Im thinking of an EV!

Discussion

I never thought I would be able to afford a new car, and not an EV. But a combination of tax savings via a salary sacrifice scheme and fuel savings are making it viable now, coupled with the removal of failure risk from my current 18 year old car. Im seriously considering it.

I currently drive an estate (BMW e91). I carry my bike on occasion and camping gear sometimes, suitcases etc. Quite often stuff from the DIY store. Most of the time its just me in a motorway commute to work though.

1. Can I live without an estate? I love estates, they are great for transporting big things. But I can get nicer cars if I ditch the estate and go back to hatchback.

2. Does anyone have any recommendations for what EV to buy? I was looking at the MG5 estate or the Peugeot e-308 SW. In hatchbacks I like the look of the MG4 or the Hyundai Ionic 5 or the Kia EV6.

3. How good are the boots on SUV style cars?

EV's are completely new to me. Advice would be fantastic thanks!

I currently drive an estate (BMW e91). I carry my bike on occasion and camping gear sometimes, suitcases etc. Quite often stuff from the DIY store. Most of the time its just me in a motorway commute to work though.

1. Can I live without an estate? I love estates, they are great for transporting big things. But I can get nicer cars if I ditch the estate and go back to hatchback.

2. Does anyone have any recommendations for what EV to buy? I was looking at the MG5 estate or the Peugeot e-308 SW. In hatchbacks I like the look of the MG4 or the Hyundai Ionic 5 or the Kia EV6.

3. How good are the boots on SUV style cars?

EV's are completely new to me. Advice would be fantastic thanks!

Edited by danlightbulb on Monday 8th July 12:35

First question, can you charge it at home? (driveway/garage with power)

Second question, budget?

Third question, what's the longest journey you do monthly? Or in other words, how long of a trip do you want to be able to cover without stopping to recharge? The win with EVs is they do all the local stuff for pennies and you never have to go to the petrol station. In exchange for that, a handful of times a year you have to stop for a rapid charge when doing a long trip. So ideally you want an EV whose range covers the longest 'normal' trips you do, then you don't mind breaking the occasional longer run with a 30 mins coffee and charge.

MG5 is cheap and cheerful. MG4 is credible and a good £:range candidate. 308 is a plug-in hybrid, so not a full EV. Ioniq 5 and EV6 are larger cars so more room inside.

I've made a similar switch from a W203 C-class estate to a Citroen e-C4 and am happy, although I wouldn't necessarily recommend the Citroen, depending on your needs. I do get my bicycle in the back fine though.

samoht said:

First question, can you charge it at home? (driveway/garage with power)

Second question, budget?

Third question, what's the longest journey you do monthly? Or in other words, how long of a trip do you want to be able to cover without stopping to recharge? The win with EVs is they do all the local stuff for pennies and you never have to go to the petrol station. In exchange for that, a handful of times a year you have to stop for a rapid charge when doing a long trip. So ideally you want an EV whose range covers the longest 'normal' trips you do, then you don't mind breaking the occasional longer run with a 30 mins coffee and charge.

MG5 is cheap and cheerful. MG4 is credible and a good £:range candidate. 308 is a plug-in hybrid, so not a full EV. Ioniq 5 and EV6 are larger cars so more room inside.

I've made a similar switch from a W203 C-class estate to a Citroen e-C4 and am happy, although I wouldn't necessarily recommend the Citroen, depending on your needs. I do get my bicycle in the back fine though.

Hi.Second question, budget?

Third question, what's the longest journey you do monthly? Or in other words, how long of a trip do you want to be able to cover without stopping to recharge? The win with EVs is they do all the local stuff for pennies and you never have to go to the petrol station. In exchange for that, a handful of times a year you have to stop for a rapid charge when doing a long trip. So ideally you want an EV whose range covers the longest 'normal' trips you do, then you don't mind breaking the occasional longer run with a 30 mins coffee and charge.

MG5 is cheap and cheerful. MG4 is credible and a good £:range candidate. 308 is a plug-in hybrid, so not a full EV. Ioniq 5 and EV6 are larger cars so more room inside.

I've made a similar switch from a W203 C-class estate to a Citroen e-C4 and am happy, although I wouldn't necessarily recommend the Citroen, depending on your needs. I do get my bicycle in the back fine though.

1. Yes. I would need to get a charger installed but could charge it on a cable through the window if need be. I have a driveway and a place to mount a charger on the wall. Worst case would be 20p per kWh cost on my current tariff (Octopus tracker), but I could hopefully switch to a better EV tariff and get in the region of 7p per kWh overnight rate. Id have to budget around £800 for the charger installation.

2. Im looking at doing this through my workplace salary sacrifice scheme. It includes insurance, road tax, all servicing and maintenance etc, breakdown cover, tyres. So given this, and with the salary sacrifice tax savings, Im looking around £400-£500 per month net off my salary. I'd then not need any of my own insurance, servicing etc and would save loads on fuel too so Im looking that this will cost me, after all that taken into account, £100-200 per month. I'd then carry no failure risk either so that would be an average of £100 a month repair/maintenance costs (average over last 18 months on current car) I don't have to worry about either.

3. My commute is 50 miles a day so that's fine. The longest trips I make are when I go over to Wales camping, maybe 3 times a year give or take. So I'd have to charge then. Other than that its just local use, shops etc.

The 308 Im looking at is the new e-308 SW, it is full electric.

The MG5 is the cheapest available, and doesn't have the biggest boot even comparing to some of the SUV style ones. It has decent reviews though?

The Ionic 5 is nice, but more expensive.

PoorCarCollector said:

Tesla Model Y

Tesla currently have 0% finance on PCP and HP for all models including the Performance

Huge amount of space for a bike etc

I need to do it inside of my workplace salary sacrifice scheme, otherwise I can't afford it. The tax savings make a big difference.Tesla currently have 0% finance on PCP and HP for all models including the Performance

Huge amount of space for a bike etc

Sorry, you're absolutely right about the e-308.

Other cars you could consider would be the VW Group models - VW ID3, Cupra Born, Skoda Enyaq, these have the advantage of RWD. The Kia Niro is less exciting than the EV6 but might be worth considering.

I've found the RIDC website useful on space for carrying stuff as it quotes the length of the load bay with rear seats folded, which is a key stat for loading bicycles, eg https://www.ridc.org.uk/features-reviews/out-and-a...

danlightbulb said:

I need to do it inside of my workplace salary sacrifice scheme, otherwise I can't afford it. The tax savings make a big difference.

Is the Tesla not available through the scheme? Might be worth listing the options that are? Your original post mentioned you were buying the car, hence the confusion!

PoorCarCollector said:

Is the Tesla not available through the scheme? Might be worth listing the options that are?

Your original post mentioned you were buying the car, hence the confusion!

Sorry for confusing. Yes I am buying it, but through the workplace salary sacrifice scheme.Your original post mentioned you were buying the car, hence the confusion!

The Tesla is available but its at the premium end and so outside of my budget.

Here's what Ive looked at in price order. These are all on a 48 month term, no deposit, price shown is the net impact on my salary after tax.

Enyaq has the biggest boot, Niro and Kona are decent sizes a little smaller.

MG5 boot isn't really all that big or useful.

I'd imagine the SW or Astra estate are likely options?

Alternatively, the Stellantis Berlingo EV vans or electric combi vans. The combi van is now available with a sizeable 75kWh battery. The 50kWh range are quite poor.

MG5 boot isn't really all that big or useful.

I'd imagine the SW or Astra estate are likely options?

Alternatively, the Stellantis Berlingo EV vans or electric combi vans. The combi van is now available with a sizeable 75kWh battery. The 50kWh range are quite poor.

Evanivitch said:

Alternatively, the Stellantis Berlingo EV vans or electric combi vans. The combi van is now available with a sizeable 75kWh battery. The 50kWh range are quite poor.

These are well worth a look, I've got a mate who loves his, you can remove the seats and treat like a van, as well as having a multi seat car, very flexibledanlightbulb said:

Sorry for confusing. Yes I am buying it, but through the workplace salary sacrifice scheme.

Are you definitely buying it? All the schemes I've looked at are for leases. What happens when the car is outside the manufacturer warranty - will the payments still cover maintenance and insurance? Once you've paid off the car how do you pay for the maintenance and insurance? How long until it is paid off and what happens if you leave your employer? Sorry for the off topic questions but this looks like a financial minefield if you leave after 6 months and are responsible for paying for the car in full without the tax breaks.Another financial cost to consider is the pension impact - do the salary sacrifice payments negatively impact your pension contributions? My wife works for the NHS and there are some very attractive deals on offer, but only if you ignore the huge impact on pension contributions.

JQ said:

Are you definitely buying it? All the schemes I've looked at are for leases. What happens when the car is outside the manufacturer warranty - will the payments still cover maintenance and insurance? Once you've paid off the car how do you pay for the maintenance and insurance? How long until it is paid off and what happens if you leave your employer? Sorry for the off topic questions but this looks like a financial minefield if you leave after 6 months and are responsible for paying for the car in full without the tax breaks.

Another financial cost to consider is the pension impact - do the salary sacrifice payments negatively impact your pension contributions? My wife works for the NHS and there are some very attractive deals on offer, but only if you ignore the huge impact on pension contributions.

Ah I see what you mean. Its a lease yes. When I said Im buying it, I meant Im paying for it, its not a company car as part of my salary package.Another financial cost to consider is the pension impact - do the salary sacrifice payments negatively impact your pension contributions? My wife works for the NHS and there are some very attractive deals on offer, but only if you ignore the huge impact on pension contributions.

There are various protection things included that mean Im not liable if I leave or get made redundant.

Pension comes out gross salary so no impact.

I know I'm a bit of a dinosaur when it comes to PCP, but if you get the MG you will have chipped in nearly 21k after 4 years and have nothing at the end of lease?

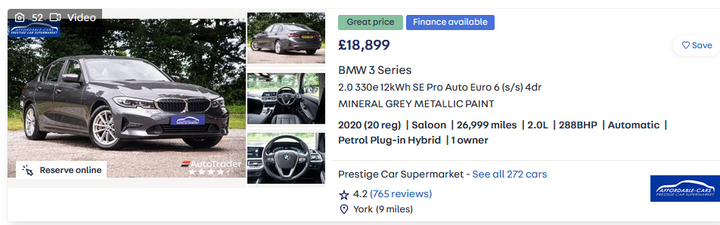

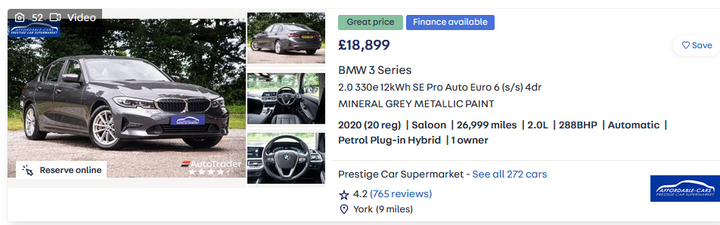

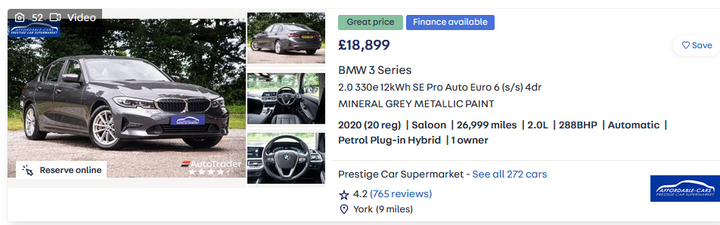

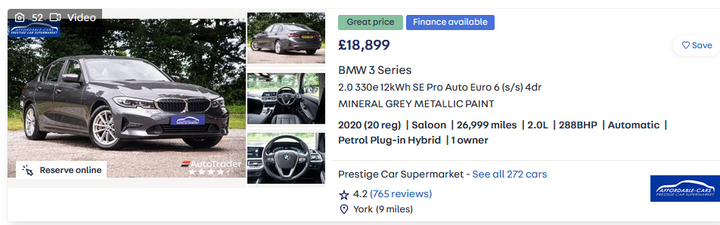

Alternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

Alternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

_Hoppers said:

I know I'm a bit of a dinosaur when it comes to PCP, but if you get the MG you will have chipped in nearly 21k after 4 years and have nothing at the end of lease?

Alternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

In your example there, I have the cost of the loan at £430 a month, there is no salary sacrifice on this so no tax saving. Also I then have to pay for insurance, maintenance, tyres myself which is all included in the work scheme.Alternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

So Im only considering this because its an all inclusive package and I also get the tax saving from it being salary sacrifice.

Consider what I have right now. A petrol BMW E91 that is worth maybe £3k at a push.

Consider insurance, servicing & MOT, fuel - Im at £400 a month running costs for this car. So after 4 years Im in for £19k as well. Its not much different as far as I can see.

The EV is a game changer I think, because I save massively on the petrol costs.

Edited by danlightbulb on Monday 8th July 16:47

danlightbulb said:

In your example there, I have the cost of the loan at £430 a month, there is no salary sacrifice on this so no tax saving.

Unless I'm misunderstanding this, which is probable, the £430 a month for the MG is what would come out of your salary after all the deductions, so does it matter if there's no tax saving on a loan of the same amount?The running costs of your Beemer seem high but if that's what it is, it's not hard to justify the salary sacrifice scheme option. I'm not against EVs,in fact my next car will be an EV but alternatively to the 330e above you could get a decent Model 3 in the £20k region

Edited by _Hoppers on Monday 8th July 17:17

_Hoppers said:

I know I'm a bit of a dinosaur when it comes to PCP, but if you get the MG you will have chipped in nearly 21k after 4 years and have nothing at the end of lease?

Alternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

I'm completely guessing the figures below, so feel free to correct me, but the real world cost of that car is actuallyAlternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

Depreciation £200pcm

Finance cost £60pcm

Insurance £60pcm

Maintenance £50pcm

Fuel £150pcm

So £520pcm to drive a 4 year old car. Or get a brand new car for a similar total cost. Then factor in that the new car has fixed costs and the 2nd hand car will have a bork factor that could significantly increase those costs stated above.

_Hoppers said:

Unless I'm misunderstanding this, which is probable, the £430 a month for the MG is what would come out of your salary after all the deductions, so does it matter if there's no tax saving on a loan of the same amount?

The running costs of your Beemer seem high but if that's what it is, it's not hard to justify the salary sacrifice scheme option. I'm not against EVs,in fact my next car will be an EV but alternatively to the 330e above you could get a decent Model 3 in the £20k region

Ah yes you're probably right there, tax is irrelevant. The net cost on the work scheme does of course include all insurance, maintenance, servicing etc.The running costs of your Beemer seem high but if that's what it is, it's not hard to justify the salary sacrifice scheme option. I'm not against EVs,in fact my next car will be an EV but alternatively to the 330e above you could get a decent Model 3 in the £20k region

Edited by _Hoppers on Monday 8th July 17:17

My BMW is 19 years old.

Insurance £50

Road tax -£35 a month

Servicing and MOT - £13 a month (£150 a year)

Breakdown cover - £10 a month

Tyre allowance (new set every 2 years) - £17 a month (£400 every 2 years).

Fuel - £200 a month (around 1000 miles a month at 33mpg and £1.40 per litre).

Repairs - averaging £100 a month over 18 months. Who knows what big bills it could throw me at any time.

That's the c.£400 a month running costs. Plus the big bill risk.

But the salary sacrifice option only works because of the fuel saving. It makes a massive difference being able to move the £200 a month fuel costs to the costs of buying the car itself. Any other new car (petrol, diesel), I'd still have the fuel costs.

Edited by danlightbulb on Monday 8th July 17:25

Edited by danlightbulb on Monday 8th July 17:26

JQ said:

_Hoppers said:

I know I'm a bit of a dinosaur when it comes to PCP, but if you get the MG you will have chipped in nearly 21k after 4 years and have nothing at the end of lease?

Alternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

I'm completely guessing the figures below, so feel free to correct me, but the real world cost of that car is actuallyAlternatively, you could borrow about £18.5k for £430 a month which will get you a decent car and at the end of 4 years it will be worth, say, +-£10k. For example.....

If you want a new car that's fair enough but I can't get my head around why people are prepared to pay so much on a monthly PCP?

Depreciation £200pcm

Finance cost £60pcm

Insurance £60pcm

Maintenance £50pcm

Fuel £150pcm

So £520pcm to drive a 4 year old car. Or get a brand new car for a similar total cost. Then factor in that the new car has fixed costs and the 2nd hand car will have a bork factor that could significantly increase those costs stated above.

Dont get me wrong, its still a huge amount of money and its causing me some real hard thinking.

I think the maths does add up. I'm a bit concerned about future risks, such as if the BIK rates increase hugely or the salary sacrifice rules change. I need those things to stay favourable otherwise I cant afford this.

The other problem is that almost all of the cars I can order are at least 25-30 weeks lead time. If I order it now I won't get it till 2025. That's crazy.

I think the maths does add up. I'm a bit concerned about future risks, such as if the BIK rates increase hugely or the salary sacrifice rules change. I need those things to stay favourable otherwise I cant afford this.

The other problem is that almost all of the cars I can order are at least 25-30 weeks lead time. If I order it now I won't get it till 2025. That's crazy.

Gassing Station | Car Buying | Top of Page | What's New | My Stuff