Second hand EV as company car

Discussion

Considering an EV purchase through Ltd company, non VAT registered, and wondered about buying second hand instead of used. My understanding is there is nothing stopping a second hand vehicle purchase and the only difference would be the tax relief.

I would be grateful if anyone could help me understand the pro's and con's.......

So new would be 100% allowable in first year

Used vehicle would be in the main rate pool at 18%

Does this mean I can claim 18% of the vehicle cost in tax relief, if so is this 18% of the value each year (until 100% claimed) or just in the first year?

What happens on disposal?

What happens if it is not bought outright but financed?

Thanks in advance

I would be grateful if anyone could help me understand the pro's and con's.......

So new would be 100% allowable in first year

Used vehicle would be in the main rate pool at 18%

Does this mean I can claim 18% of the vehicle cost in tax relief, if so is this 18% of the value each year (until 100% claimed) or just in the first year?

What happens on disposal?

What happens if it is not bought outright but financed?

Thanks in advance

PurpleFox said:

Considering an EV purchase through Ltd company, non VAT registered, and wondered about buying second hand instead of used. My understanding is there is nothing stopping a second hand vehicle purchase and the only difference would be the tax relief.

I would be grateful if anyone could help me understand the pro's and con's.......

So new would be 100% allowable in first year

Used vehicle would be in the main rate pool at 18%

Does this mean I can claim 18% of the vehicle cost in tax relief, if so is this 18% of the value each year (until 100% claimed) or just in the first year?

What happens on disposal?

What happens if it is not bought outright but financed?

Thanks in advance

Broadly right. 100% WDA exists for new vehicles so can lop off a decent amount of tax to pay, even if the vehicle is financed (useful to note, so you could finance a £50k car with a £5k deposit and £500 a month and spend £11k on finance in the first year, yet recover £12.5k in tax write-down charges. I did exactly this in 2015, bought a £110k car on IF finance that cost £37k in first year costs yet claimed £44k tax (40% payer, LLP) rebates.I would be grateful if anyone could help me understand the pro's and con's.......

So new would be 100% allowable in first year

Used vehicle would be in the main rate pool at 18%

Does this mean I can claim 18% of the vehicle cost in tax relief, if so is this 18% of the value each year (until 100% claimed) or just in the first year?

What happens on disposal?

What happens if it is not bought outright but financed?

Thanks in advance

Second hand is 18% per year of the reduced value so never goes to zero. On disposal, the difference between the sell price and it’s book value is added/removed from the P&L.

For 100% WDA, it is really a cashflow wheeze as you pay back the tax on disposal- but with creative financial planning around disposal dates you can soften the blow.

Thanks for both of the replies.

So, trying a worked example on used:

If I bought a second hand car for £50k, I write down 18% in first year, so £9k.

then second year, I write down 18% so another £9k.

By the time I get to year 5 I have claimed £45k against profits instead of the £50k for a new one.

So only £5k difference over 5 years (but spread out rather than in single year)?

I am sure I must be looking at this incorrectly.

So, trying a worked example on used:

If I bought a second hand car for £50k, I write down 18% in first year, so £9k.

then second year, I write down 18% so another £9k.

By the time I get to year 5 I have claimed £45k against profits instead of the £50k for a new one.

So only £5k difference over 5 years (but spread out rather than in single year)?

I am sure I must be looking at this incorrectly.

PurpleFox said:

Thanks for both of the replies.

So, trying a worked example on used:

If I bought a second hand car for £50k, I write down 18% in first year, so £9k.

then second year, I write down 18% so another £9k.

By the time I get to year 5 I have claimed £45k against profits instead of the £50k for a new one.

So only £5k difference over 5 years (but spread out rather than in single year)?

I am sure I must be looking at this incorrectly.

You take 18%(?) from £45,000, then 18% from 82% of £45,000, I thinkSo, trying a worked example on used:

If I bought a second hand car for £50k, I write down 18% in first year, so £9k.

then second year, I write down 18% so another £9k.

By the time I get to year 5 I have claimed £45k against profits instead of the £50k for a new one.

So only £5k difference over 5 years (but spread out rather than in single year)?

I am sure I must be looking at this incorrectly.

PurpleFox said:

So, trying a worked example on used:

If I bought a second hand car for £50k, I write down 18% in first year, so £9k.

then second year, I write down 18% so another £9k.

By the time I get to year 5 I have claimed £45k against profits instead of the £50k for a new one.

So only £5k difference over 5 years (but spread out rather than in single year)?

I am sure I must be looking at this incorrectly.

Yup, it's 18% of the *REDUCING* balance so:If I bought a second hand car for £50k, I write down 18% in first year, so £9k.

then second year, I write down 18% so another £9k.

By the time I get to year 5 I have claimed £45k against profits instead of the £50k for a new one.

So only £5k difference over 5 years (but spread out rather than in single year)?

I am sure I must be looking at this incorrectly.

Year 1: Opening value £50k, write down 9K, closing value £41k

Year 2: Opening value £41k, write down 7.4k, closing value £33.6k

Year 3: Opening value £33.6k, write down £6k, closing value £27.6k

Year 4: Opening value £27.6k, write down £5k, closing value £22.6k

Year 5; Opening value £22.6k, write down £4k, closing value £18.6k

So after 5 years you've written down £31.4k and have the car on the balance sheet at £18.6k. You will then pay any balancing tax charges between that value and what you sell it for. So, if you sell it for £25k then you'll record a profit of £6.4k and be liable for tax on that.

If it was a NEW car then you would have written off £50k in the first year so if you sell it anytime after that point then whatever you sell it for will be charged as profit.

Ok?

Edit: to correct dodgy maths done in my head

Edited by MrOrange on Monday 24th April 16:18

Edited by MrOrange on Monday 24th April 16:19

Thanks for explaining the write down, most helpful.

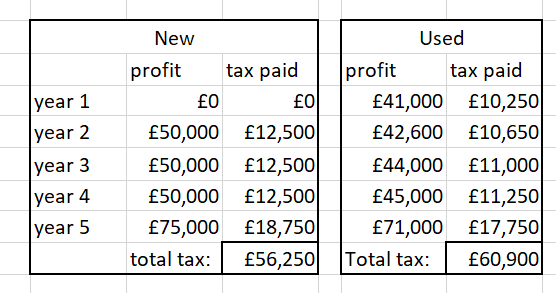

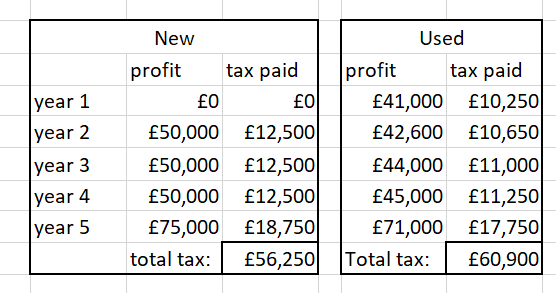

I think I have my calcs below correct, assuming a £50k profit every year, £50k car. 25% tax and car sold in year 5 for £25k to keep the maths simple....

So it's not just a wheeze to defer tax, it actually saves tax too BUT, could you save more than that by buying used and avoiding the worst of the depreciation. Depends on all sorts of factors I suppose

I think I have my calcs below correct, assuming a £50k profit every year, £50k car. 25% tax and car sold in year 5 for £25k to keep the maths simple....

So it's not just a wheeze to defer tax, it actually saves tax too BUT, could you save more than that by buying used and avoiding the worst of the depreciation. Depends on all sorts of factors I suppose

Doesn't really save tax: At Year 5 the used car will have a smaller balancing tax charge to pay (ie not fully written down) vs the new car where you pay tax on the whole of the selling price.

In reality, unless you can skew the purchase/sale in a year where you pay differing rates of tax the tax benefit is exactly the same - it's just that you get it all up front for a new car.

Edit: I've not gone through your numbers but the net tax writedown over any given period is the same in both scenarios

New car: Buy £50k, sell £25k, claim £25k against tax (actually claim £50k in year 1 and liable for £25k in year 5)

Old Car: Buy £50k,write is down at, to take the piss, 1% a year then claim back the difference when you sell.

i.e. It's an allowance but doesn't change the liability unless you pump into a different tax band.

In reality, unless you can skew the purchase/sale in a year where you pay differing rates of tax the tax benefit is exactly the same - it's just that you get it all up front for a new car.

Edit: I've not gone through your numbers but the net tax writedown over any given period is the same in both scenarios

New car: Buy £50k, sell £25k, claim £25k against tax (actually claim £50k in year 1 and liable for £25k in year 5)

Old Car: Buy £50k,write is down at, to take the piss, 1% a year then claim back the difference when you sell.

i.e. It's an allowance but doesn't change the liability unless you pump into a different tax band.

Edited by MrOrange on Tuesday 25th April 16:51

Regy53 said:

Also ex demo is covered under the scheme of 100% tax w/d

Interesting point that.What does a car need to be to be an ex-demo?

Presumably owned by a dealer or manufacturer only?

Any limit on age and mileage?

I'm looking at one that is a legit ex-demo at the moment - sub-6 months old and less than 4k miles - but assumed i needed to go brand new to get the 100% WD.

I am fairly sure an ex demonstrator would count or a pre-registered car for the purposes of a dealer hitting their targets.

I had a look into it but info from hmrc seemed fairly vague....

"New cars are ‘unused and not second hand’. You should accept a car is unused and not second hand even if it has been driven a limited number of miles for the purposes of testing, delivery, test driven by a potential purchaser, or used as a demonstration car."

I had a look into it but info from hmrc seemed fairly vague....

"New cars are ‘unused and not second hand’. You should accept a car is unused and not second hand even if it has been driven a limited number of miles for the purposes of testing, delivery, test driven by a potential purchaser, or used as a demonstration car."

A VAT registered company can recover 100% of the VAT on any new car (EV or petrol/diesel) providing its 100% for business use. If it's a mix of business/personal use (including commuting) then the company cannot recover any of the VAT.

If the VAT is not reclaimed, it also means that the vehicle is not VAT qualifying, and the company does not need to charge VAT when it sells the vehicle on.

If a new car is leased, you can recover 50% of the VAT on the lease payments if its a mix of business/personal use, and 100% of the VAT if its solely business use.

To recover the VAT on a used vehicle, the same rules as above apply, but the vehicle would need to be VAT Qualifying (i.e. being an ex-company car who has recovered the VAT on it initially). Most used cars are not VAT qualifying.

If the VAT is not reclaimed, it also means that the vehicle is not VAT qualifying, and the company does not need to charge VAT when it sells the vehicle on.

If a new car is leased, you can recover 50% of the VAT on the lease payments if its a mix of business/personal use, and 100% of the VAT if its solely business use.

To recover the VAT on a used vehicle, the same rules as above apply, but the vehicle would need to be VAT Qualifying (i.e. being an ex-company car who has recovered the VAT on it initially). Most used cars are not VAT qualifying.

Dr Interceptor said:

A VAT registered company can recover 100% of the VAT on any new car (EV or petrol/diesel) providing its 100% for business use. If it's a mix of business/personal use (including commuting) then the company cannot recover any of the VAT.

If the VAT is not reclaimed, it also means that the vehicle is not VAT qualifying, and the company does not need to charge VAT when it sells the vehicle on.

If a new car is leased, you can recover 50% of the VAT on the lease payments if its a mix of business/personal use, and 100% of the VAT if its solely business use.

To recover the VAT on a used vehicle, the same rules as above apply, but the vehicle would need to be VAT Qualifying (i.e. being an ex-company car who has recovered the VAT on it initially). Most used cars are not VAT qualifying.

ETA. Apologies as I misread your message. I've left it to show what an idiot I am If the VAT is not reclaimed, it also means that the vehicle is not VAT qualifying, and the company does not need to charge VAT when it sells the vehicle on.

If a new car is leased, you can recover 50% of the VAT on the lease payments if its a mix of business/personal use, and 100% of the VAT if its solely business use.

To recover the VAT on a used vehicle, the same rules as above apply, but the vehicle would need to be VAT Qualifying (i.e. being an ex-company car who has recovered the VAT on it initially). Most used cars are not VAT qualifying.

but my inability to claim VAT was because the car was being used for business and personal.

but my inability to claim VAT was because the car was being used for business and personal.That's not my understanding but the law could've change sine I purchased mine 5 years ago. VAT can be claimed on commercial vehicles but my accountant advised that I could only claim VAT on a lease. Puzzling but was what I was told at the time.

The othe thing my accountant advised (not relevant to your post but to the OP) was that I could buy a used car but the BIK would still be based on the new price. It doesn't make much difference for an EV but would naturally be significant on anything with an ICE.

Edited by Zero Fuchs on Wednesday 17th January 12:14

Another one resurrecting this thread.

I’m fairly new to the business ownership game but have been considering an EV.

The depreciation on the second hand ones with barely any miles on is sometimes more than half the new value.

So I was considering how the tax worked with a used EV and 2nd hand vehicle and the 18% capital allowance.

Is the 18% based on the purchase price (2nd hand) or the list price of the car when new?

I’m fairly new to the business ownership game but have been considering an EV.

The depreciation on the second hand ones with barely any miles on is sometimes more than half the new value.

So I was considering how the tax worked with a used EV and 2nd hand vehicle and the 18% capital allowance.

Is the 18% based on the purchase price (2nd hand) or the list price of the car when new?

Hi

Resurrecting thread once more!

Can UK businesses lease second hand EV cars? and if so is there a 100% allowance for the lease as it is an EV or does it revert to the 18% that it would be for a second hand car? The business wouldn't own the asset so I can't think what would happen.

Cheers

Resurrecting thread once more!

Can UK businesses lease second hand EV cars? and if so is there a 100% allowance for the lease as it is an EV or does it revert to the 18% that it would be for a second hand car? The business wouldn't own the asset so I can't think what would happen.

Cheers

Gassing Station | Business | Top of Page | What's New | My Stuff