Are gold sovereign coins a good investment?

Discussion

Not sure if this is the correct forum but it's kind of finance/investment related.....

I have been offered a full collectors set (1980-2024) of gold proof UK 1/2 sovereign coins. On the face of it they are good value based on what I would have to pay for them against what it would cost if you shopped around and purchased each coin from a gold dealer or the Royal mint. Nobody seems to have a full set for sale and some coin years would appear not to be available. The majority are and there are 6-7 that are more valuable than the rest this appears to be due to the coin design. They changed in 2023 when the Queen died and now have Charles's head on them.

Are gold coins a good investment?. I am not buying them to flip now but partly as a future investment as an alternative to cash in the bank (ISA) and partly as they are my dads, not sure why he is giving up on them but he's being really morbid at the moment and mumbling about only having a few 'turkeys' left in him and wants to get rid of his stuff.

Being proof collectors coins I guess it is not the same as simply their weight in gold. If I ever sold them I wouldn't want to break the set as I guess that adds to their uniqueness but a complete set would cost you about £18,000 if you averaged the range of prices to purchase today individually.

I think they are kind of cool and if I buy them I want to get a custom coin frame made and display them. I have watched my dad collect them each year since I was 5 years old, for the last 5 years he has bought me one as a Christmas present too.

The sad thing is he would buy them each year, look at it and then put it in the safe, I reckon most of them have never been out of the box in 30 years it seems a shame not to display them safely and insured.

"I have been offered a full collectors set (1980-2024) of gold proof UK 1/2 sovereign coins. On the face of it they are good value based on what I would have to pay for them "

What could you sell them for right now is the question. If you could only sell them for 75% of what you are being offered them for then you will need the price to go up by a third just to break even.

What could you sell them for right now is the question. If you could only sell them for 75% of what you are being offered them for then you will need the price to go up by a third just to break even.

Gold is generally a good long term investment.

With this particular set it really depends on the premium you are paying for the set and for the rarer coins like the George & the Dragon. I don't have soveriegns but do have Kruggerands which I bought just before the massive dip around 11 years ago. In the 11 years i've owned them they have increased in value by around 230% (I bought them slightly under the spot price per g at the time).

With this particular set it really depends on the premium you are paying for the set and for the rarer coins like the George & the Dragon. I don't have soveriegns but do have Kruggerands which I bought just before the massive dip around 11 years ago. In the 11 years i've owned them they have increased in value by around 230% (I bought them slightly under the spot price per g at the time).

Sy1441 said:

Gold is generally a good long term investment.

With this particular set it really depends on the premium you are paying for the set and for the rarer coins like the George & the Dragon. I don't have soveriegns but do have Kruggerands which I bought just before the massive dip around 11 years ago. In the 11 years i've owned them they have increased in value by around 230% (I bought them slightly under the spot price per g at the time).

My dad only wants what he paid for them over the years so there is no premium as such. I reckon about 6.5K. Not buying them to profit from them short term, he has said he wouldn't care what I did with them but when the time comes to sell it might not be quite as easy as the value is more than their gold weight (I think they are 3.7g each)With this particular set it really depends on the premium you are paying for the set and for the rarer coins like the George & the Dragon. I don't have soveriegns but do have Kruggerands which I bought just before the massive dip around 11 years ago. In the 11 years i've owned them they have increased in value by around 230% (I bought them slightly under the spot price per g at the time).

shep1001 said:

My dad only wants what he paid for them over the years so there is no premium as such. I reckon about 6.5K. Not buying them to profit from them short term, he has said he wouldn't care what I did with them but when the time comes to sell it might not be quite as easy as the value is more than their gold weight (I think they are 3.7g each)

Does your dad need to sell and you are just trying to help him out? It feels like something you'd eventually be given or [without being heartless] inheritbalham123 said:

Get them appraised though by someone with an XRF machine. You can buy really good quality fakes these days, you don't want to get scammed

I guess the question is where he bought them?Plenty of genuine dealers.

We have bought pairs of full sovereigns for about 7 years from time to time to specifically leave our offspring as a little gift….nothing like a full set, but some variety for them.

Overall, I think they have gone up over 60% in that time.

Never did it as a massive investment: more a way to pass some wealth down, but has done fairly well, I would say.

CambsBill said:

Really

As we're talking long term, let's look at a longer date range shall we? This is 1980 onwards with inflation adjusted prices:

Source is https://www.macrotrends.net/1333/historical-gold-p...

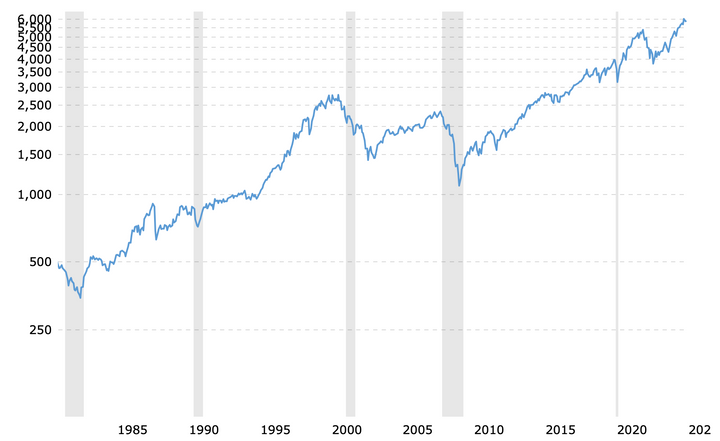

As a contrast, this is the SP 500 (I didn't have a global equity chart handy). Also inflation adjusted, and note this is a log scale, so vertical moves look bigger near the bottom than the top of the chart, i.e. it makes performance look worse than than a linear chart.

I know which of those I'd rather own for the long term, and it is the one which has gone up more and is less volatile.

scot_aln said:

shep1001 said:

My dad only wants what he paid for them over the years so there is no premium as such. I reckon about 6.5K. Not buying them to profit from them short term, he has said he wouldn't care what I did with them but when the time comes to sell it might not be quite as easy as the value is more than their gold weight (I think they are 3.7g each)

Does your dad need to sell and you are just trying to help him out? It feels like something you'd eventually be given or [without being heartless] inheritcaziques said:

The going price on e bay is GBP250 for a half sovereign, which is also about the "melt" value.

If there are 45 coins, base value is around GBP11,000.

Beg, borrow or steal 6,500 to buy them.

On the other hand, you could tell him you have £5k, buy & sell next day If there are 45 coins, base value is around GBP11,000.

Beg, borrow or steal 6,500 to buy them.

I do agree with the other about this not being a great ‘investment’, but as a useful valuable collection, might be nice to have.

If you do nothing, would he actually take action to sell, or would you be likely to inherit?

If he doesn’t like them round his house, you can always look after them for him….

Who buys proofs like this then stores them away?

Been better spending on bullion 1oz brits if you’re just gonna stash away.

I’d definitely want to make sure they’re being and have continued to be bought from somewhere legit.

Usually proof coins are all sealed up with reference numbers and stuff.

I’d get them appraised and if buy is lower than sell, pick them up.

They won’t lose value, have nostalgic value, and stuff.

Wrt turkeys left. Could be dead tomorrow or be hanging on in 20yrs+, who knows.

I wouldn’t base a buying decision on that.

Plus if they’ve been noted in the will then HMRC will want a cut if they’re inherited.

Been better spending on bullion 1oz brits if you’re just gonna stash away.

I’d definitely want to make sure they’re being and have continued to be bought from somewhere legit.

Usually proof coins are all sealed up with reference numbers and stuff.

I’d get them appraised and if buy is lower than sell, pick them up.

They won’t lose value, have nostalgic value, and stuff.

Wrt turkeys left. Could be dead tomorrow or be hanging on in 20yrs+, who knows.

I wouldn’t base a buying decision on that.

Plus if they’ve been noted in the will then HMRC will want a cut if they’re inherited.

No CGT on them.

But proof coins are limited production so value increases due to rarity.

But you need to make sure there is a buyer willing to pay more for them.

As time goes on I think that market might shrink… more modern investors/savers may be more pragmatic?

I for one don’t get proof coins like this at all.

I’d actually be more interested in uncirculated or proof coins of actual circulated tender, rather than proof of coins that just get made for holding as bullion (99% of people will never have seen one) or for collectors who hide them in a safe

But proof coins are limited production so value increases due to rarity.

But you need to make sure there is a buyer willing to pay more for them.

As time goes on I think that market might shrink… more modern investors/savers may be more pragmatic?

I for one don’t get proof coins like this at all.

I’d actually be more interested in uncirculated or proof coins of actual circulated tender, rather than proof of coins that just get made for holding as bullion (99% of people will never have seen one) or for collectors who hide them in a safe

xeny said:

Really

As we're talking long term, let's look at a longer date range shall we? This is 1980 onwards with inflation adjusted prices:

Source is https://www.macrotrends.net/1333/historical-gold-p...

As a contrast, this is the SP 500 (I didn't have a global equity chart handy). Also inflation adjusted, and note this is a log scale, so vertical moves look bigger near the bottom than the top of the chart, i.e. it makes performance look worse than than a linear chart.

I know which of those I'd rather own for the long term, and it is the one which has gone up more and is less volatile.

Is it fair to say from these charts that Gold provides a good counter to the rare general market ie S&P shocks/declines, ie Golds best performance on this chart occurs at the same time as the S&P's worst period, around the 2008 crisis and it's aftermath?

As we're talking long term, let's look at a longer date range shall we? This is 1980 onwards with inflation adjusted prices:

Source is https://www.macrotrends.net/1333/historical-gold-p...

As a contrast, this is the SP 500 (I didn't have a global equity chart handy). Also inflation adjusted, and note this is a log scale, so vertical moves look bigger near the bottom than the top of the chart, i.e. it makes performance look worse than than a linear chart.

I know which of those I'd rather own for the long term, and it is the one which has gone up more and is less volatile.

It was long considered a worthy small % counter balance type portfolio asset for I think this reason, but it's now barely considered at all due to the recent performance of the stock market and general maliase. Shouldn't owning both be the answer?

Shocks to the system are rare as in general it's in everyone's interest for them not to happen, but happen they do from time to time regardless of this. When they do occur Gold seems to do relatively well, as people shift into something tangible and 'safe', even currency values can be under threat in a crisis so money flows out of the 10-20 year 'in vogue' stuff , then out of everything as panic ensues, but not all to cash, or certainly not all stays in cash for long and so what does that leave? historically metals, that are always grossly under owned before such a crisis, as it hasn't made sense to own them for years, maybe decades as their performance has been worse than pretty much everything in times of real/percieved prosperity?

Gassing Station | Finance | Top of Page | What's New | My Stuff