pension opt in and immediate opt out

Discussion

Through the NEST scheme, unsure about others, employers are obliged to enroll qualifying staff. If the employer and employee get on with it then it may be possible to get the paperwork sorted so the employee is opted out before the first payment it due.

If not then the deductions must be made but they will all be refunded once the employee has confirmed they are opting out.

I'm waiting to do this for a new employee and when my wife and I have to be re enrolled every 3 years (I think) then I don't make the payments as I know there will be no comeback as we are the employees in that situation. For "proper" employees I think there is some sort of code they must give you to remove them from the NEST list. I shall find out.

If not then the deductions must be made but they will all be refunded once the employee has confirmed they are opting out.

I'm waiting to do this for a new employee and when my wife and I have to be re enrolled every 3 years (I think) then I don't make the payments as I know there will be no comeback as we are the employees in that situation. For "proper" employees I think there is some sort of code they must give you to remove them from the NEST list. I shall find out.

DKL said:

Through the NEST scheme, unsure about others, employers are obliged to enroll qualifying staff. If the employer and employee get on with it then it may be possible to get the paperwork sorted so the employee is opted out before the first payment it due.

If not then the deductions must be made but they will all be refunded once the employee has confirmed they are opting out.

I'm waiting to do this for a new employee and when my wife and I have to be re enrolled every 3 years (I think) then I don't make the payments as I know there will be no comeback as we are the employees in that situation. For "proper" employees I think there is some sort of code they must give you to remove them from the NEST list. I shall find out.

Pretty much this, except there is no code. I’ve enrolled quite a few now that immediately opt out.If not then the deductions must be made but they will all be refunded once the employee has confirmed they are opting out.

I'm waiting to do this for a new employee and when my wife and I have to be re enrolled every 3 years (I think) then I don't make the payments as I know there will be no comeback as we are the employees in that situation. For "proper" employees I think there is some sort of code they must give you to remove them from the NEST list. I shall find out.

Employee can ring up and opt out as soon as they receive their confirmation of auto-enrollment / wage slip from employer.

Employer then receives notification from NEST to confirm employee OPT OUT.

As mentioned the employer can catch the payment if both parties are quick enough, however it’s just as easy to reimburse the amount the following pay period.

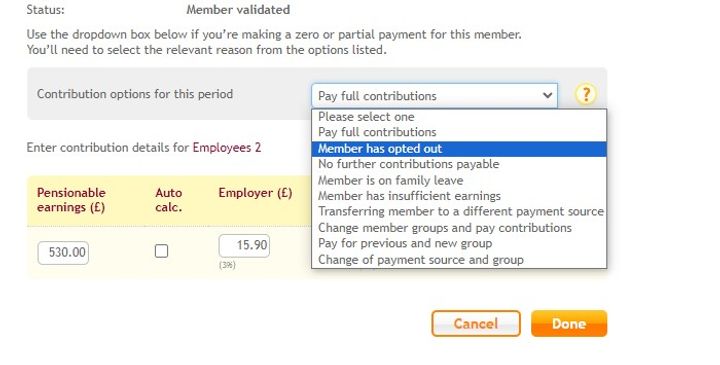

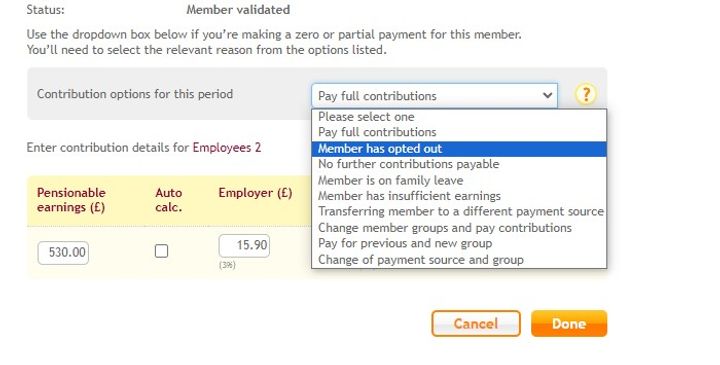

The employee can also opt out by informing the employer, in which case (in Nest at least) when you process the next Payrol, on the contributions schedule you click 'Options' next to that employee and then just set that employee to "member has opted out" or "no further contributions due" - that then removes them from the pension scheme.

Dr Interceptor said:

The employee can also opt out by informing the employer, in which case (in Nest at least) when you process the next Payrol, on the contributions schedule you click 'Options' next to that employee and then just set that employee to "member has opted out" or "no further contributions due" - that then removes them from the pension scheme.

They can inform the employer, but must do so in writing using an opt out notice, which is normally given by the pension provider.They must also have been an active member of the pension scheme, i.e. they must be enrolled and cannot simply go straight to being ‘opted out’.

Gassing Station | Business | Top of Page | What's New | My Stuff