Tesla unlikely to Survive (Vol. 3)

Discussion

TheDeuce said:

I'll leave the robotaxi thing to one side for the moment - I simply don't believe that's anywhere remotely close to being a commercial reality.

I should have put a sarcastic face. Actions speak louder than words and cutting back on staff who would build a foundation service for the robotaxi kind of implies even Musk doesn’t believe they’re coming soon. I’m struggling to think of a reason to stay with Tesla other than effectively free supercharging for the next 3 years due to accumulated referral credits. There is a nice year old iX 50 nearby that’s got everything from laser lights to a massage drivers seat and air suspension, all for the price of a new MY P

I put this on another thread but seems it should be here.

Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

Edited by h0b0 on Wednesday 1st May 13:05

Gone fishing said:

TheDeuce said:

I'll leave the robotaxi thing to one side for the moment - I simply don't believe that's anywhere remotely close to being a commercial reality.

I should have put a sarcastic face. Actions speak louder than words and cutting back on staff who would build a foundation service for the robotaxi kind of implies even Musk doesn’t believe they’re coming soon. I’m struggling to think of a reason to stay with Tesla other than effectively free supercharging for the next 3 years due to accumulated referral credits. There is a nice year old iX 50 nearby that’s got everything from laser lights to a massage drivers seat and air suspension, all for the price of a new MY P

The IX 50 is a lovely car! My business partner has the 40, but it's a bit slow. We tested a 50 and it was night and day, the car really became a bit of fun in addition to being very practical. It can't compete with effectively free charging though! Although if you can mostly charge at home I guess the difference is just a couple hundred quid a year.

h0b0 said:

I out this on another thread but seems it should be here.

Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

They started opening them in Europe a long time ago and seemingly without pressure to do so. If Musk thinks the world stops at the US border and kills the worldwide supercharging team then that’s a bit stupid.Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

Superchargers have always been a sales point, in the US, through the app, you have a captive audience of people you can promote to, that’s quote valuable. In the U.K. the majority of the early ones to be opened up were collocated at sales centres, brilliant idea, you turn up in the etron, you’re at a lose end for 30 mins, you go and look in the showroom.

Absolute chaos at Tesla.

Word on the street is that the supercharger exec pushed back to Musk to have a debate around the level of headcount reduction so he just removed them all, every single one of them.

Hearing that the head of Tesla HR has just quit as well.

Also hearing that the new unboxing platform, originally for M2 and robotaxi, then just robotaxi....well it looks like the whole thing has been shelved. Not sure what they can reveal on robotaxi day in August, especially considering the head of new vehicles program no longer works at Tesla either.

Hearing that Tesla has hired an ex military airbase in Germany with strict controls and that there are thousands of unsold vehicles being stored there.

Sounds like an assortment of issues that typically precede unfortunate events....

Word on the street is that the supercharger exec pushed back to Musk to have a debate around the level of headcount reduction so he just removed them all, every single one of them.

Hearing that the head of Tesla HR has just quit as well.

Also hearing that the new unboxing platform, originally for M2 and robotaxi, then just robotaxi....well it looks like the whole thing has been shelved. Not sure what they can reveal on robotaxi day in August, especially considering the head of new vehicles program no longer works at Tesla either.

Hearing that Tesla has hired an ex military airbase in Germany with strict controls and that there are thousands of unsold vehicles being stored there.

Sounds like an assortment of issues that typically precede unfortunate events....

This isn’t just a Tesla problem; this is an everyone problem. Cheap credit has driven growth and relative prosperity. Now that’s gone, together with soaring energy costs, there’s potential for a global slowdown on a scale we haven’t seen in a while.

Many out there in business are already saying it is - for then - worse than 2008. In its own way, this is a credit crunch. Tesla’s value - and Musk’s net worth - is intrinsically linked to the growth story.

Tesla have been expanded at a dramatic rate. Their sunk costs in setting up new facilities alone have been dramatic. If there’s going to be a major downturn, Musk is likely to want to target cash preservation and profitability in order to prevent having to dilute by going back to issuing lots of convertible debt.

Especially when his pay deal hasn’t yet been renewed - right now he’s worked for nothing for years, and faces the possibility of that becoming the new reality.

Now I’ll be the first to say he shouldn’t have bought Twitter. Coupled with the never-ending costs at SpaceX, I very much doubt his life is especially pleasant right now; the prospect of it all crashing down and/or - worse - his being diluted out, will feel very real.

The reported story of firing the whole team because the manager pushed back on headcount reductions, and his writing to the company that this was - as it were - to make sure everyone understood the seriousness of his intent, has all the hallmarks of somebody in a very real stress crisis.

Where is the board in all of this? What about major shareholders?

Many out there in business are already saying it is - for then - worse than 2008. In its own way, this is a credit crunch. Tesla’s value - and Musk’s net worth - is intrinsically linked to the growth story.

Tesla have been expanded at a dramatic rate. Their sunk costs in setting up new facilities alone have been dramatic. If there’s going to be a major downturn, Musk is likely to want to target cash preservation and profitability in order to prevent having to dilute by going back to issuing lots of convertible debt.

Especially when his pay deal hasn’t yet been renewed - right now he’s worked for nothing for years, and faces the possibility of that becoming the new reality.

Now I’ll be the first to say he shouldn’t have bought Twitter. Coupled with the never-ending costs at SpaceX, I very much doubt his life is especially pleasant right now; the prospect of it all crashing down and/or - worse - his being diluted out, will feel very real.

The reported story of firing the whole team because the manager pushed back on headcount reductions, and his writing to the company that this was - as it were - to make sure everyone understood the seriousness of his intent, has all the hallmarks of somebody in a very real stress crisis.

Where is the board in all of this? What about major shareholders?

It's beginning to sound a lot like Musk is doing to Tesla what he did to Twitter, which is possibly the worst thing that could happen to them.

There may be strategic reasons for getting rid of the supercharger team but as others have said, it has always been one of Tesla's primary USPs. Even the people who don't use it still mention it because it's reassuring to know it's there. They could have wound it down steadily and quietly, and nobody would notice, but dropping the team in such a panicky, clumsy, headline-grabbing way, suddenly makes the future of the network look very uncertain, and undermines that confidence.

Is it simply that Musk doesn't have a clue about running a business when borrowing isn't cheap? He really doesn't seem to understand that firing people doesn't necessarily save you money.

There may be strategic reasons for getting rid of the supercharger team but as others have said, it has always been one of Tesla's primary USPs. Even the people who don't use it still mention it because it's reassuring to know it's there. They could have wound it down steadily and quietly, and nobody would notice, but dropping the team in such a panicky, clumsy, headline-grabbing way, suddenly makes the future of the network look very uncertain, and undermines that confidence.

Is it simply that Musk doesn't have a clue about running a business when borrowing isn't cheap? He really doesn't seem to understand that firing people doesn't necessarily save you money.

durbster said:

This is the bit I'm confused about too. With Twitter there's nobody to stop him burning it to the ground but you'd think Tesla would have some layers of protection against this kind of thing.

IIRC he has selected people who are supportive of him within the company, so gets little push back, also they’d get fired if they did.Shareholders might feel the value can only be sustained with musk and his AI/visionary leadership.

If it’s a regular car company they are going to lose a lot of value.

Are most Tesla chargers now open to every EV make? Seems as though they are (but I'm not sure). If this is the case, maybe Tesla don't see the benefit of building chargers for the benefit other makes?

Do Tesla have enough sites now? Are they focussed on expanding those rather than building new ones?

Just guessing....

Do Tesla have enough sites now? Are they focussed on expanding those rather than building new ones?

Just guessing....

NDA said:

Are most Tesla chargers now open to every EV make? Seems as though they are (but I'm not sure). If this is the case, maybe Tesla don't see the benefit of building chargers for the benefit other makes?

Do Tesla have enough sites now? Are they focussed on expanding those rather than building new ones?

Just guessing....

Still expanding but at a slower rate.Do Tesla have enough sites now? Are they focussed on expanding those rather than building new ones?

Just guessing....

NDA said:

Are most Tesla chargers now open to every EV make? Seems as though they are (but I'm not sure). If this is the case, maybe Tesla don't see the benefit of building chargers for the benefit other makes?

Do Tesla have enough sites now? Are they focussed on expanding those rather than building new ones?

Just guessing....

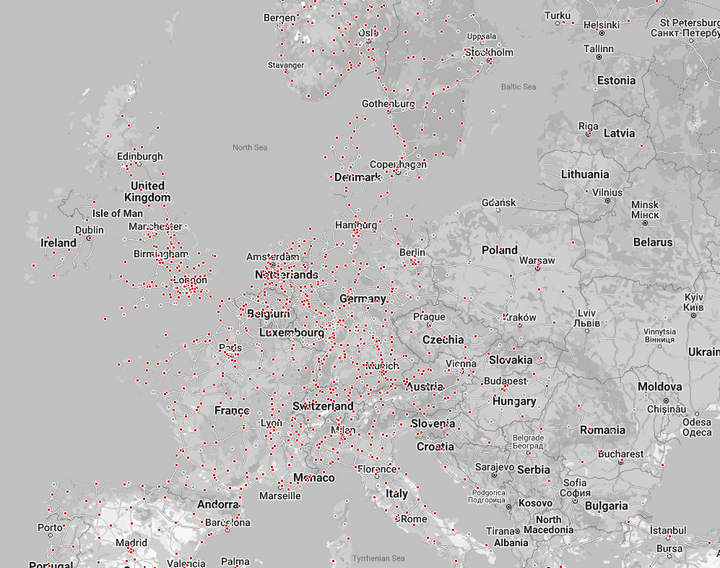

I've been traveling through Europe for over 5 years and there are definetely some dead spots and still new ones opening up, but the center of Europe is quite well endowed.Do Tesla have enough sites now? Are they focussed on expanding those rather than building new ones?

Just guessing....

England, Netherlands, Belgium, France, Switzerland, Austria, Denmark, North of Italy I've never had a problem finding a charger and basically have the freedom of movement I had in my diesel.

Been to south of Italy a couple of times, same as Croatia and while feasible it does require a bit of planning.

The network is great but it does need some expansion. I like to take the train to Poland and from the look of it it's not something I'd do in the Tesla.

I've never used a non-tesla supercharger to this day. I do use destination charging as much as possible though, so do use other networks there.

This map from Tesla's own site perfectly aligns with my experience.

ZesPak said:

I've been traveling through Europe for over 5 years and there are definetely some dead spots and still new ones opening up, but the center of Europe is quite well endowed.

England, Netherlands, Belgium, France, Switzerland, Austria, Denmark, North of Italy I've never had a problem finding a charger and basically have the freedom of movement I had in my diesel.

Been to south of Italy a couple of times, same as Croatia and while feasible it does require a bit of planning.

The network is great but it does need some expansion. I like to take the train to Poland and from the look of it it's not something I'd do in the Tesla.

I've never used a non-tesla supercharger to this day. I do use destination charging as much as possible though, so do use other networks there.

This map from Tesla's own site perfectly aligns with my experience.

For some of us, that map looks like a great way to identify places in Europe to live well away from the madding crowds England, Netherlands, Belgium, France, Switzerland, Austria, Denmark, North of Italy I've never had a problem finding a charger and basically have the freedom of movement I had in my diesel.

Been to south of Italy a couple of times, same as Croatia and while feasible it does require a bit of planning.

The network is great but it does need some expansion. I like to take the train to Poland and from the look of it it's not something I'd do in the Tesla.

I've never used a non-tesla supercharger to this day. I do use destination charging as much as possible though, so do use other networks there.

This map from Tesla's own site perfectly aligns with my experience.

Some interesting videos coming out of FSD 12.3.4 and 12.3.5, showing impressive progress.

On the question of direct sunlight, this video seems to suggest this isn’t a huge problem: https://youtu.be/Ly05FWCHrKs?si=laBI0XGYcUd4dFou

On the question of direct sunlight, this video seems to suggest this isn’t a huge problem: https://youtu.be/Ly05FWCHrKs?si=laBI0XGYcUd4dFou

Mikebentley said:

Just got a Reddit email linking to a thread saying more lay offs from Engineering and Software Services departments. Don’t know if this is true or not.

Probably true, but Reddit has become toxic, if you post in the “RealTesla” area the moderators of the other Tesla groups ban you, they don’t like people posting negative articles about their brand. #freespeech Gone fishing said:

h0b0 said:

I out this on another thread but seems it should be here.

Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

They started opening them in Europe a long time ago and seemingly without pressure to do so. If Musk thinks the world stops at the US border and kills the worldwide supercharging team then that’s a bit stupid.Elon was forced to open up his supercharger network to all in the US. As a result, any investment I the network nets him zero competitive advantage. In fact, his biggest asset in over coming people’s fear was the super charger network. Now it is open, any investment is helping his competition.

No surprise he pulled out. Elon isn’t in this for his customers. He is in it for the money as a CEO.

Superchargers have always been a sales point, in the US, through the app, you have a captive audience of people you can promote to, that’s quote valuable. In the U.K. the majority of the early ones to be opened up were collocated at sales centres, brilliant idea, you turn up in the etron, you’re at a lose end for 30 mins, you go and look in the showroom.

My read on the situation, FWIW, is that the financials are really hurting big-time. At the end of Q1 2024, Tesla had something like $29bn in cash on hand, which sounds a lot. However, IIRC, there are debt repayments coming up, plus a chunk of that money is deposits against future orders (CT etc.).

The factors really hurting Tesla right now include:

- interest rates (competitive finance is an important selling point, and Tesla is presumably having to underwrite the finance deals) - many forecasters assumed rates would have started falling by now;

- interest rates (dampening demand because of cost ups in daily living, alongside inflation) - again, the forecasts were for an easing of that problem by now;

- a major price war with Chinese manufacturers, some of whom appear to be essentially dumping product in order to buy market share;

- the continued high costs of utilities (which are likely to be hurting the Supercharger business);

- a very cash-hungry roadmap (new factories, new models, new tech).

At times like this, Tesla gets stung by its reliance on in-house tech (as opposed to just buying-in and licensing from suppliers such as MobilEye - whose own financial performance has taken a major hit).

Tesla won't want to go back to raising finance using convertible bonds, or selling equity. And there is - of course - the conflict of interest issue (we believe Musk's debt is secured against Tesla stock; if the stock price continues to fall, he's going to be in trouble posting collateral to keep his loans afloat). I suspect he can't leverage SpaceX stock for this purpose and, besides, SpaceX is itself in a continuing cash-burn situation.

As I've said before, there's no doubt in my mind that his purchase of Twitter was a major mis-step. Not only did it distract him at an important time; it also created a really poor (for Tesla) feedback loop in which the stock price became even more of a driver of short-term decision-making than in other firms.

It would seem Musk is responding to all of these things by slashing costs hither and yon (presumably in an attempt to beat analysts' forecasts on P&L for Q2), whilst trying to maintain progress on what he sees as core tech (whether that's core to Tesla's future or core to the stock price is up for discussion). Hence his comments on the earnings call (anyone who sees as as just a car company shouldn't be invested in Tesla stock), continued updates on robotics (which do, to be fair, look promising), the accelerating cadence of FSD beta releases (which, judging by the videos, are now very impressive), the announced China FSD deal, the continued pressure on European regulators over FSD, and so on.

Musk isn't short of imagination. I'm sure, were I in his shoes, I'd be looking at the world quite similarly. He can see the prospect for ill economic winds to blow away the fantastic gains he's made so far. Right now he's probably looking to batten down the hatches, try to maximise revenues from the existing investments, and weather the next 2-3 quarters in the hope of an economic rebound.

As far as Superchargers go, now the standardisation issue has been resolved in Tesla's favour in North America, the smart money would be on a strategic partnership, JV or spin-out of that business. There's a ready-made pool of employees (who could usefully be taken off of Tesla's payroll), and bringing in a partner (say a financial institution) to underpin the capital required for the next phase of expansion could be a smart move. Whilst it would be a hit to P&L (assuming Superchargers are profitable), it would generate very useful cash right now, and it would reassure investors that one of Tesla's key competitive advantages is safely underpinned by fresh capital.

If only he'd left Twitter alone...

The factors really hurting Tesla right now include:

- interest rates (competitive finance is an important selling point, and Tesla is presumably having to underwrite the finance deals) - many forecasters assumed rates would have started falling by now;

- interest rates (dampening demand because of cost ups in daily living, alongside inflation) - again, the forecasts were for an easing of that problem by now;

- a major price war with Chinese manufacturers, some of whom appear to be essentially dumping product in order to buy market share;

- the continued high costs of utilities (which are likely to be hurting the Supercharger business);

- a very cash-hungry roadmap (new factories, new models, new tech).

At times like this, Tesla gets stung by its reliance on in-house tech (as opposed to just buying-in and licensing from suppliers such as MobilEye - whose own financial performance has taken a major hit).

Tesla won't want to go back to raising finance using convertible bonds, or selling equity. And there is - of course - the conflict of interest issue (we believe Musk's debt is secured against Tesla stock; if the stock price continues to fall, he's going to be in trouble posting collateral to keep his loans afloat). I suspect he can't leverage SpaceX stock for this purpose and, besides, SpaceX is itself in a continuing cash-burn situation.

As I've said before, there's no doubt in my mind that his purchase of Twitter was a major mis-step. Not only did it distract him at an important time; it also created a really poor (for Tesla) feedback loop in which the stock price became even more of a driver of short-term decision-making than in other firms.

It would seem Musk is responding to all of these things by slashing costs hither and yon (presumably in an attempt to beat analysts' forecasts on P&L for Q2), whilst trying to maintain progress on what he sees as core tech (whether that's core to Tesla's future or core to the stock price is up for discussion). Hence his comments on the earnings call (anyone who sees as as just a car company shouldn't be invested in Tesla stock), continued updates on robotics (which do, to be fair, look promising), the accelerating cadence of FSD beta releases (which, judging by the videos, are now very impressive), the announced China FSD deal, the continued pressure on European regulators over FSD, and so on.

Musk isn't short of imagination. I'm sure, were I in his shoes, I'd be looking at the world quite similarly. He can see the prospect for ill economic winds to blow away the fantastic gains he's made so far. Right now he's probably looking to batten down the hatches, try to maximise revenues from the existing investments, and weather the next 2-3 quarters in the hope of an economic rebound.

As far as Superchargers go, now the standardisation issue has been resolved in Tesla's favour in North America, the smart money would be on a strategic partnership, JV or spin-out of that business. There's a ready-made pool of employees (who could usefully be taken off of Tesla's payroll), and bringing in a partner (say a financial institution) to underpin the capital required for the next phase of expansion could be a smart move. Whilst it would be a hit to P&L (assuming Superchargers are profitable), it would generate very useful cash right now, and it would reassure investors that one of Tesla's key competitive advantages is safely underpinned by fresh capital.

If only he'd left Twitter alone...

Gassing Station | Tesla | Top of Page | What's New | My Stuff