Cash, lease or PCP for a 3 year old motor?

Discussion

First post here so be gentle..

I have read some posts on finance but haven't found a clear answer, hoping you guys can help. I work in sales, grafted and saved/traded up every few years.

I have owned my last few cars cash and for BMW's was great when trading up!

I'm looking to sell/p/x my 69 plate Mustang GT and got caught out paying cash for that one!

In 14 months, it has lost a good 13 grand maybe due to the new one coming out.

Looking ideally at a 'used' new shape RS3 because I like my tech (yes I know, "Daza is the best car in the world")

If the Mustang is worth 30(ish)K, I could cash/credit card to 45K (saw a few 71 plates at that last week) and I'd like an RS3 for 2-3 years.

"What in the cozzy livs" is the smartest way to finance? I'm tempted by PCP to keep the monthly down then free up some cash to invest in the background but all the rates are 9+%!

I could get one cash for 45K and still have savings kicking around that I won't touch but. it's a lot of dough (to me) to lose through depreciation (again!)

What's the smart move?

(Test drove A45s & RS3 side by side and much prefer the Audi but if I get stuck I could save 7K and get the Merc but it didn't wow me)

I have read some posts on finance but haven't found a clear answer, hoping you guys can help. I work in sales, grafted and saved/traded up every few years.

I have owned my last few cars cash and for BMW's was great when trading up!

I'm looking to sell/p/x my 69 plate Mustang GT and got caught out paying cash for that one!

In 14 months, it has lost a good 13 grand maybe due to the new one coming out.

Looking ideally at a 'used' new shape RS3 because I like my tech (yes I know, "Daza is the best car in the world")

If the Mustang is worth 30(ish)K, I could cash/credit card to 45K (saw a few 71 plates at that last week) and I'd like an RS3 for 2-3 years.

"What in the cozzy livs" is the smartest way to finance? I'm tempted by PCP to keep the monthly down then free up some cash to invest in the background but all the rates are 9+%!

I could get one cash for 45K and still have savings kicking around that I won't touch but. it's a lot of dough (to me) to lose through depreciation (again!)

What's the smart move?

(Test drove A45s & RS3 side by side and much prefer the Audi but if I get stuck I could save 7K and get the Merc but it didn't wow me)

Edited by Ryan-tspg1 on Monday 5th February 13:55

jonathan_roberts said:

The smart move, now, is to stick with what you have for a bit.

Thanks for the quick reply - as I'm a new poster I have to wait 24hrs between replies!My challenge with waiting is that my Mustang has already lost 4grand this year already and I don't foresee that cash hemorrhage slowing down in a hurry plus no-one can really predict when the 2024 'market correction' will arrive.

I like the idea of PCP for paying depreciation mainly not the car as I switch every 2-3 years anyway but the Interest rates everywhere aren't that pleasant (with a brilliant credit score).

The less interesting A45s is looking like a better financial move but the RS is my preference

I'm tempted to say, don't over think it. Same as with the housing market...folks get in a state about falling prices. It simply doesn't matter unless you're cashing in or materially downsizing.

Unless it's something very niche/exotic/in-demand, all used motors are falling in price. You may well suffer more depreciation if you hold on to you current car for another 6-12 moths, but the rest of the market will come down as well. So, when it does come to swap, the cost to change may not be much different to today.

Unless it's something very niche/exotic/in-demand, all used motors are falling in price. You may well suffer more depreciation if you hold on to you current car for another 6-12 moths, but the rest of the market will come down as well. So, when it does come to swap, the cost to change may not be much different to today.

I tend to change cars less often than you but I have been getting a personal loan from the bank for the last couple of purchases. Rates tend to be cheaper than most finance deals and will be lower than using a credit card.

I usually borrow around £20k over 5 years which has been costing around £360 a month but this will have gone up now.

Best thing with personal loans is you can always sell the car and pay it back with out the painful early settlement charges you get on leases.

I usually borrow around £20k over 5 years which has been costing around £360 a month but this will have gone up now.

Best thing with personal loans is you can always sell the car and pay it back with out the painful early settlement charges you get on leases.

Ezra said:

I'm tempted to say, don't over think it. Same as with the housing market...folks get in a state about falling prices. It simply doesn't matter unless you're cashing in or materially downsizing.

Unless it's something very niche/exotic/in-demand, all used motors are falling in price. You may well suffer more depreciation if you hold on to you current car for another 6-12 moths, but the rest of the market will come down as well. So, when it does come to swap, the cost to change may not be much different to today.

A fair view Ezra, housing market is another beast but I'm in a happy place there.Unless it's something very niche/exotic/in-demand, all used motors are falling in price. You may well suffer more depreciation if you hold on to you current car for another 6-12 moths, but the rest of the market will come down as well. So, when it does come to swap, the cost to change may not be much different to today.

You are correct, I am overthinking depreciation! Mainly because I've never lost so much hard-earned cash in such a short space of time, it seems that the Mustang S550 is falling a lot quicker than a lot of stuff and the old RS3 8v seems to be going up in Value to nearly match the new ones?!

I need more doors, parents are 70+ so rather than beg the wife for her car from time to time, I'd rather have a nippy four door.

LeeM135i said:

I tend to change cars less often than you but I have been getting a personal loan from the bank for the last couple of purchases. Rates tend to be cheaper than most finance deals and will be lower than using a credit card.

I usually borrow around £20k over 5 years which has been costing around £360 a month but this will have gone up now.

Best thing with personal loans is you can always sell the car and pay it back with out the painful early settlement charges you get on leases.

Lee, this exactly what I do, just borrow that last few quid as a personal loan to get the next one and yes, usually no headache when selling on, do as many or little miles as you want.I usually borrow around £20k over 5 years which has been costing around £360 a month but this will have gone up now.

Best thing with personal loans is you can always sell the car and pay it back with out the painful early settlement charges you get on leases.

I can credit card + cash 15K to change up but don't want to find myself in the same position again in 2 years, losing a big chunk of change!

Why I thought some form of finance could be interesting to free up some cash to invest but read a lot of "don't PCP a used car"

OP I've not used PCP so apologies if I am wrong on this, but don't PCP deals involve a GFV?

If so, the advantage I can see here is that you know what you're getting into w.r.t. depreciation in advance, as opposed to the Mustang with which you're not enjoying the marked movement in value?

If so, the advantage I can see here is that you know what you're getting into w.r.t. depreciation in advance, as opposed to the Mustang with which you're not enjoying the marked movement in value?

BlueJ said:

OP I've not used PCP so apologies if I am wrong on this, but don't PCP deals involve a GFV?

If so, the advantage I can see here is that you know what you're getting into w.r.t. depreciation in advance, as opposed to the Mustang with which you're not enjoying the marked movement in value?

Hey BlueJ,If so, the advantage I can see here is that you know what you're getting into w.r.t. depreciation in advance, as opposed to the Mustang with which you're not enjoying the marked movement in value?

This is exactly my trail of thought but interest rates aren't so hot currently. Also, I got burned hard by pcp ten years ago when my financial circumstances changed for the worse.

I had a Mazda 6MPS, balloon payment was 8K, dealers would only offer 3.5K for it but luckily I sold it privately through PH for 9, quite a stressful ordeal at the time, so I pledged to always pay cash for peace of mind... Which comes with the depreciation challenge instead.

No matter which way you're spinning it you're paying for the depreciation one way or another.

If you pay cash you're not paying interest but the money you've tied up in the car is depreciating. If you PCP or loan, you're paying for depreciation monthly but have less money tied up in the car (more liquid assets)

PCP interest rates on used cars isn't that great compared to new but it's less steep on the depreciation curve.

If you pay cash you're not paying interest but the money you've tied up in the car is depreciating. If you PCP or loan, you're paying for depreciation monthly but have less money tied up in the car (more liquid assets)

PCP interest rates on used cars isn't that great compared to new but it's less steep on the depreciation curve.

Ryan-tspg1 said:

If the Mustang is worth 30(ish)K, I could cash/credit card to 45K (saw a few 71 plates at that last week) and I'd like an RS3 for 2-3 years.

"What in the cozzy livs" is the smartest way to finance? I'm tempted by PCP to keep the monthly down then free up some cash to invest in the background but all the rates are 9+%!

If you MUST have a more expensive car, my suggestion is to sell the Mustang and take out a personal loan. "What in the cozzy livs" is the smartest way to finance? I'm tempted by PCP to keep the monthly down then free up some cash to invest in the background but all the rates are 9+%!

But a few thoughts on this....

1) If you're referring to "cozzy livs" and RS3s in the same post then that could potentially be a warning sign.

2) Please don't credit card the difference.

3) The whole "free to cash to invest" argument is trotted out time and time again by guys on youtube (and tbf, on here too). And yes, some will manage to achieve a high enough return to beat the 9.9%+ interest charged. But they were lucky - and they know it.

Aunty Pasty said:

No matter which way you're spinning it you're paying for the depreciation one way or another.

If you pay cash you're not paying interest but the money you've tied up in the car is depreciating. If you PCP or loan, you're paying for depreciation monthly but have less money tied up in the car (more liquid assets)

PCP interest rates on used cars isn't that great compared to new but it's less steep on the depreciation curve.

You're absolutely right, essentially if pcp interest rates calmed down it would be more straightforward.If you pay cash you're not paying interest but the money you've tied up in the car is depreciating. If you PCP or loan, you're paying for depreciation monthly but have less money tied up in the car (more liquid assets)

PCP interest rates on used cars isn't that great compared to new but it's less steep on the depreciation curve.

Sell the muscle car and get this or newest, lowest mileage one for under £30k you can find

https://www.autotrader.co.uk/car-details/202401296...

https://www.autotrader.co.uk/car-details/202401296...

Wololo said:

Ryan-tspg1 said:

If the Mustang is worth 30(ish)K, I could cash/credit card to 45K (saw a few 71 plates at that last week) and I'd like an RS3 for 2-3 years.

"What in the cozzy livs" is the smartest way to finance? I'm tempted by PCP to keep the monthly down then free up some cash to invest in the background but all the rates are 9+%!

If you MUST have a more expensive car, my suggestion is to sell the Mustang and take out a personal loan. "What in the cozzy livs" is the smartest way to finance? I'm tempted by PCP to keep the monthly down then free up some cash to invest in the background but all the rates are 9+%!

But a few thoughts on this....

1) If you're referring to "cozzy livs" and RS3s in the same post then that could potentially be a warning sign.

2) Please don't credit card the difference.

3) The whole "free to cash to invest" argument is trotted out time and time again by guys on youtube (and tbf, on here too). And yes, some will manage to achieve a high enough return to beat the 9.9%+ interest charged. But they were lucky - and they know it.

1) A fair observation, I refer to the silly term too much with the cost of living in the UK getting a bit OTT, just forked out £1500 for the brakes on the Mustang a few weeks ago, cats dental £800 & boiler service with other bits last week.

2) The credit card is on a 0% for a while so I thought of 4K on it & chip it off as & when like I did for the Mustang. I have over 20K knocking around in savings but was looking at alternatives to blowing a chunk of it on a depreciating asset so maybe just personal loan for 15K is the answer - best guaranteed I can see is 8.6%

3) Was thinking of making savings work for me instead of the depreciating vanishing magic act is all.

Or I just get over myself, get an A45s cash and save thousands but know the residuals won't be as strong as an RS..

Ryan-tspg1 said:

jonathan_roberts said:

The smart move, now, is to stick with what you have for a bit.

Thanks for the quick reply - as I'm a new poster I have to wait 24hrs between replies!My challenge with waiting is that my Mustang has already lost 4grand this year already and I don't foresee that cash hemorrhage slowing down in a hurry plus no-one can really predict when the 2024 'market correction' will arrive.

I like the idea of PCP for paying depreciation mainly not the car as I switch every 2-3 years anyway but the Interest rates everywhere aren't that pleasant (with a brilliant credit score).

The less interesting A45s is looking like a better financial move but the RS is my preference

An interesting view.

I love the Stang, it was always going to be a short term bucket list car for me but now I've been there, done that I need more doors, the ability to get people in/out the back, when the weather gets very British/ icy, its the only car I've ever got stuck - they're not great on grip. I would like a more nimble daily as there's a lot of country lanes where I live. It would surely be a loss whenever I move on, this year or in 10?

I accept that All every day cars depreciate I think it's an issue of I bought at the worst time & am looking to upgrade at probably a bad time but there is no certainty for when the next good time is whilst mine continues to plummet as I put miles on it.

My last 4 cars have been over 300bhp so.. I like a bit of pace whilst I can afford it and character where possible. Some people like football, I like cars.

I can afford a loss just looking to minimise it after I sold the last 340i for as much as I bought it for then looking at a 13K+ loss on this one

I love the Stang, it was always going to be a short term bucket list car for me but now I've been there, done that I need more doors, the ability to get people in/out the back, when the weather gets very British/ icy, its the only car I've ever got stuck - they're not great on grip. I would like a more nimble daily as there's a lot of country lanes where I live. It would surely be a loss whenever I move on, this year or in 10?

I accept that All every day cars depreciate I think it's an issue of I bought at the worst time & am looking to upgrade at probably a bad time but there is no certainty for when the next good time is whilst mine continues to plummet as I put miles on it.

My last 4 cars have been over 300bhp so.. I like a bit of pace whilst I can afford it and character where possible. Some people like football, I like cars.

I can afford a loss just looking to minimise it after I sold the last 340i for as much as I bought it for then looking at a 13K+ loss on this one

For starters leases are typically for new cars. There are exceptions, some places now do leases on used lease returns but there is limited options and highly doubt you are going to find a 'cheap' used RS3 knocking about on a lease.

For PCP, the interest rates are going to cut deep. Go get a quote from somewhere like Magnitude Finance and look for yourself but with high interest rates (9%+) and usually a lower GFV than you would get from a dealer financially it won't make sense. The interest is also applied to the GFV over the term so PCP's often don't make sense for anything over ~5% interest. You might even find trying to PCP a 3 year old car ends up more expensive than a brand new/pre reg one on a lower interest rate with dealer contributions depending on the car.

That leaves the last option of realising your losses in the mustang and using a bank loan to top up to get you to the next level.

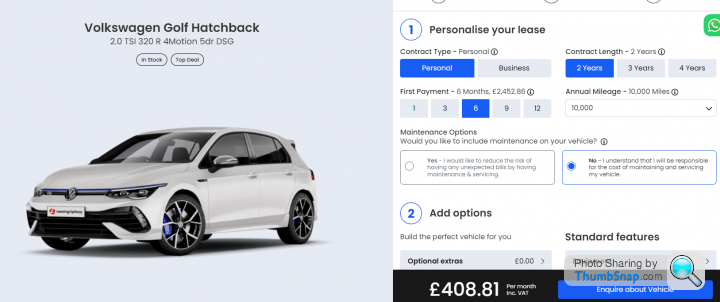

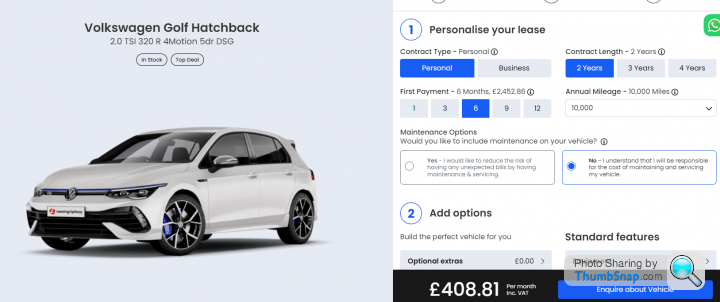

The wild card option (especially if you change cars every 2-3 years) is selling the mustang, parking the money in an ISA on 5% interest and take out a lease on a 5 door Golf R for £400 a month. Might not be as fancy as an RS3 but will give you some hassle free motoring in a reasonably quick car for a net ~£275 a month after the £125 a month interest you will get from your 30k.

For PCP, the interest rates are going to cut deep. Go get a quote from somewhere like Magnitude Finance and look for yourself but with high interest rates (9%+) and usually a lower GFV than you would get from a dealer financially it won't make sense. The interest is also applied to the GFV over the term so PCP's often don't make sense for anything over ~5% interest. You might even find trying to PCP a 3 year old car ends up more expensive than a brand new/pre reg one on a lower interest rate with dealer contributions depending on the car.

That leaves the last option of realising your losses in the mustang and using a bank loan to top up to get you to the next level.

The wild card option (especially if you change cars every 2-3 years) is selling the mustang, parking the money in an ISA on 5% interest and take out a lease on a 5 door Golf R for £400 a month. Might not be as fancy as an RS3 but will give you some hassle free motoring in a reasonably quick car for a net ~£275 a month after the £125 a month interest you will get from your 30k.

MullacAbz

Great answer, not sure why but I was blocked from replying or maybe the thread got closed?

Thanks for clearing things up as everyone raves about leasing but didn't know that was for new mainly, also the pcp insight of 'if it's above 5% interest', run the other way is tres useful.

You're on the pulse with your two options;

Most likely going to have to take the blade out quick and personal loan to trade up like I normally do maybe the depreciation simply hits ford harder than German motors?

The wild card option is a brilliant example, the problem is i've never been fussed by the latest Golfs . If i'm to change, it needs to be to something faster or lightyears beyond the Mustang to mitigate the heartbreak! I wish I didn't have an interest in cars, life would be a lot cheaper! If it was purely a financial decision, hands down your Golf solution is the way forward but... it's probably 80% upgrade to 20% financial

. If i'm to change, it needs to be to something faster or lightyears beyond the Mustang to mitigate the heartbreak! I wish I didn't have an interest in cars, life would be a lot cheaper! If it was purely a financial decision, hands down your Golf solution is the way forward but... it's probably 80% upgrade to 20% financial

The local Mercedes guy is trying to get me down this weekend as they have 'an event' on claiming higher p/x values and Lower APRs so will have a sniff just in case there's a deal kicking around.

Meanwhile the Merc A45s prices have now jumped up overnight!?

Great answer, not sure why but I was blocked from replying or maybe the thread got closed?

Thanks for clearing things up as everyone raves about leasing but didn't know that was for new mainly, also the pcp insight of 'if it's above 5% interest', run the other way is tres useful.

You're on the pulse with your two options;

Most likely going to have to take the blade out quick and personal loan to trade up like I normally do maybe the depreciation simply hits ford harder than German motors?

The wild card option is a brilliant example, the problem is i've never been fussed by the latest Golfs

. If i'm to change, it needs to be to something faster or lightyears beyond the Mustang to mitigate the heartbreak! I wish I didn't have an interest in cars, life would be a lot cheaper! If it was purely a financial decision, hands down your Golf solution is the way forward but... it's probably 80% upgrade to 20% financial

. If i'm to change, it needs to be to something faster or lightyears beyond the Mustang to mitigate the heartbreak! I wish I didn't have an interest in cars, life would be a lot cheaper! If it was purely a financial decision, hands down your Golf solution is the way forward but... it's probably 80% upgrade to 20% financial

The local Mercedes guy is trying to get me down this weekend as they have 'an event' on claiming higher p/x values and Lower APRs so will have a sniff just in case there's a deal kicking around.

Meanwhile the Merc A45s prices have now jumped up overnight!?

A lot of performance cars have started selling again. I don’t think a big 2024 crash is coming but no one can predict.

Anyways….you’ve done well to own a great car outright. But 45k is a lot of money. In 2 years even is things don’t crash you’ll be lucky to see 30k, that’s £15k down plus the cost of the finance. It’s a big chunk for what’s ultimately a decent car but not an exceptionally special one.

It’s your decision, keep the mustang which has taken its drop, you don’t owe on and is a great car, or go again with the rs3 but doubling up on depreciation. Or if you really fancy a change find something around 30k you like. There’s a big choice out there for that.

Anyways….you’ve done well to own a great car outright. But 45k is a lot of money. In 2 years even is things don’t crash you’ll be lucky to see 30k, that’s £15k down plus the cost of the finance. It’s a big chunk for what’s ultimately a decent car but not an exceptionally special one.

It’s your decision, keep the mustang which has taken its drop, you don’t owe on and is a great car, or go again with the rs3 but doubling up on depreciation. Or if you really fancy a change find something around 30k you like. There’s a big choice out there for that.

Gassing Station | Car Buying | Top of Page | What's New | My Stuff