Air b&b and income

Discussion

Looking at potential changing jobs for an easier work life balance, this would also mean a lower income so I’m trying to think of ways to substitute the difference. Normally it’s only me and the misses that live in our 4 bed house and then family staying with us (they don’t live near by) a couple of times a year so thinking about renting out a room on air b&b when we want to.

Do you have to set yourself as a business or do you just add the income to your normal income for tax reasons? As it two of use that own the property can the income be split to try and get below tax band segments?

Do you have to set yourself as a business or do you just add the income to your normal income for tax reasons? As it two of use that own the property can the income be split to try and get below tax band segments?

As above, no need for a business, just add as rental income on your tax return and yes, you would split between you and your wife if you both own the property.

Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

PurpleFox said:

As above, no need for a business, just add as rental income on your tax return and yes, you would split between you and your wife if you both own the property.

Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Nope - not eligible for inclusion under the "Rent a Room" provisions.Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Rent a Room applies only to long term lodgers - not to people who are staying for short periods on holiday.

Eric Mc said:

PurpleFox said:

As above, no need for a business, just add as rental income on your tax return and yes, you would split between you and your wife if you both own the property.

Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Nope - not eligible for inclusion under the "Rent a Room" provisions.Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Rent a Room applies only to long term lodgers - not to people who are staying for short periods on holiday.

Eric Mc said:

PurpleFox said:

As above, no need for a business, just add as rental income on your tax return and yes, you would split between you and your wife if you both own the property.

Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Nope - not eligible for inclusion under the "Rent a Room" provisions.Having said that, it should come under rent a room relief so you should get £7,500 income tax free. This would also be split if joint owned. Anything over is taxed. You can’t deduct costs such as repairs and maintenance etc.

Rent a Room applies only to long term lodgers - not to people who are staying for short periods on holiday.

PurpleFox said:

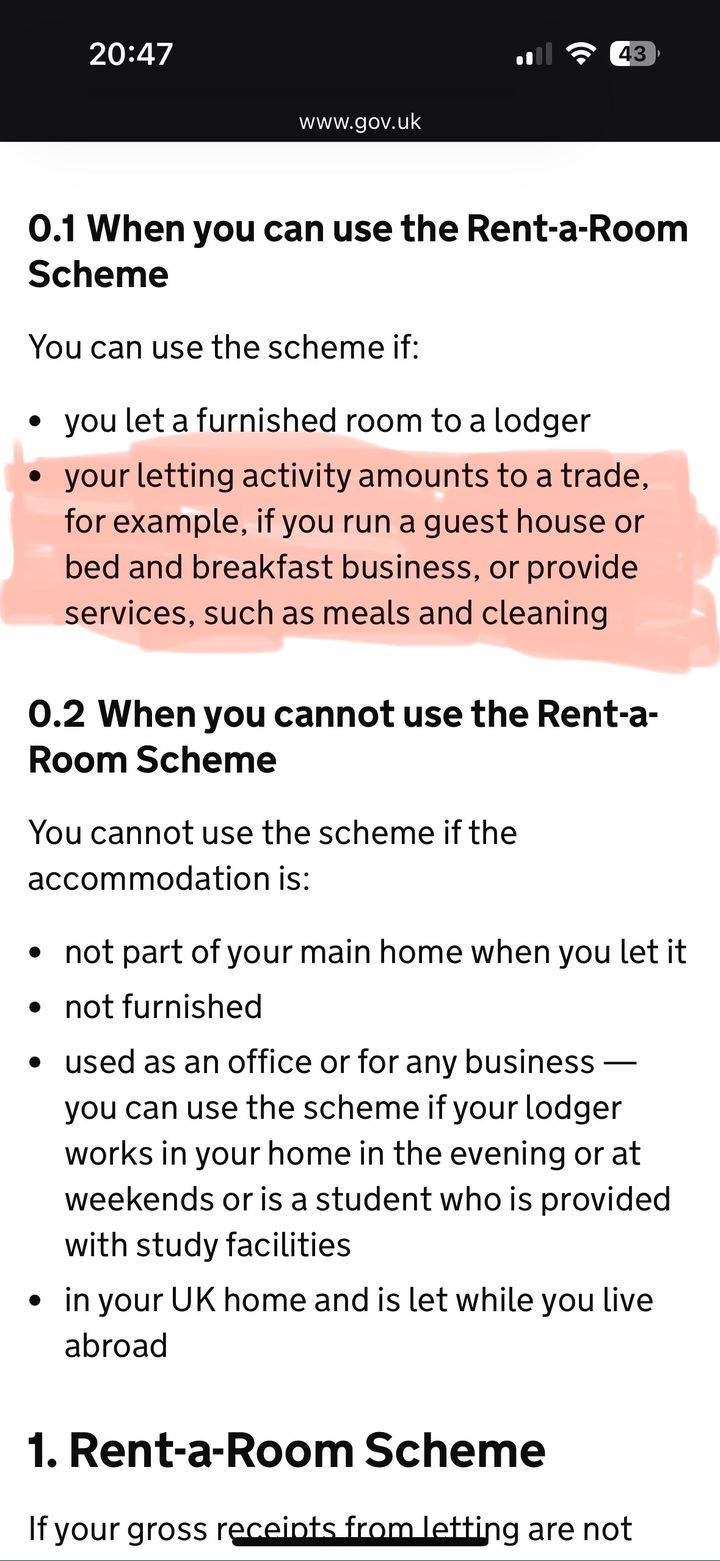

I can’t see anything in the help sheet that specifies long term lodgers only…..on the contrary, it seems to specifically include a guest houses, bed and breakfast.

Agreed. Rent-a-room relief applies to Air BnB as long as it meets the criteria. Length of stay isn't one of them.OIC said:

Probable thread hijack - sorry.

I own a commercial property.

If I Airbnb the studio space over my garage am I now running a property business?

Would be nice to up my relevant earnings for pension contributions.

Best to ask your accountant as there's a lot of moving parts in that one.I own a commercial property.

If I Airbnb the studio space over my garage am I now running a property business?

Would be nice to up my relevant earnings for pension contributions.

PurpleFox said:

I can’t see anything in the help sheet that specifies long term lodgers only…..on the contrary, it seems to specifically include a guest houses, bed and breakfast.

The problem is, on 6 April 2025 the special tax rules relating to "holiday lets" are abolished. In effect, "holiday lets" are now just normal "rental properties" - so where does that leave holiday accomodation in your own home?The quote you show above will be obsolete or, at the very least, will be open to challenge.

Tax rules change over time and the landscape for renters is changing very quickly.

Edited by Eric Mc on Friday 10th January 08:24

Eric Mc said:

The problem is, on 6 April 2025 the special tax rules relating to "holiday lets" are abolished. In effect, "holiday lets" are now just normal "rental properties" - so where does that leave holiday accomodation in your own home?

The quote you show above will be obsolete or, at the very least, will be open to challenge.

Tax rules change over time and the landscape for renters is changing very quickly.

I don't see the relevance Eric. The common theme on this thread is that you are letting part of your house (lodger or trade), which is different from your average holiday let where the whole house is let. That quote is not obsolete as the legislation is specific on the use of the house. See the PIM manual 4000 onwards.The quote you show above will be obsolete or, at the very least, will be open to challenge.

Tax rules change over time and the landscape for renters is changing very quickly.

Edited by Eric Mc on Friday 10th January 08:24

Gassing Station | Business | Top of Page | What's New | My Stuff