NI gap-filling window closing 5th April 2025

Discussion

I was wasting time watching Youtube (as you do) and I came across a video describing a window of opportunity to buy into NI for any years where it was missed. I had no idea it was possible to do this and no idea there was a window closing. It may be that it was advertised in newspapers or on TV, but I don't consume either media and rely on various internet sources for my news.

I've looked into it and it appears that there are five years (2006-2011) when I was working abroad and didn't pay NI which I can now catch up on. I do have a few private workplace pensions and I have some crypto which I hope will give me a nice nest egg in a few years time. From the video, it seems that I would be bonkers not to fill in the gaps. But I'm not a genius when it comes to tax, investing and pensions and there may be things I'm overlooking.

Is it money well spent or is the state pension a waste of time? I already have 25 years of contributions and by the time I retire I'll probably have another 10 years anyway. Although I'm seriously considering moving abroad to either France, Spain or Italy for better food, weather and driving roads. What would you do in this situation? Would I be better off buying more BTC for example? Probably, but it's defintely debatable! In case it's relevant I'm 50 years old and single, live alone and earn just over £100k pa. I could come up with the money fairly easily if necessary.

Thanks!

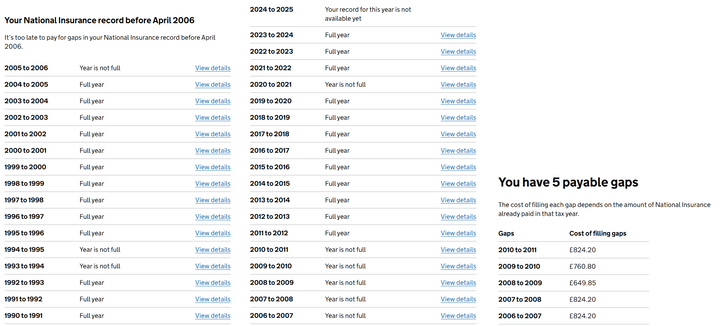

My contributions history - I don't know why I can fill in years between 2006 and 2011 but not 2020/2011 when I was off work caring for my mother full time. Also, I don't know why 1993 to 1995 are counted as not full - I was in full time education at university:

The video:

I've looked into it and it appears that there are five years (2006-2011) when I was working abroad and didn't pay NI which I can now catch up on. I do have a few private workplace pensions and I have some crypto which I hope will give me a nice nest egg in a few years time. From the video, it seems that I would be bonkers not to fill in the gaps. But I'm not a genius when it comes to tax, investing and pensions and there may be things I'm overlooking.

Is it money well spent or is the state pension a waste of time? I already have 25 years of contributions and by the time I retire I'll probably have another 10 years anyway. Although I'm seriously considering moving abroad to either France, Spain or Italy for better food, weather and driving roads. What would you do in this situation? Would I be better off buying more BTC for example? Probably, but it's defintely debatable! In case it's relevant I'm 50 years old and single, live alone and earn just over £100k pa. I could come up with the money fairly easily if necessary.

Thanks!

My contributions history - I don't know why I can fill in years between 2006 and 2011 but not 2020/2011 when I was off work caring for my mother full time. Also, I don't know why 1993 to 1995 are counted as not full - I was in full time education at university:

The video:

nuyorican said:

How do you actually pay it though? Last time I looked I had gaps too, with an option to pay, but no obvious way of doing so.

In my case there's a green button under my payable gaps saying "Check if you can pay for gaps online"...But if I click it, I am told I cannot pay online and need to contact them by phone and it gives phone numbers, open between 8am and 6pm.

Tax Service said:

Contact the Future Pension Centre to find out if you can pay gaps in your National Insurance record.

How to contact the Future Pension Centre

Speak to an agent at the Future Pension Centre. They can give you more information about your State Pension and filling gaps in your National Insurance record.

Telephone

Telephone: 0800 731 0175

Telephone from outside UK: +44 (0)191 218 3600

Welsh language telephone: 0800 731 0453

Textphone

Textphone: 0800 731 0176

Textphone from outside the UK: +44 (0)191 218 2051

Welsh language textphone: 0800 731 0456

Relay UK

If you cannot hear or speak on the phone, use Relay UK:

18001 then 0800 731 0175

https://www.tax.service.gov.uk/check-your-state-pension/modelling/contact-future-pension-centre-service-problemHow to contact the Future Pension Centre

Speak to an agent at the Future Pension Centre. They can give you more information about your State Pension and filling gaps in your National Insurance record.

Telephone

Telephone: 0800 731 0175

Telephone from outside UK: +44 (0)191 218 3600

Welsh language telephone: 0800 731 0453

Textphone

Textphone: 0800 731 0176

Textphone from outside the UK: +44 (0)191 218 2051

Welsh language textphone: 0800 731 0456

Relay UK

If you cannot hear or speak on the phone, use Relay UK:

18001 then 0800 731 0175

GPH said:

The maximum number of qualifying years is 35 so if you have already done 25 and will do another 10 then no need to fill in the missed years.

Even 25 will therefore get you 70% so if you have other pensions you're not missing out much.

But if I do move to France in the next couple of years, there likely won't be more than 26 or 27 full years. I'd rather get 100% of something than 70% of it, especially if it works out beneficial after 3 years. The way I see it, my savings aren't earning me much in interest. But I wonder if putting the money into a regular workplace pension would be a better idea...Even 25 will therefore get you 70% so if you have other pensions you're not missing out much.

OP, have you looked into whether you are entitled to NI Credits for the period you were looking after mum?

see https://www.gov.uk/national-insurance-credits

see https://www.gov.uk/national-insurance-credits

LunarOne said:

Also, I don't know why 1993 to 1995 are counted as not full - I was in full time education at university

Years in higher education don't count. But your 2 years in the 6th form do.I believe that was done to encourage you to stay on at school as opposed to leaving at 16.

You can always go back six years, and yes, you need 35 years for a full state pension.

Work it out, will you need those years for the full 35 years? If yes, get working on it.

I managed to pay most of my back years at the much lower self employed rate (from NZ), even better value. But then I had been self employed in the UK when I left and in NZ for the last 25 years.

caziques said:

I managed to pay most of my back years at the much lower self employed rate (from NZ), even better value.

Interesting. I was self-employed between 2005 and 2011. I was a contractor paid by a UK company, but I was working abroad in Scandinavia and Germany. I wonder if that means I have a lower rate to pay?the tribester said:

OP, have you looked into whether you are entitled to NI Credits for the period you were looking after mum?

see https://www.gov.uk/national-insurance-credits

Hmmm. Mum never worked in the UK and didn't have an NI number. And without that I was unable to claim carer's allowance. So while my GP practice had me registered as a carer, there was no record of that from an official point of view. I was still earning a little doing freelance work for a few hours a week I paid tax on my meagre earnings, but no NI. In fact I'm surprised that they have recorded me as having contributed in 2020 as I was made redundant in 2019 and used the redundancy pay to help carry me though until May 2022 when I started earning again after mum died. But I don't see the need to question things that might work in my favour one year and not another. In the end it's all give and take, although I'm sure the taxman won't agree!see https://www.gov.uk/national-insurance-credits

I see you are 50, with 25 years of contributions already.

You only need another ten, out of the 18 years before you can get the state pension (68 for someone your age I think).

So no, don't bother with some old ones - make sure one way or another you pay another ten years by the time you are 68.

Being able to pay NI contributions at the self employed rate can be time consuming, and in your case not much point anyway.

I've just applied to fill my one missing year, and am hoping to pay class 2 (I'm no longer in the UK).

This is where I applied:

https://www.gov.uk/guidance/apply-to-pay-voluntary...

This is where I applied:

https://www.gov.uk/guidance/apply-to-pay-voluntary...

LunarOne said:

But if I do move to France in the next couple of years, there likely won't be more than 26 or 27 full years. I'd rather get 100% of something than 70% of it, especially if it works out beneficial after 3 years. The way I see it, my savings aren't earning me much in interest. But I wonder if putting the money into a regular workplace pension would be a better idea...

When you move to France you can continue paying likely class 2 contributions at a rate of three quid odd a week. I live in Switzerland and in 2021 paid back missing years from living here going back to 2009 and have been paying since. The only benefit I can see for you in paying back years is that it‘s at the current rate rather than an unknown rate in the future and that‘s assuming the back years are class 2.I called the number given by the website today and it's apparently an organisation called "Future Pensions". After a half hour wait on hold, I got through to an advisor. He told me that my 2020-2021 year which shows up as "not full" is actually recorded on their system as an "Undecided" year and this apparently happens when there's a change in circumstances to self-employment. The advisor told me that it's actually HMRC that I have to pay if I want to fill in these gaps, and that the undecided year will likely be much cheaper than the others. So perhaps I'll fill in that year and the £650 one. According to him, I have only 9 years to go (I guess the 2024-2025 year is almost up) and so that would bring me down to 7 years needed to pay in to get 100% credit. Perhaps that's the best way, since I still have 18 years until pensionable age.

For anyone who wants to avoid holding for 30 minutes, the HMRC number to call to actually do the transaction (if you like me can't do it online) is 0300 200 3500

For anyone who wants to avoid holding for 30 minutes, the HMRC number to call to actually do the transaction (if you like me can't do it online) is 0300 200 3500

eyebeebe said:

LunarOne said:

But if I do move to France in the next couple of years, there likely won't be more than 26 or 27 full years. I'd rather get 100% of something than 70% of it, especially if it works out beneficial after 3 years. The way I see it, my savings aren't earning me much in interest. But I wonder if putting the money into a regular workplace pension would be a better idea...

When you move to France you can continue paying likely class 2 contributions at a rate of three quid odd a week. I live in Switzerland and in 2021 paid back missing years from living here going back to 2009 and have been paying since. The only benefit I can see for you in paying back years is that it‘s at the current rate rather than an unknown rate in the future and that‘s assuming the back years are class 2.eyebeebe said:

LunarOne said:

But if I do move to France in the next couple of years, there likely won't be more than 26 or 27 full years. I'd rather get 100% of something than 70% of it, especially if it works out beneficial after 3 years. The way I see it, my savings aren't earning me much in interest. But I wonder if putting the money into a regular workplace pension would be a better idea...

When you move to France you can continue paying likely class 2 contributions at a rate of three quid odd a week. I live in Switzerland and in 2021 paid back missing years from living here going back to 2009 and have been paying since. The only benefit I can see for you in paying back years is that it‘s at the current rate rather than an unknown rate in the future and that‘s assuming the back years are class 2.Gassing Station | Finance | Top of Page | What's New | My Stuff