Noob investor - what do I need to know to get started?

Discussion

Over on the 'Threat to ISAs' thread it diverged a little into wider comment about Rachel from Accounts' proposals to try and push Cash ISA savers to move that to S&S ISAs (ideally, she evidently hopes, with a view to us all investing in UK firms). I posted that I'm pretty much exactly that target saver with a chunk of money in a Cash ISA and no idea what I'd be doing if I had to invest it via S&S ISA.

A number of PHers have given some helpful and welcome input and I thought it might be worth breaking it out into a separate thread so as not to derail the ISA one. I'll post here what I posted there and hopefully it can continue here...

And the Trump tarrifs thing is a particularly bad justification- because four months on, markets are back at or near all time highs.I'll be honest I think that is perhaps a little harsh; the reason I haven't invested yet is because I know I could easily make some bad/rookie error decisions and see the money I've worked hard to save disappear. I need advice but to anyone in a position to advise, I'm small fry and probably not worth their time.

I'm not saying 'S&S ISAs are crap' or 'don't invest!!' - I just don't know what I should be doing without making dumb or ill-informed mistakes and putting potentially a large chunk of hard-earned savings at risk.I saved up a chunk of cash for a house deposit starting in 2014. I didn t know then that it would be ten years before I actually bought. Diligently shuffling ISAs to achieve 1% while stock markets more than doubled.

The lesson I learned in my 20s and early 30s was a different one from you!

Also ten years ago a family member told me to buy some shares in something so I watched how that developed (poorly) and later read the book Millionaire Teacher by Andrew Hallam. Started playing around with index funds in small amounts in a GIA in 2023.

I have nothing to crow about, but you have time on your side and IMO should get comfortable with taking some risk, you will have plenty of years in later life to dial those risks back again.

ETA: If you wonder what point I was trying to make in the middle there, it was that I got used to the moods of the markets. I can honestly say I didn t lose a moment s sleep during the recent turbulence.

Put an amount you're comfortable seeing halve in an equity ISA.

Look at it perhaps every 3 months now you have some skin in the game.

Glance at the FT's headlines (which are free) to understand what moves things.

Look back over the past twenty years at the way the pricing on share indices has moved, and correlate them with news stories.

That would take you perhaps a weekend and then 5 minutes a day and would leave you with a reasonable enough understanding you'd be very unlikely to do anything foolish.

How is your pension invested?Thanks, that was a really helpful read and made a lot of sense.

Appreciate I'm derailing the conversation and this isn't the 'help Funk learn to invest' thread so I'll hide this in spoiler tags...

Using your 'if it halved' approach, I think I could live with losing £5-7.5k - I'd wince, but it wouldn't materially change anything for me - so on that basis move £10-15k into the S&S ISA and invest with that?

As I've maxed out the ISA allowance for 25-26 would it also be logical to put a chunk of money into a GIA and invest that too to make use of the £3k CGT allowance?

Pension is nothing special - I was auto-enrolled into Nest when it was rolled out and I've just left it to it with my 5% and employer's 3% contributions monthly. I probably should be paying more into it (or setting up a SIPP that might perform better?) but I have plans to move home at some point so having a large amount tied up in a pension pot can't access for another decade or so would be less appealing as it might be better to use that (or some of it) so I don't need to borrow as much on a mortgage. I do appreciate it needs to form part of my overall longer-term strategy at some stage though.

If I'm thinking along the right lines, it makes sense to keep the Cash ISA for emergencies/short term need, S&S ISA for mid- to long-term investment (but still accessible if required) and pension for long-term which not to be accessed until I retire?

One thing i learned way too late with regards to my pensions is that the funds you are put into by default are often poor for returns. The financial advisor who signed you up for a pension are often never seen again and the funds are often too low risk to make decent long term gains.

If you want to get more out of it, you need to spend some time to learn about what options are there. A lot of pensions use managed funds which switch the risk level as you get closer to your retirement age, so when you get within 5 years of your chosen retirement age you'll have more of your fund switched to cash and lower risk equities and less in the riskier equities.

That's fine if you told the FA a realistic retirement age you were targeting, but most people state an unrealistic age, they use what they hope to be possible, rather than what is genuinely practical. What you often find is people state an age 5-15 years earlier than they actually retire at, so they lose out on 5-10 years growth, that is highly damaging to their pension pot size.

If you currently have a pension, check what your retirement age is set to and be sure it matches what you are likely to do, not what you'd like to do. At the same time take a look at which funds you are invested in and see if those are matching your risk appetite and term to your true retirement age.

I did this properly about 10 years ago, and realised a lot of my funds were in too low risk and growth potential funds, and were invested in regions that were expected to be high growth areas that never materialised. Back in the day Japan was the big growth story, but it never materialised, it did the complete opposite and has been in that malaise for 20 years, so it's worth reassessing everything at least once a year.

Taking a look at this has made a huge difference to my older pensions, i diversified into funds that had some higher risk for some of it, lower risk for others, some exposure to currency changes, some without. It's fascinating to see how each approach has played out over the last 10, 5, 3 and 1 years.

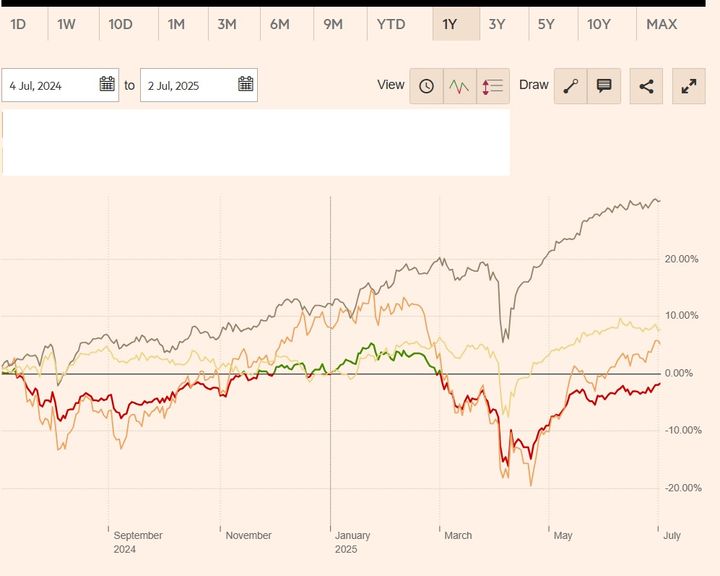

This is my returns in 4 of the funds i invested one of my pensions in, this doesn't include any dividends, this is just the core share price value, so for example some of the lower growth returns on share price, have some of the highest dividends, the highest growth fund which is tech stocks, have very low dividends, so the share price is closer to the true value increase.

It can be extremely confusing, and as you get older and nearer retirement, you do look at reducing risk. The issue there is a lot of funds which are rated as low/minimum risk on their fund sheet, has been disastrous and turned out to be high risk in the environment we have lived through over the last few years. It's important to have money in all the various areas you need as you go through life, from cash reserve to see you through the loss of job or family emergency, to wealth building for retirement. Do whatever you can to reduce your tax liability, because that saps your wealth, especially long term. This applies to anyone, it's not just those will real money this affects, its plebs like me who have only earned average income.

Gone off topic regarding cash ISA's, but if you can get anything from my basic experience then worth the segway.

10 Year returns

5 Year returns

3 Year returns

1 Year returns

A number of PHers have given some helpful and welcome input and I thought it might be worth breaking it out into a separate thread so as not to derail the ISA one. I'll post here what I posted there and hopefully it can continue here...

Hustle_ said:

Funk said:

Hustle_ said:

Funk said:

I'm probably exactly the kind of person Rachel from Accounts is trying to manipulate encourage - I've got just over £40k in a cash ISA currently at 4.1% which I know can't go down. I've never invested in my life, I wouldn't know where to begin and at the moment I don't have time - or inclination - to try and learn.

I was someone who grew up with nothing, as a kid we were a poor family and just about scraped through. I then swung completely the other way and was offered ridiculous amounts of money on cards and loans in my 20s; amounts I should never realistically had thrown at me. I spent my late 20s and early 30s fixing that and paying off tens of thousands of pounds.

I learned the lesson - along with the value of money - and as such I'm now probably too cautious with (or perhaps protective of) my money. I don't want to see what I've worked hard for and saved disappearing due to unforeseen 'market forces' in a downturn or thousands being wiped just because some mental-case orange man-child in a White House declares 'TARIFFS FOR EVERYONE!" one afternoon and crashes markets gloablly.

I don t want to come off overly harsh but in the context of everything else you said, that just reads like another bad financial decision to me (not investing). It s a decision which could well cost you considerably more than the credit cards and loans. I was someone who grew up with nothing, as a kid we were a poor family and just about scraped through. I then swung completely the other way and was offered ridiculous amounts of money on cards and loans in my 20s; amounts I should never realistically had thrown at me. I spent my late 20s and early 30s fixing that and paying off tens of thousands of pounds.

I learned the lesson - along with the value of money - and as such I'm now probably too cautious with (or perhaps protective of) my money. I don't want to see what I've worked hard for and saved disappearing due to unforeseen 'market forces' in a downturn or thousands being wiped just because some mental-case orange man-child in a White House declares 'TARIFFS FOR EVERYONE!" one afternoon and crashes markets gloablly.

And the Trump tarrifs thing is a particularly bad justification- because four months on, markets are back at or near all time highs.

I'm not saying 'S&S ISAs are crap' or 'don't invest!!' - I just don't know what I should be doing without making dumb or ill-informed mistakes and putting potentially a large chunk of hard-earned savings at risk.

The lesson I learned in my 20s and early 30s was a different one from you!

Also ten years ago a family member told me to buy some shares in something so I watched how that developed (poorly) and later read the book Millionaire Teacher by Andrew Hallam. Started playing around with index funds in small amounts in a GIA in 2023.

I have nothing to crow about, but you have time on your side and IMO should get comfortable with taking some risk, you will have plenty of years in later life to dial those risks back again.

ETA: If you wonder what point I was trying to make in the middle there, it was that I got used to the moods of the markets. I can honestly say I didn t lose a moment s sleep during the recent turbulence.

732NM said:

Funk said:

xeny said:

Funk said:

I'll be honest I think that is perhaps a little harsh; the reason I haven't invested yet is because I know I could easily make some bad/rookie error decisions and see the money I've worked hard to save disappear. I need advice but to anyone in a position to advise, I'm small fry and probably not worth their time.

I'm not saying 'S&S ISAs are crap' or 'don't invest!!' - I just don't know what I should be doing without making dumb or ill-informed mistakes and putting potentially a large chunk of hard-earned savings at risk.

Read https://monevator.com/why-a-total-world-equity-ind...I'm not saying 'S&S ISAs are crap' or 'don't invest!!' - I just don't know what I should be doing without making dumb or ill-informed mistakes and putting potentially a large chunk of hard-earned savings at risk.

Put an amount you're comfortable seeing halve in an equity ISA.

Look at it perhaps every 3 months now you have some skin in the game.

Glance at the FT's headlines (which are free) to understand what moves things.

Look back over the past twenty years at the way the pricing on share indices has moved, and correlate them with news stories.

That would take you perhaps a weekend and then 5 minutes a day and would leave you with a reasonable enough understanding you'd be very unlikely to do anything foolish.

How is your pension invested?

Appreciate I'm derailing the conversation and this isn't the 'help Funk learn to invest' thread so I'll hide this in spoiler tags...

Using your 'if it halved' approach, I think I could live with losing £5-7.5k - I'd wince, but it wouldn't materially change anything for me - so on that basis move £10-15k into the S&S ISA and invest with that?

As I've maxed out the ISA allowance for 25-26 would it also be logical to put a chunk of money into a GIA and invest that too to make use of the £3k CGT allowance?

Pension is nothing special - I was auto-enrolled into Nest when it was rolled out and I've just left it to it with my 5% and employer's 3% contributions monthly. I probably should be paying more into it (or setting up a SIPP that might perform better?) but I have plans to move home at some point so having a large amount tied up in a pension pot can't access for another decade or so would be less appealing as it might be better to use that (or some of it) so I don't need to borrow as much on a mortgage. I do appreciate it needs to form part of my overall longer-term strategy at some stage though.

If I'm thinking along the right lines, it makes sense to keep the Cash ISA for emergencies/short term need, S&S ISA for mid- to long-term investment (but still accessible if required) and pension for long-term which not to be accessed until I retire?

One thing i learned way too late with regards to my pensions is that the funds you are put into by default are often poor for returns. The financial advisor who signed you up for a pension are often never seen again and the funds are often too low risk to make decent long term gains.

If you want to get more out of it, you need to spend some time to learn about what options are there. A lot of pensions use managed funds which switch the risk level as you get closer to your retirement age, so when you get within 5 years of your chosen retirement age you'll have more of your fund switched to cash and lower risk equities and less in the riskier equities.

That's fine if you told the FA a realistic retirement age you were targeting, but most people state an unrealistic age, they use what they hope to be possible, rather than what is genuinely practical. What you often find is people state an age 5-15 years earlier than they actually retire at, so they lose out on 5-10 years growth, that is highly damaging to their pension pot size.

If you currently have a pension, check what your retirement age is set to and be sure it matches what you are likely to do, not what you'd like to do. At the same time take a look at which funds you are invested in and see if those are matching your risk appetite and term to your true retirement age.

I did this properly about 10 years ago, and realised a lot of my funds were in too low risk and growth potential funds, and were invested in regions that were expected to be high growth areas that never materialised. Back in the day Japan was the big growth story, but it never materialised, it did the complete opposite and has been in that malaise for 20 years, so it's worth reassessing everything at least once a year.

Taking a look at this has made a huge difference to my older pensions, i diversified into funds that had some higher risk for some of it, lower risk for others, some exposure to currency changes, some without. It's fascinating to see how each approach has played out over the last 10, 5, 3 and 1 years.

This is my returns in 4 of the funds i invested one of my pensions in, this doesn't include any dividends, this is just the core share price value, so for example some of the lower growth returns on share price, have some of the highest dividends, the highest growth fund which is tech stocks, have very low dividends, so the share price is closer to the true value increase.

It can be extremely confusing, and as you get older and nearer retirement, you do look at reducing risk. The issue there is a lot of funds which are rated as low/minimum risk on their fund sheet, has been disastrous and turned out to be high risk in the environment we have lived through over the last few years. It's important to have money in all the various areas you need as you go through life, from cash reserve to see you through the loss of job or family emergency, to wealth building for retirement. Do whatever you can to reduce your tax liability, because that saps your wealth, especially long term. This applies to anyone, it's not just those will real money this affects, its plebs like me who have only earned average income.

Gone off topic regarding cash ISA's, but if you can get anything from my basic experience then worth the segway.

10 Year returns

5 Year returns

3 Year returns

1 Year returns

greengreenwood7 said:

@Funk....

"If I'm thinking along the right lines, it makes sense to keep the Cash ISA for emergencies/short term need, S&S ISA for mid- to long-term investment (but still accessible if required) and pension for long-term which not to be accessed until I retire?"

Probs goes against the grain of many, but FWIW - i'd be thinking and trying to plan way ahead.

Pension is great in that there's the ingoing tax relief, downside is that build up a big enough pot and then there'll be possible tax consequences when taking monies out ( if its grown large enough)

ISA = great, especially 'flexible isa' whichg allows withdrawal of funds AND ability to replace up to the amount taken during same financial year. Might find that there's compelling products that allow you to use them as a kind of 'cash' acount whilst still enjoying upside potential;

an example of the above is STRK, which nominally pays $8 per year per 'share', and which should have a floor of $100-120'ish per share. So something like that gives a yield, and also has upside ( no point in splurging every detail here but the point is that sometimes accessible cash doesn't have to be in a cash based ISA).

GIA. i reckon they're underated as folks often get hung up on the CGT element. IE/ they're not a tax wrapper. The upside though is margin is generally provided = increased purchasing power ( if one wants to take advantage of opportunities) and there's far wider access to stocks/etf's etc that are not always avail in a sipp/isa ( plus if one decides to push the boat out - there's the ability to trade Options, however simple the person might choose to do). The leverage and access to pretty jmuch full market products makes them IMO - valuable; BUT mainly when used in conjunction with decent pension planning and ISA allocation.

You can then get creative: build monies inside a S&S flexible isa, pull out a tranche into the GIA, buy 'whatever', wait for some appreciation and then pull out some funds on margin and top the isa back up.

I've recently retired and have only planned 'how' for the past cple of years, but for my circs, i wanted to not get hammered on higher rate tax out of a pension, nor did i want to rely on 'organic' growth in an isa.....so living monies will be a mix of all 3.

as to 'what'...worth spending time researching/getting a feel of where life may be heading over the coming years and playing 'where the puck is heading', or if that's not your style - then you can either make up your own little basket of stocks ( like a mini etf fund) or just get a tracker. Keep a weather eye on what's happening, but don't get wed to the stock prices....a mate of mine finally invested in Tesla, but moans when he sees the price wobble; because his mentality isn't to just let the stock do its thing for the next 18-24mths.

Hope there's something of use in there for you.

TLDR version - I could be making more from my money if I were investing it. I know that I know nothing and don't want to do something stupid, wiping out hard-earned savings. I also need to think about other products in the wider context including pension (top-up Nest/start a separate SIPP?),GIA etc. Continued suggestions/advice and additional recommendations for trustworthy/helpful sources of knowledge very much welcomed!"If I'm thinking along the right lines, it makes sense to keep the Cash ISA for emergencies/short term need, S&S ISA for mid- to long-term investment (but still accessible if required) and pension for long-term which not to be accessed until I retire?"

Probs goes against the grain of many, but FWIW - i'd be thinking and trying to plan way ahead.

Pension is great in that there's the ingoing tax relief, downside is that build up a big enough pot and then there'll be possible tax consequences when taking monies out ( if its grown large enough)

ISA = great, especially 'flexible isa' whichg allows withdrawal of funds AND ability to replace up to the amount taken during same financial year. Might find that there's compelling products that allow you to use them as a kind of 'cash' acount whilst still enjoying upside potential;

an example of the above is STRK, which nominally pays $8 per year per 'share', and which should have a floor of $100-120'ish per share. So something like that gives a yield, and also has upside ( no point in splurging every detail here but the point is that sometimes accessible cash doesn't have to be in a cash based ISA).

GIA. i reckon they're underated as folks often get hung up on the CGT element. IE/ they're not a tax wrapper. The upside though is margin is generally provided = increased purchasing power ( if one wants to take advantage of opportunities) and there's far wider access to stocks/etf's etc that are not always avail in a sipp/isa ( plus if one decides to push the boat out - there's the ability to trade Options, however simple the person might choose to do). The leverage and access to pretty jmuch full market products makes them IMO - valuable; BUT mainly when used in conjunction with decent pension planning and ISA allocation.

You can then get creative: build monies inside a S&S flexible isa, pull out a tranche into the GIA, buy 'whatever', wait for some appreciation and then pull out some funds on margin and top the isa back up.

I've recently retired and have only planned 'how' for the past cple of years, but for my circs, i wanted to not get hammered on higher rate tax out of a pension, nor did i want to rely on 'organic' growth in an isa.....so living monies will be a mix of all 3.

as to 'what'...worth spending time researching/getting a feel of where life may be heading over the coming years and playing 'where the puck is heading', or if that's not your style - then you can either make up your own little basket of stocks ( like a mini etf fund) or just get a tracker. Keep a weather eye on what's happening, but don't get wed to the stock prices....a mate of mine finally invested in Tesla, but moans when he sees the price wobble; because his mentality isn't to just let the stock do its thing for the next 18-24mths.

Hope there's something of use in there for you.

Edited by Funk on Thursday 3rd July 17:42

Mr Funk,

I have phases of posting on this finance forum, simply to make comments that might be helpful to others.

Through 35 years of equity investment, my knowledge has been gained though practical involvement.

Imagine the ups and downs of markets during that period of time. It certainly teaches you what works and what doesn't. During the (rare) stock market crashes, that is when you see panic behaviour. Need to step back, keep calm, don't follow the herd and when you have more experience, you will realise that it can be an ideal buying opportunity.

To pass on 35 years of investment experience is obviously not possible, but just a few pointers might be of help to you.

You should be pleased that you have already reached the first rung.

What I mean by that, is you have clearly recognised that investing in businesses, can give you a much better chance of becoming wealthy, than only using bank or building society savings accounts throughout life, which so many people do.

Those accounts form an essential part of personal finance, but it is important to recognise that by holding cash or cash equivalents over a long-term, you are guaranteed to lose money. Think inflation.

As an example which might encourage you, (one day means nothing), I noticed today that five of my shareholdings increased in value by more than 2%.

With your cash account savings, you would have to wait 6 months to achieve that.

An illustration of the potential.

A stock and shares ISA is not an investment, it is simply a way of holding various investments in a tax free way.

What I would do if I was starting now, is open (could just be £100) a stocks and shares ISA with either AJ Bell or Hargreaves Lansdown. Reason, their fees remain low when your portfolio grows.

I have always held shares directly in individual businesses, but you will probably be happier to start with buying Index funds (Vanguard have low fees) within your S&S ISA.

As you gain business knowledge, you may become ready to buy direct shareholdings within your S&S ISA. That gives you the opportunity to achieve better results than the market average. I have holdings in 25 companies, so that gives me sector diversification, worldwide exposure and foreign exchange exposure. Many of the holdings have been held for decades.

Businesses form the economic drivers of many countries' wealth. Therefore if you own part (a shareholder) of a good business, you can directly benefit from the creation of prosperity.

Thanks Jon, very helpful and food for thought. At the moment the cash ISA is with Trading212 and I can easily move the money over into their S&S ISA for investing so I may start by doing that and keep it on a platform it's already on (and one with which I'm already more familiar with). I would think with the amounts I'm looking at at the moment that any fees etc wouldn't be particularly hefty on T212?

Funk said:

Thanks Jon, very helpful and food for thought. At the moment the cash ISA is with Trading212 and I can easily move the money over into their S&S ISA for investing so I may start by doing that and keep it on a platform it's already on (and one with which I'm already more familiar with). I would think with the amounts I'm looking at at the moment that any fees etc wouldn't be particularly hefty on T212?

T212 is a great place to dabble with a S&S ISA. Go to "manage funds" and move £500 from your Cash ISA to your S&S ISA. Stick £50 into a S&P 500 ETF and £50 into Rolls Royce and just watch what they both do over the next few weeks. Having a play with some small sums is a great way t0 figure it out. okgo said:

You won’t improve on the monevator post you had in response on the other thread.

I heavily suspect it s word soup like the post above mine that puts most people off.

Yup….if the Monevator link is also too wordy, you can hear him explain it in about half an hour on the videos up at https://kroijer.com - well worth some of your time to watch, I would suggest.I heavily suspect it s word soup like the post above mine that puts most people off.

Chucking little amounts in to individual stocks might be ‘fun’, but it is essentially light gambling in comparison.

The other question is how to move from a cash savings to S&S mindset.

Do you move it all across at once, or a little each month over a year (or more) ?

No one can tell you the right answer on that, sadly.

Around ⅔ of the time, doing it all in a single move will be best.

I prefer to move things over time, even though I know the odds are against me. I would just hate to move 40K & see it drop 20% the next day, which is of course possible

The S&S investments should be a long term thing - money you don’t plan on touching for 5-10 years.

You should also keep some cash funds for emergencies. Some suggest up to 6 months pay.

My personal preference is for that to be in premium bonds.

Note - they are NOT an investment, but there is always a slim chance of beating the average payout (which I think it around 4% now). In Jan, my 5k holdings won a grand - a 20% win for the year!

Probably won’t win for the next 5 years, but at least it is easy to get my hands on the money within 3 days if I need it

Pension.

You should really get that going - always put at least what your employer would match - it is free money

Again, check the funds the pension is in and try to get a low cost world tracker.

Pay a little attention to it over the years (maybe just a quarterly or annual check).

If you pay high rate taxes, try to pop more in if you can: tax benefits going in, and you may be a lower tax payer when you draw it out in years to come.

Good luck!

Is there a simple world index one can use to compare the rate of return of my funds, when using the HL platform.

Having watched the Kroijer videos I decided to check the few funds I am invested in for their rate of return. Seems several have underperformed the FTSE100.

What index can I chart against them to see their perfomance relative to the "world index" he talks of.

Also, vanguard seem to have an awful lot of funds.....which one is the world tracker that best meets Kroijers definition?

Having watched the Kroijer videos I decided to check the few funds I am invested in for their rate of return. Seems several have underperformed the FTSE100.

What index can I chart against them to see their perfomance relative to the "world index" he talks of.

Also, vanguard seem to have an awful lot of funds.....which one is the world tracker that best meets Kroijers definition?

FredAstaire said:

Is there a simple world index one can use to compare the rate of return of my funds, when using the HL platform.

Having watched the Kroijer videos I decided to check the few funds I am invested in for their rate of return. Seems several have underperformed the FTSE100.

What index can I chart against them to see their perfomance relative to the "world index" he talks of.

Also, vanguard seem to have an awful lot of funds.....which one is the world tracker that best meets Kroijers definition?

Of course there is no single best one - that would be too easy! - but https://monevator.com/best-global-tracker-funds gives you a few to consider:Having watched the Kroijer videos I decided to check the few funds I am invested in for their rate of return. Seems several have underperformed the FTSE100.

What index can I chart against them to see their perfomance relative to the "world index" he talks of.

Also, vanguard seem to have an awful lot of funds.....which one is the world tracker that best meets Kroijers definition?

thanks both

yes, I found a few of those funds on HL after I'd posted yesterday.

I was left wondering why vanguard had higher fees than the likes of legal and general and HSBC, given that Vanguards calling card (as I understood it) is low cost.

On the subject of bonds, which is the other strand of Kroijers strategy - how does one go about buying those? Selecting one, buying one etc? I've looked at these before and as far as I could tell the interest rates didn't seem any better than cash-ISA accounts. Also what to buy - the range of intersest figures and maturity dates and above/below par pricing left me somewhat bewildered on the supposedly 'safe, low risk' side of the investment strategy.

yes, I found a few of those funds on HL after I'd posted yesterday.

I was left wondering why vanguard had higher fees than the likes of legal and general and HSBC, given that Vanguards calling card (as I understood it) is low cost.

On the subject of bonds, which is the other strand of Kroijers strategy - how does one go about buying those? Selecting one, buying one etc? I've looked at these before and as far as I could tell the interest rates didn't seem any better than cash-ISA accounts. Also what to buy - the range of intersest figures and maturity dates and above/below par pricing left me somewhat bewildered on the supposedly 'safe, low risk' side of the investment strategy.

Keep it simple, and try to avoid the usual mistakes of (a) tinkering, and (b) panicking.

Get plenty of risk "on", but hold a sensible cash reserve as well. You don't want to be a forced seller in a short downturn.

Focus on keeping overall costs and charges to a sensible minimum. I like them "under 1%" but some people go a lot lower than that.

So-called "drip-feeding" of tiny amounts is favoured by some people but in reality you might as well invest in decent sized chunks. "Time in the market" is likely to beat a "slow drip" even if there may be one or two wobbles along the way. For instance, some people invest their full ISA in April while others might do small monthly contributions.

Get plenty of risk "on", but hold a sensible cash reserve as well. You don't want to be a forced seller in a short downturn.

Focus on keeping overall costs and charges to a sensible minimum. I like them "under 1%" but some people go a lot lower than that.

So-called "drip-feeding" of tiny amounts is favoured by some people but in reality you might as well invest in decent sized chunks. "Time in the market" is likely to beat a "slow drip" even if there may be one or two wobbles along the way. For instance, some people invest their full ISA in April while others might do small monthly contributions.

FredAstaire said:

On the subject of bonds, which is the other strand of Kroijers strategy - how does one go about buying those? Selecting one, buying one etc? I've looked at these before and as far as I could tell the interest rates didn't seem any better than cash-ISA accounts..

This is my best understanding of the reasoning:Over the long term, on average, bonds "tend"to outperform savings accounts.

Aditionally, the value of bonds goes up as interest rates fall. As interest rates tend to be reduced which the economy is doing badly, which is bad for equities, you get a less volatile portfolio overall.

Funk said:

Thanks Jon, very helpful and food for thought. At the moment the cash ISA is with Trading212 and I can easily move the money over into their S&S ISA for investing so I may start by doing that and keep it on a platform it's already on (and one with which I'm already more familiar with). I would think with the amounts I'm looking at at the moment that any fees etc wouldn't be particularly hefty on T212?

One word in your platform title caught my attention, trading.

There seems to be great enthusiasm on forums for short-term trading.

Perhaps some traders do become billionaires, but you should be clear that long-term equity holding is investment, whereas buying now and selling next week is gambling. Anything can happen tomorrow, next week, next month, so trading introduces unforseen events and greater risk. For even greater risk, combine trading with leverage (borrowing) and very 'interesting' things can occur.

Many people think all share holding is very risky, so never want to become involved. Probably without realising, they are very likely to be involved, with their pension savings. Think about any individual company. If revenue and earnings steadily increase over the years, then the company becomes more valuable with an increasing share price. The share price will have many fluctuations along the way, but higher earnings dol eventually result in the share price increasing. You can therefore see, that the risk is not huge, providing a business do make good progress.

I have never bought funds, but they are a sensible entry for new investors. Don't think you necessarily need to have a Far East, US or Global fund. Just think about some of the very large UK listed businesses. Most of their business is conducted all around the world, so there is built-in geographic and currency diversification. When a British listed company trades in 160 countries, I think you could call that a global business.

Index funds will of course enable you to achieve the average return of the associated market.

However, don't believe that it is impossible for an individual investor to beat the market average.

When you become confident in having an understanding of business prospects, then that would be the time to select individual businesses. I hold about 25 businesses. You are probably a customer of some.

It is always the case, that some of those holdings are bad performers for a time, or even continually, but there is no need to worry, because you should only be interested in the overall performance of your portfolio.

Each year, some holdings will be up and some down. Another point, when the overall stock market goes down which it will, if your portfolio falls by a lesser percentage, then count that as a win. You can sleep well. Do not panic.

It is impossible to do better than the market every year, but of course with index funds, you can never beat the market.

I always try to keep everything as simple as possible. If the overall performance generally keeps up with, or beats the market index (average), I don't make any changes to the holdings. Some holdings were held 30 years ago. The beauty of that strategy, if all goes well, is very little time needs to be involved, but do ensure that you keep very accurate records. Even a basic spreadsheet can cope with that task.

It might be an encouragement for you to see some results over a reasonable period.

UK All-Share Index ............................ Portfolio (included some cash and the dividends received)

2019 ..... + 14.19% ................................... + 21.60%

2020 ...... - 12.46% ................................... - 13.96% ....... Pandemic

2021 ..... + 14.55% .................................. + 15.19%

2022 ...... - 3.16% .................................... + 15.88%

2023 ....... + 3.85% ................................... - 4.70%

2024 ....... + 4.47% ................................... + 18.31%

2025 to end of June +7.43% ................... + 16.52%

Good luck. All the effort of learning as much as you can, will hopefully be rewarded.

( By the way. I don't sell books, videos or training courses. -

)

) Edited by Jon39 on Saturday 5th July 14:03

Jon39 said:

UK All-Share Index ............................ Portfolio (included some cash and the dividends received)

2019 ..... + 14.19% ................................... + 21.60%

22.19% for Global All Cap, which I'd suggest should be the default starting benchmark.

Jon39 said:

It might be an encouragement for you to see some results over a reasonable period.

UK All-Share Index ............................ Portfolio (included some cash and the dividends received)

2019 ..... + 14.19% ................................... + 21.60%

2020 ...... - 12.46% ................................... - 13.96% ....... Pandemic

2021 ..... + 14.55% .................................. + 15.19%

2022 ...... - 3.16% .................................... + 15.88%

2023 ....... + 3.85% ................................... - 4.70%

2024 ....... + 4.47% ................................... + 18.31%

2025 to end of June +7.43% ................... + 16.52%

( By the way. I don't sell books, videos or training courses. -

)

) Edited by Jon39 on Saturday 5th July 14:03

Maybe you could tell us of the 25 businesses you invest in which produce such stellar returns.....

Similar to Funk, I've made my mistakes along the way. Unstructured debt can bite pretty hard.

I've got £20k in a cash ISA.

I have a need to fund the school fees that will start in just over 2 years, I was nervous about investing.

So I've opened a S&S ISA with Vanguard, with them managing it, I've got other options to fund the school fees if I need to, so I can ride through any dips, with that in mind I selected the highest risk group, I read that the high risk ISA's average over ten years is 9.64%.

I'm going to pay in £500 a month.

I've got £20k in a cash ISA.

I have a need to fund the school fees that will start in just over 2 years, I was nervous about investing.

So I've opened a S&S ISA with Vanguard, with them managing it, I've got other options to fund the school fees if I need to, so I can ride through any dips, with that in mind I selected the highest risk group, I read that the high risk ISA's average over ten years is 9.64%.

I'm going to pay in £500 a month.

Countdown said:

That's an amazing record. Have you ever compared yourself to some of the professionals to see how you compare ?

Maybe you could tell us of the 25 businesses you invest in which produce such stellar returns.....

Maybe you could tell us of the 25 businesses you invest in which produce such stellar returns.....

No. My only comparator has always been FTSE A/S Index.

Better returns have been in America with the new tech, now very big businesses, but as I have mentioned previously, many of the UK giants do have businesses running in America. The US market has higher capitalisation ratings than UK, so I could have done better, but I have continued with what seems to work reasonably well. Having steered clear of the high tech dot com bubble in 1999, I realised at that time, that picking which of the huge number of high tech companies will become future giants was almost impossible. Hence the number of tech failures in 2000 and 2001. I knew about the Amazon flotation, but had no idea how an online business selling books, would in about 20 years, would dominate the retail world. One example of a mistake by failure to act.

The holdings are mostly businesses supplying very ordinary products and services, that continue to be in consistant demand.

In other words non-cyclical, so tend to cope reasonably well during market downturns. Beating a falling stock market of also helps overall investment results.

We don't recognise a 'powerhouse' until the portfolio has been running for some years, but for me it turned out to be BAT.

Admittedly a controversial business sector, but as a money maker, their steady financial growth over a very long period has been impressive. There is another steady business I like that you might like to research, Compass Group. Steady growth. I did encounter an unexpected event, the pandemic. Hospitality was the worst sector to be holding then, but I did have confidence to increase my holding then. Look at their share price chart to see how rapidly they recovered from that worldwide catastrophe. An indication of quality management. The PE ratio seems high at present, so perhaps to see if there might be a better buying opportunity. Most of Compass business is now in USA.

How long have you held BAT and Compass Group for?

P.s. I think most posters in this forum will be aware of how the general market and specific sectors have done. It would be far more useful to know which specific companies you’ve held which have generated the returns you quote.

P.s. I think most posters in this forum will be aware of how the general market and specific sectors have done. It would be far more useful to know which specific companies you’ve held which have generated the returns you quote.

Edited by Countdown on Saturday 5th July 17:22

Gassing Station | Finance | Top of Page | What's New | My Stuff