to conclude without being alarmist that the UK, EU and global economic outlooks appear to have higher risks than in recent years.

In which case, do the PH financial gurus think that hands-off investors with ISAs and pensions in funds such as Vanguard LifeStrategy should adjust their share/bond ratio to lessen potential losses? Perhaps to switch to a fund with a lower risk factor?

In which case, do the PH financial gurus think that hands-off investors with ISAs and pensions in funds such as Vanguard LifeStrategy should adjust their share/bond ratio to lessen potential losses? Perhaps to switch to a fund with a lower risk factor?

ecs0set said:

I think it would be fair to conclude without being alarmist that the UK, EU and global economic outlooks appear to have higher risks than in recent years.

In which case, do the PH financial gurus think that hands-off investors with ISAs and pensions in funds such as Vanguard LifeStrategy should adjust their share/bond ratio to lessen potential losses? Perhaps to switch to a fund with a lower risk factor?

If you’re investing for the long term, do nothing.In which case, do the PH financial gurus think that hands-off investors with ISAs and pensions in funds such as Vanguard LifeStrategy should adjust their share/bond ratio to lessen potential losses? Perhaps to switch to a fund with a lower risk factor?

An acquaintance told me about 2 years ago that things were looking likely that there was going to be a bit of a stock market crash and he was going to cash, still don't know whether he's back in the market but he's certainly missed out on some decent gains.

If you're sufficiently diversified, just sit on your hands.

If you're sufficiently diversified, just sit on your hands.

YouWhat said:

If you’re investing for the long term, do nothing.

Whilst I sort of agree with this I would also suggest people think whether their appetite for risk is really what they think it is.It's very easy to be bullish and risk-on when everything is going up.

Sideways and down can often focus minds.

b hstewie said:

hstewie said:

hstewie said:

hstewie said: Whilst I sort of agree with this I would also suggest people think whether their appetite for risk is really what they think it is.

It's very easy to be bullish and risk-on when everything is going up.

Sideways and down can often focus minds.

I’ve been investing in my pension and S&S ISA for 35 years and that’s exactly what I’ve been doing, investing every month in passive index funds, never in Bonds. During that time the markets have seen many dips and “crashes” and I’m glad I ignored all the noise. I’m more than happy with the results. It's very easy to be bullish and risk-on when everything is going up.

Sideways and down can often focus minds.

YouWhat said:

I’ve been investing in my pension and S&S ISA for 35 years and that’s exactly what I’ve been doing, investing every month in passive index funds, never in Bonds. During that time the markets have seen many dips and “crashes” and I’m glad I ignored all the noise. I’m more than happy with the results.

This, there are some stats (that I can't find) that say something like that if you miss out on the 10 or so biggest "gain days" in a 10 year period then you basically wipe out all of your potential stock market gains, and that the biggest gain days occur shortly (within days or weeks) after the biggest loss days / crashes.i.e. If you were somehow so spectularly smart / lucky that you did pull out before the next crash, it is highly highly unlikely that you'd go back in in time for the upswings and you'd lose overall anyway.

The smart play is to invest and don't look - if you do look and it is down, then be glad that you can buy in at a lower price point and invest more, and then don't look!

(You only have to go back to Feb where a bunch of folks tried to time Trump's tariff news and missed out exactly as above -- They thought they were being cautious by selling after the first dip, but they were actually making the riskiest play of all and sold at exactly the wrong time. I on the other hand bought more

)

)Good thread and something I've been very much thinking about.

Just had a bit of money from a pension land in my bank and now it's coming to actually investing it, I read all the economy doom and gloom and find myself struggling to actually do it. I was looking at putting some into a Vanguard Lifestrategy and a HL stocks and shares ISA.

This investment needs to give me a bit of a return over the next 10 yrs (hopefully) but the listening too hard and subsequent worry is holding me back.

Just had a bit of money from a pension land in my bank and now it's coming to actually investing it, I read all the economy doom and gloom and find myself struggling to actually do it. I was looking at putting some into a Vanguard Lifestrategy and a HL stocks and shares ISA.

This investment needs to give me a bit of a return over the next 10 yrs (hopefully) but the listening too hard and subsequent worry is holding me back.

nordboy said:

Good thread and something I've been very much thinking about.

Just had a bit of money from a pension land in my bank and now it's coming to actually investing it, I read all the economy doom and gloom and find myself struggling to actually do it. I was looking at putting some into a Vanguard Lifestrategy and a HL stocks and shares ISA.

This investment needs to give me a bit of a return over the next 10 yrs (hopefully) but the listening too hard and subsequent worry is holding me back.

I think the normal (definitely not advice) advice is that if you are nervous, then drip feed it in - DCA style. Pick a day of the month, divide the total by 12 and deposit monthly regardless of that day's price. That way you get to average out the daily ups and downs and get it invested over the time you want. Just had a bit of money from a pension land in my bank and now it's coming to actually investing it, I read all the economy doom and gloom and find myself struggling to actually do it. I was looking at putting some into a Vanguard Lifestrategy and a HL stocks and shares ISA.

This investment needs to give me a bit of a return over the next 10 yrs (hopefully) but the listening too hard and subsequent worry is holding me back.

nordboy said:

Good thread and something I've been very much thinking about.

Just had a bit of money from a pension land in my bank and now it's coming to actually investing it, I read all the economy doom and gloom and find myself struggling to actually do it. I was looking at putting some into a Vanguard Lifestrategy and a HL stocks and shares ISA.

Just to say HL is an expensive way to hold LifeStategy as HL are expensive for holding what are called "funds" which is what LS is. https://monevator.com/compare-uk-cheapest-online-b... has a table of platforms and their fee structures.Just had a bit of money from a pension land in my bank and now it's coming to actually investing it, I read all the economy doom and gloom and find myself struggling to actually do it. I was looking at putting some into a Vanguard Lifestrategy and a HL stocks and shares ISA.

YouWhat said:

I’ve been investing in my pension and S&S ISA for 35 years and that’s exactly what I’ve been doing, investing every month in passive index funds, never in Bonds. During that time the markets have seen many dips and “crashes” and I’m glad I ignored all the noise. I’m more than happy with the results.

Sure and in spreadsheet land I agree.But not everyone has the stomach and risk appetite for 100% stocks - that was my point - and when you're 30% down it's a bit late to realise that.

Happy with 100% stocks fill your boots exactly as you said - but multi-asset funds exist for a reason

Both retired late 50's / 60 pensions sorted

I'm still piling into a mix of VLS60 and VLS80 coming up to £260k, this is simply spending money, might use it for one last house move but not essential as we could happilly see out time in the current house.

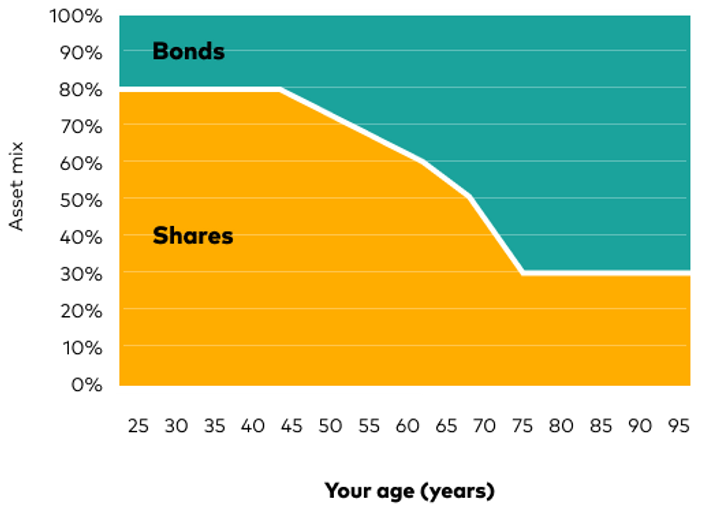

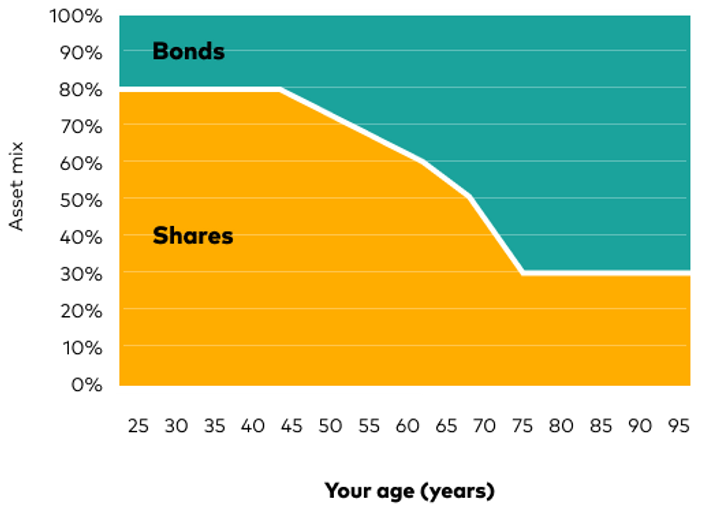

Any thoughts considering our age, should we de -risk. I think the Vanguard target retirement fund for our age is roughly in line with our current investments not that I've intentially stuck to this.

Does this chart make sense ?

I'm still piling into a mix of VLS60 and VLS80 coming up to £260k, this is simply spending money, might use it for one last house move but not essential as we could happilly see out time in the current house.

Any thoughts considering our age, should we de -risk. I think the Vanguard target retirement fund for our age is roughly in line with our current investments not that I've intentially stuck to this.

Does this chart make sense ?

DT1975 said:

Both retired late 50's / 60 pensions sorted

I'm still piling into a mix of VLS60 and VLS80 coming up to £260k, this is simply spending money, might use it for one last house move but not essential as we could happilly see out time in the current house.

Any thoughts considering our age, should we de -risk. I think the Vanguard target retirement fund for our age is roughly in line with our current investments not that I've intentially stuck to this.

Does this chart make sense ?

You do need to understand bonds though. If you look at the performance of pretty much any given bond fund you will see some big swings. In the 2021 / 2022 period for example double digit percentage falls were common. Not what most people would expect from bonds.I'm still piling into a mix of VLS60 and VLS80 coming up to £260k, this is simply spending money, might use it for one last house move but not essential as we could happilly see out time in the current house.

Any thoughts considering our age, should we de -risk. I think the Vanguard target retirement fund for our age is roughly in line with our current investments not that I've intentially stuck to this.

Does this chart make sense ?

LeoSayer said:

Yes, history shows long-term generally works.

There have obviously been bad periods, probably the worst being 1930s and 1940s.

As you can see from the chart, it took about 25 years to regain the previous high.

I dont know great detail about the 1929 crash, but it is Interesting to note the very steep increase prior to that crash.

That line might suggest hugely over inflated share prices prior to the crash.

In the 'Black Monday' crash of 1987 (it was not just the Monday) there was huge panic selling.

I did not know enough at that time, so just sat doing nothing. Should have been buying.

A full year chart of 1987 shows first another steep increase, then the crash, but by the year end the UK market was up about 3% on the year. So there was no need to panic. It was a market over valuation which led to that crash.

Although the 1987 crash was frightening at the time, that crash hardly even shows as a dip, on current long-term charts.

That probably emphasises that a long-term strategy can be successful and also means no gambling by dancing in and out of markets. .

Edited by Jon39 on Thursday 4th September 14:17

Gassing Station | Finance | Top of Page | What's New | My Stuff