Sewer build over indemnity insurance

Discussion

Hi, have encountered a stumbling block when meant to exchange next week and wondered if anyone has any advice.

Basically the previous owner (now deceased) had an extension built around 25 years ago and the searches my solicitor has done show that the sewer line may have been built over.

The indemnity policy is over £500 and the sellers (executors) are refusing to pay it, I've spoken to family and work colleagues and everyone is surprised at the cost as most seem to have have paid under £50 for home indemnity insurance.

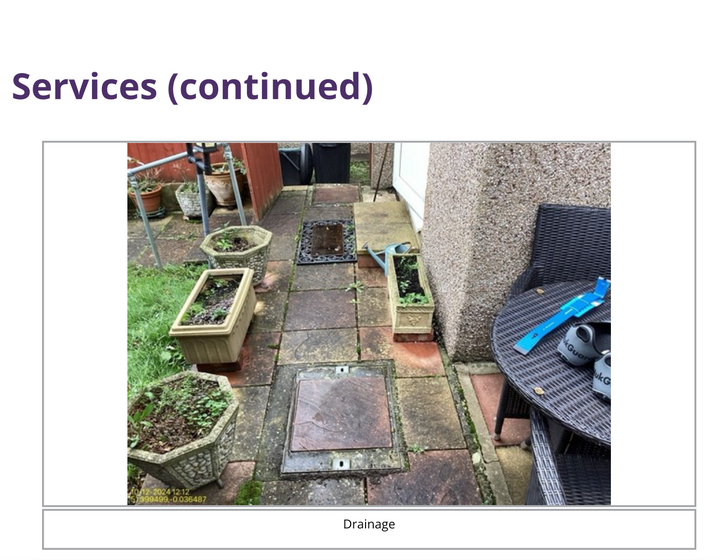

I've had a look at the extension and the wastewater feeds out the side into the original drain stack and the two inspection covers look to in the original position when comparing it to neighbouring properties so I don't think it's been built over.

Picture from survey:

I've told my solicitors that I'm happy with not paying for the indemnity insurance as it doesn't look like it's been built over but they are now saying that they will need to get confirmation from my lender that this is ok?

As far as I can see I could contact Thames Water and ask for retrospective permission but doing this has risks if they don't grant permission.

I'm unsure if I did take out the indemnity and then had issues further down the line would the indemnity insurance pay for the repairs or would it just cover any legal action taken by the water company?

I've tried shopping around for policies but it looks like there's no direct to consumer offerings which is annoying, wondered if my lender (Lloyds) could do a search for quotes instead?

Cheers.

Basically the previous owner (now deceased) had an extension built around 25 years ago and the searches my solicitor has done show that the sewer line may have been built over.

The indemnity policy is over £500 and the sellers (executors) are refusing to pay it, I've spoken to family and work colleagues and everyone is surprised at the cost as most seem to have have paid under £50 for home indemnity insurance.

I've had a look at the extension and the wastewater feeds out the side into the original drain stack and the two inspection covers look to in the original position when comparing it to neighbouring properties so I don't think it's been built over.

Picture from survey:

I've told my solicitors that I'm happy with not paying for the indemnity insurance as it doesn't look like it's been built over but they are now saying that they will need to get confirmation from my lender that this is ok?

As far as I can see I could contact Thames Water and ask for retrospective permission but doing this has risks if they don't grant permission.

I'm unsure if I did take out the indemnity and then had issues further down the line would the indemnity insurance pay for the repairs or would it just cover any legal action taken by the water company?

I've tried shopping around for policies but it looks like there's no direct to consumer offerings which is annoying, wondered if my lender (Lloyds) could do a search for quotes instead?

Cheers.

That seems very high to me.

Not directly comparable as it's a different risk, but I recently had to obtain indemnity insurance for unregistered access land when I sold my house - it cost £625 but that indemnified the buyer for the full purchase price of £600k.

It's something of a scam IMO as insurers will not quote you directly - they will only deal through a solicitor who tend to have their pet insurers and consequently there is no incentive for them to seek out competitive quotes.

Not directly comparable as it's a different risk, but I recently had to obtain indemnity insurance for unregistered access land when I sold my house - it cost £625 but that indemnified the buyer for the full purchase price of £600k.

It's something of a scam IMO as insurers will not quote you directly - they will only deal through a solicitor who tend to have their pet insurers and consequently there is no incentive for them to seek out competitive quotes.

Gassing Station | Homes, Gardens and DIY | Top of Page | What's New | My Stuff