Salary sacrifice leasing

Discussion

Every IT/consultancy company I know has done it, I believe a lot of gov departments do it like the nhs (although there is seemingly a potential implication linked to pension for a minority), I think most progressive companies now look at these things.

The thing to be mindful of is the heavy reduction in mileage allowance if you do a lot of business miles. A car through salary sacrifice becomes a company car and you get 4p a mile, as a private car you’d get 45p either directly or part direct and part enhanced tax relief.

The thing to be mindful of is the heavy reduction in mileage allowance if you do a lot of business miles. A car through salary sacrifice becomes a company car and you get 4p a mile, as a private car you’d get 45p either directly or part direct and part enhanced tax relief.

LHRFlightman said:

My place offers it through Hitachi.

I spec'd up a Tesla Model 3 base model, 10k X 36 months. Monthly cost, everything included, insurance as well, £1,079.

Better off with Evezy. All of the above but 12k per year, free public charging and no 3 year commitment for £599 a month.I spec'd up a Tesla Model 3 base model, 10k X 36 months. Monthly cost, everything included, insurance as well, £1,079.

This seems a pretty basic but easy to follow explanation of the maths behind it:

https://www.youtube.com/watch?v=0KAD1EbxztA&t=...

I leased a model 3 through my company (unfortunately not on as good terms as the video!) and it definitely makes a lot of sense with the tax breaks on EV.

https://www.youtube.com/watch?v=0KAD1EbxztA&t=...

I leased a model 3 through my company (unfortunately not on as good terms as the video!) and it definitely makes a lot of sense with the tax breaks on EV.

speciald said:

The company I work for offers this scheme. I've not yet been able to make the numbers work for me though.

I've just checked and the Model 3 is now there -

20k a year, maintenance , insurance etc included, no deposit over 4 years is £516.25 per month.

Thats out of gross income before taxI've just checked and the Model 3 is now there -

20k a year, maintenance , insurance etc included, no deposit over 4 years is £516.25 per month.

BIK for the next 3 years from April is eithe nothing or tiny so, depending on your tax rate, could be around £300 a month

Then your fuel costs will be approx 1/3 to 1/4 of what they are now - so if you do 20k miles a year, at 40 mpg, 500 gallons @£5 = £2500, you'd save say a further £1800 to £150 a month,

You're not down to a car costing you £150-£200 a month

(your man maths figures may vary).

The £516 is the final impact to my net salary, not gross so it's not that great unfortunately. As its a salary sacrifice the BIK is also tiny so not a lot to save there either, think its £11 a month.

I spend roughly £200 a month on diesel at the moment so there is that to consider.

On the same scheme and details a i3 is £350 per month which is more tempting.

I spend roughly £200 a month on diesel at the moment so there is that to consider.

On the same scheme and details a i3 is £350 per month which is more tempting.

speciald said:

The £516 is the final impact to my net salary, not gross so it's not that great unfortunately.

I spend roughly £200 a month on diesel at the moment so there is that to consider.

On the same scheme and details a i3 is £350 per month which is more tempting.

So an extra £150pm to go from an i3 to a Model 3? Seems like a decent upgrade for the money, especially if you’re doing lots of miles.I spend roughly £200 a month on diesel at the moment so there is that to consider.

On the same scheme and details a i3 is £350 per month which is more tempting.

You need to run your maths through and compare like for like. When doing your numbers include insurance in your numbers.

I know a young lad who bought a focus for £3k and in the first 6 months the fly wheel and clutch needed replacing and various other things. On top of that his insurance was about 1200 as he was young. He looked into the car scheme through his public sector job.

Ended up in a brand new fiesta titanium x for a drop of £190 a month off his net salary. That included his insurance and maintenance. For him it made total sense.

If your numbers stack up go for it. Alrhough I seem to remember the same scheme offered him an a class 180 for something like 650 a month. Which didn’t seem good.

I know a young lad who bought a focus for £3k and in the first 6 months the fly wheel and clutch needed replacing and various other things. On top of that his insurance was about 1200 as he was young. He looked into the car scheme through his public sector job.

Ended up in a brand new fiesta titanium x for a drop of £190 a month off his net salary. That included his insurance and maintenance. For him it made total sense.

If your numbers stack up go for it. Alrhough I seem to remember the same scheme offered him an a class 180 for something like 650 a month. Which didn’t seem good.

We're getting salary sacrifice via Tusker at my workplace next month.

Dropping the BIK will knock about £100 off the cost of a Model 3 but not sure what it's going to wind up costing us. I think I could do the "man maths" for up to about £450 per month, but over that I'd have to stick with my current car.

Can't wait to have a look around in the website when I get my hands on a log in.

Dropping the BIK will knock about £100 off the cost of a Model 3 but not sure what it's going to wind up costing us. I think I could do the "man maths" for up to about £450 per month, but over that I'd have to stick with my current car.

Can't wait to have a look around in the website when I get my hands on a log in.

Been a while since the last post on this but have been looking into it as start a new job in the next few weeks.

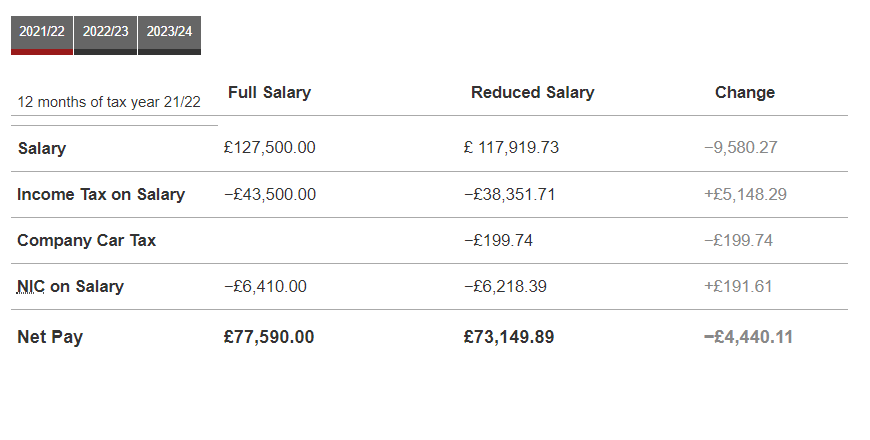

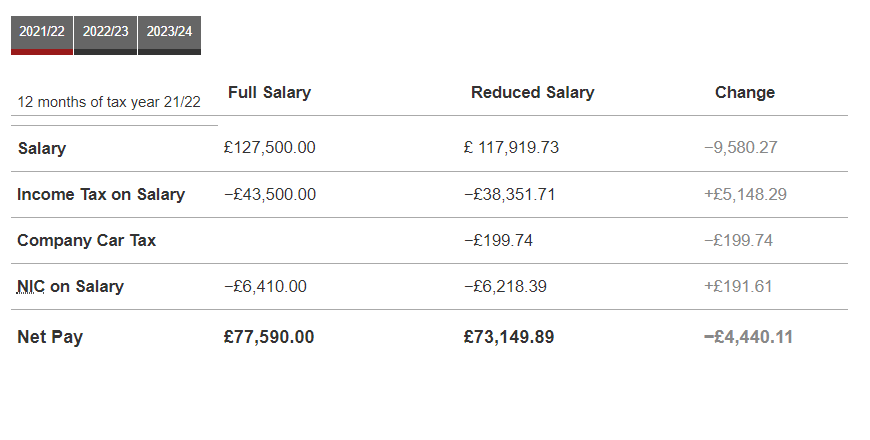

I've pulled the following from https://legacy.comcar.co.uk/taxtools/salarysacrifi... for a Tesla 3 Performance to replace the one we have currently through On.To that is costing £799 a month all in.

Does this look right to anyone with more knowledge in this area than I do at present? Suggests it will be costing approx £360 a month in salary reduction based on a lease cost of around £800 a month for the car so just checking I'm not missing something (aware of the affect SS will have on pension contributions).

I've pulled the following from https://legacy.comcar.co.uk/taxtools/salarysacrifi... for a Tesla 3 Performance to replace the one we have currently through On.To that is costing £799 a month all in.

Does this look right to anyone with more knowledge in this area than I do at present? Suggests it will be costing approx £360 a month in salary reduction based on a lease cost of around £800 a month for the car so just checking I'm not missing something (aware of the affect SS will have on pension contributions).

Without doing all the maths, that is a particularly good place to be reducing taxable income - the band from £100k to £125k is taxed at 60% (plus NIC @ 2%) due to loss of personal allowance. So bigger tax saving in that band than below £100k or above £125k (though the car bik will go the other way, ditto reduction in pension contribution)

If thats the total of all your income then the figures will be more or less right, if you have other sources of income, bonus, dividends etc on top then you may be in a different total earnings bracket at which point while your PAYE may seem to reflect those figures, but when you complete your tax return it could end up slightly more expensive (depends whether HMRC adjust through your tax code or you have to make payments on account for the extra income). Equally, if you pay significant sums into your pension bringing your taxable salary down, it may also be more expensive. In the overall scheme of things, £20-30 a month difference in the calculations is a rounding error when you have a 6 figure salary unless you're sailing too close to the wind with your finances.

I'm sure you know this already, but you really need to get your taxable income to just sub-£100k if you can (assuming you dont actually need the cash!!!), as the posters above mention, its not 40%, is more like 60% with the errosion of personal allowance. It sneaks up on people, certainly did with me until I wisened up a couple of years ago. While electrics continue to attract 0% - or negligable BiK, its a great way to do it.

The other obvious one is singificantly enhanced pension contributions via salary sacrifice - thats where I've been, but be mindful of the LTA if you are going to be doing it for a while - I'm sure you know this too!

In terms of car, I'm in a similar place, been getting a £600 a month pre-tax allowance in lieu of company car for the last few years. Looking at opting back in at the moment and taking an e-Niro (or Tesla M3) on 0-3% BiK over the next four years. I'll get cashback too with the e-Niro as its way below the cap and easily has the range for my commute.

Quick calcs say my salary will drop £240ish a month real terms, but I'll get a brand new car, insured, serviced etc etc with a private mileage electric bill of c. £20-30 a month. I then sell my shed that takes a good £200 a month in fuel alone, plus £400 a year insurance, plus £600 a year in servicing, plus another £200 a year in tyres.....

Its a no brainer, at least until they hike BiK in 4 years time. Then I might opt out again.....

The other obvious one is singificantly enhanced pension contributions via salary sacrifice - thats where I've been, but be mindful of the LTA if you are going to be doing it for a while - I'm sure you know this too!

In terms of car, I'm in a similar place, been getting a £600 a month pre-tax allowance in lieu of company car for the last few years. Looking at opting back in at the moment and taking an e-Niro (or Tesla M3) on 0-3% BiK over the next four years. I'll get cashback too with the e-Niro as its way below the cap and easily has the range for my commute.

Quick calcs say my salary will drop £240ish a month real terms, but I'll get a brand new car, insured, serviced etc etc with a private mileage electric bill of c. £20-30 a month. I then sell my shed that takes a good £200 a month in fuel alone, plus £400 a year insurance, plus £600 a year in servicing, plus another £200 a year in tyres.....

Its a no brainer, at least until they hike BiK in 4 years time. Then I might opt out again.....

Thanks for all the responses chaps. TBH I've been so busy and with the new package down to a promotion I'd not given any of this much consideration.

The £127.5 total includes base (£100k), bonus (£20k) and car allowance (£7.5k)

So with my pension contribution levels already high and not really able to increase by much I'm looking at the numbers and thinking that rather than take the massive tax hit I'd be better off sinking as much of that £25k as possible into an EV with things as they stand currently?

Based on the above should I be looking at the cost of Porsche Taycan's on lease and if so do I need to consider the VAT in the total sacrifice cost or would it be considered a business lease?

Sorry, this stuff really not my area and know I need to get my head around it quickly so appreciate all of your input massively.

The £127.5 total includes base (£100k), bonus (£20k) and car allowance (£7.5k)

So with my pension contribution levels already high and not really able to increase by much I'm looking at the numbers and thinking that rather than take the massive tax hit I'd be better off sinking as much of that £25k as possible into an EV with things as they stand currently?

Based on the above should I be looking at the cost of Porsche Taycan's on lease and if so do I need to consider the VAT in the total sacrifice cost or would it be considered a business lease?

Sorry, this stuff really not my area and know I need to get my head around it quickly so appreciate all of your input massively.

Unfortunately as others have said £127.5k is pretty much in the least “tax efficient” part of the income spectrum though I appreciate it’s a very fortunate problem to have!

I would certainly be looking to reduce your taxable income as close to £100k as possible as the surplus really doesn’t count for much at 62% tax.

A business can normally reclaim half but not all of the VAT on a motor lease unless it’s a pool car / for exclusive commercial use only.

Do you know if they pass any of the NI saving onto the employee with salary sacrifice schemes?

Even if you can’t get the employer to contribute more to your pension you could always make some personal contribution and still benefit from the income tax relief.

I would certainly be looking to reduce your taxable income as close to £100k as possible as the surplus really doesn’t count for much at 62% tax.

A business can normally reclaim half but not all of the VAT on a motor lease unless it’s a pool car / for exclusive commercial use only.

Do you know if they pass any of the NI saving onto the employee with salary sacrifice schemes?

Even if you can’t get the employer to contribute more to your pension you could always make some personal contribution and still benefit from the income tax relief.

Gassing Station | EV and Alternative Fuels | Top of Page | What's New | My Stuff