Quickbooks and Employers NI

Discussion

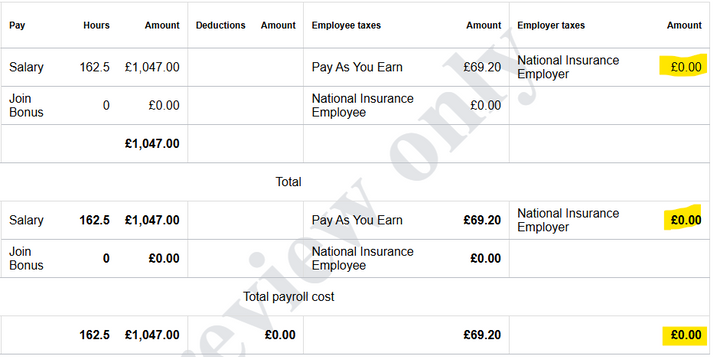

I'm running the first payroll with the updated Employer's NI threshold now at £5000 but it is not showing in the payroll details. Do I need to do anything in Quickbooks to add the Employers NI? This is a standard director's salary at £12,570 so I would expect Employer's NI on £7,570 of that. My accountants can sometimes take a few days to respond to emails so checking here too.

Have you ticked a "Director" box when setting up the payroll for the individual?

Directors' NI kicks in only when the accumulated salary breaches the annual threshold.

There is an option where you can elect to calculate NI on a director's salry just like a normal employee if you want to.

Directors' NI kicks in only when the accumulated salary breaches the annual threshold.

There is an option where you can elect to calculate NI on a director's salry just like a normal employee if you want to.

Gassing Station | Business | Top of Page | What's New | My Stuff