AML - NEW UK SALES

Discussion

alscar said:

Jon, what is your view on buying MG shares ( assuming they can be ?) ?

The maker of the SUV cars named MG, is SAIC Motor Corporation Limited.

I understand that firm is entirely owned by the state.

If you were a friend of Chairman Mao or perhaps his successors, you might be able to buy (although don't think it works that way) be given a stake.

Jon39 said:

The maker of the SUV cars named MG, is SAIC Motor Corporation Limited.

I understand that firm is entirely owned by the state.

If you were a friend of Chairman Mao or perhaps his successors, you might be able to buy (although don't think it works that way) be given a stake.

As I always said still the least money lost on an Aston bought to date.

oilit said:

Jon, Every month shows a YoY decline, but announcing your facelift/new model so far in advance is a sure way of slowing sales of existing models.

It will be interesting to see how sales numbers look in the db12 era

I thought DB11 books and lines had closed anyway so impact on that side will be obvious. Dealers won't get a DB12 demo until July, so they are likely to be built now, lets not get into whether that translates as a sale, but dealers will be forced to take on a certain number. It will be interesting to see how sales numbers look in the db12 era

Customer deliveries are not until about October from what I got told if you put a deposit down at the Works viewing, so there must be a back order of cars around September ready for the new reg.

The DVLA have at last updated their figures for 2022 Quarter 4.

Only about 6 months late, but I suppose we should be grateful.

Working from home and tea drinking, must have slowed their productivity.

Publication used to be quicker than this.

https://www.gov.uk/government/statistical-data-set...

Move down that webpage and select either the Great Britain, or United Kingdom link.

df_VEH0160_GB:

df_VEH0160_UK:

If you wish after downloading, you can save the file as an Excel spreadsheet.

I think there is only one main dealer in Northern Ireland, so if you want to have a cheeky snoop, at how many new Aston Martins they sell (and when), just compare the UK and GB figures.

12% decrease on the previous year. I understand that there is a delay in delivery of DB12, but personally I would have thought sales of DBX would have covered it.

DBX residuals appear to be falling into Range Rover levels. It is going to be difficult going forward to keep people with the brand if the cars are losing £80k in 2 years

DBX residuals appear to be falling into Range Rover levels. It is going to be difficult going forward to keep people with the brand if the cars are losing £80k in 2 years

paulbirkin said:

12% decrease on the previous year. I understand that there is a delay in delivery of DB12, but personally I would have thought sales of DBX would have covered it.

DBX residuals appear to be falling into Range Rover levels. It is going to be difficult going forward to keep people with the brand if the cars are losing £80k in 2 years

Different customers really, but I think the finance rates will have put some off. I do know a few that went away from RR following thefts, but no one is getting an AM based on residuals alone (and to be fair in certain areas of the market we are clearly issues as well regarding residual values).DBX residuals appear to be falling into Range Rover levels. It is going to be difficult going forward to keep people with the brand if the cars are losing £80k in 2 years

A better start to 2024 by Aston Martin.

UK New Registrations.

January 2023 = 106

January 2024 = 135 (+27%)

...............................................................................

Other makes;

McLaren still stand out with low figures, 11 cars, but that was up from last January's 8.

The Chinese are coming;

BYD ................. 248

GWM Ora .......... 56

MG ................. 6711

paulbirkin said:

12% decrease on the previous year. I understand that there is a delay in delivery of DB12, but personally I would have thought sales of DBX would have covered it.

DBX residuals appear to be falling into Range Rover levels. It is going to be difficult going forward to keep people with the brand if the cars are losing £80k in 2 years

I'm considering replacing my L405 Range Rover and a 2yo DBX looks like value next to a 2yo Rangie (or even a V8 Defender - which are silly money for what they are).DBX residuals appear to be falling into Range Rover levels. It is going to be difficult going forward to keep people with the brand if the cars are losing £80k in 2 years

New DBX? Er, no. Just no.

Some general market observations that may be of interest.

Clearly AML are positioned in the premium market, but as we saw in 2009, they can still be affected by general market and economic conditions.

It appears that private buyers are increasingly turning to purchasing used cars.

An interesting situation at Ford, where a dealer talks about fewer new models that his customers want to buy, and although used models have strong demand, sourcing stock is becoming increasingly difficult.

..................................

So why are private new car sales performing so badly?

There are several reasons why private new car sales have been falling for the last eight years, but the biggest is that buyers have been buying ever-more expensive cars on car finance agreements and then trying to fit those into income budgets that have not been increasing at the same rate.

Longer car finance terms

PCP car finance has been around since the 1980s, but it really started to take off in about 2010 in conjunction with a government scrappage scheme – launched in the depths of the great financial crisis in 2009 and helped by record low interest rates. Long story short, customers could buy a more expensive car for lower monthly payments than they had been used to, and they liked it.

But cars, and customer tastes, got even more expensive. So rather than buying cheaper cars to keep their payments down, buyers started taking longer agreements instead. The default PCP term shifted from three years to four years, and that meant 25% fewer new car buyers each year as everyone kept their existing car for a year longer.

Cars have become much more expensive

New cars have also become increasingly expensive over the last decade. To pick one popular car as an example: Back in 2015, the then-new Vauxhall Corsa launched with a starting price of £8,995. Today, a new Corsa starts at £18,505 – more than double the price.

Over the same period, average weekly earnings haven’t come close to matching that level of increase, and real-world average disposable income hasn’t really increased at all for many people.

Higher interest rates make car finance more expensive

On top of the extreme price increases, the cost of financing a new car has increased significantly as interest rates have climbed over the last couple years after more than a decade at record lows. This adds a significant extra chunk onto monthly payments for a PCP (or a lease, but the costs of leasing are much more opaque).

..................................................

At Platts of Marlow, a Ford retail dealer that will celebrate 100 years in the Berkshire town in 2025, they’re contemplating life without new Blue Oval cars.

“Even now, there’s such a limited range of Ford models left to sell,” said Jim Platt, company chairman and son of the founder.

“Once we had as many as 30 but now we’re down to five. “The Fiesta, which used to account for 50% of our sales, is no longer made and the Focus will soon be dropped. These are the models we can sell to private, retail customers. Fortunately, we can still offer them the Puma, which is our best-seller.”

Platt said the absence of a wider range of alternative models means his new car sales are down by 30%.

Fortunately, he’s finding that many private customers who miss the old models and who aren’t interested in electric cars are prepared to part-exchange their cars for used and nearly new Fords instead.

However, according to Platt, sourcing such cars is becoming harder by the month as more dealers compete to buy stock.

One hundred miles away in Dudley, West Midlands, this scenario of declining sales of new cars to private customers is also being played out at Summit Garage.

The dealership, founded 80 years ago, currently holds the MG franchise but will soon quit it due to declining retail sales.

Co-owner John Newey said: “The motor trade is facing some difficult times at the moment, with the decline in the number of customers actually purchasing. I know that MG has in its own words been growing exponentially but the reality is, this year, there has been more pressure with less and less retail business.”

July 2024 UK sales [new registrations] figures released today.

Figures in brackets, July 2023.

Luxury

Aston Martin ........ 32 (63)

Bentley ................. 50 (92)

Ferrari ................... 74 (90)

Lamborghini ......... 63 (75)

Lotus ..................... 227 (101)

Maserati ............... 31 (68)

McLaren ............... 16 (16)

Porsche ................ 1,195 (1,901)

Rolls Royce ........... 34 (35)

Battery

BYD ........................ 768 (81)

GWM ORA .............. 55 (77)

MG .......................... 6,231 (6,070)

Polestar .................. 816 (1,300)

Tesla ....................... 2,462 (3,141)

August is always a slow sales month for obvious reasons.

Display an up to date registration mark in September and you can be 'top dog' for 6 months.

Aston Martin year to date comparison has been running ahead this year, but has now dropped slightly behind last years sales.

UK New Registrations:- Aston Martin

August 2024 ....... 18 ..... (Aug 2023 = 27)

Year to date ..... 634 ..... (YTD 2023 =637)

Wills2 said:

Jon39 said:

Wills2 said:

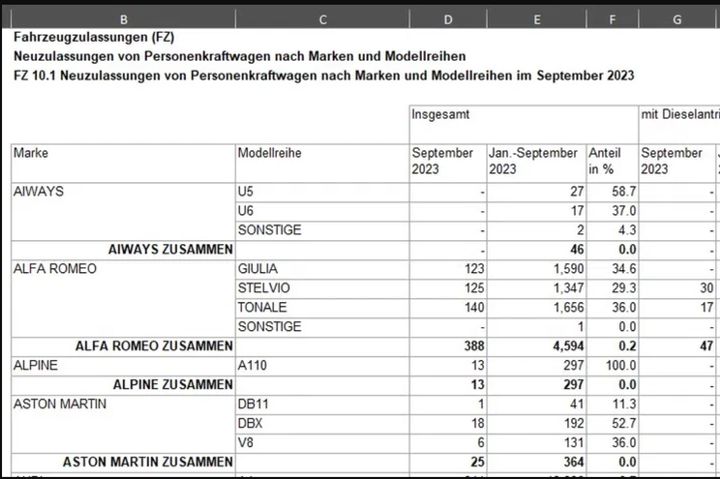

I took it to be a percentage of the previous years (sept) registration units (but understand what you're saying) I checked the actual figures for September 23 and they did register 25 cars, so my assumption seems to be correct.

Thank you Wills2.

You have found a very helpful spreadsheet, which includes individual models.

Are you happy for me to copy your post to our Sales topic?

https://www.pistonheads.com/gassing/topic.asp?h=0&...

The UK DVLA provide similar data (unfortunately only quarterly), but it takes them ages to publish each update, so by then we have almost lost interest.

Perhaps the German equivalent is posted promptly.

Is theirs a monthly publication, posted immediately following each month end?

Is there a link, enabling us to go directly to the latest German data?

The UK data is free to access, but USA (now Aston Martin's main market) seems to be behind a paywall.

Here is a link to the Federal website where I found the data, typically they are very efficient and have it all broken down by year/month and brand/model (good old Germans)

Naturally I get Google to translate the website so I can find my way around it.

https://www.kba.de/DE/Home/home_node.html

Aston Martin sales figures for Germany.

Posted by Wills2 on the Stock Market topic and has kindly allowed it to appear on this Sales topic.

Edited by Jon39 on Monday 4th November 09:03

Gassing Station | Aston Martin | Top of Page | What's New | My Stuff