£15k Savings - How to minimise inflation erosion

Discussion

What would you do with it? It's my girlfriends, she's fairly risk averse and I don't trust Banks to invest it for her, so I suspect that some sort of fixed term savings account will be the best option, but would like other suggestions to consider?

I think she'd be happy to fix for 5 years btw.

Thanks.

I think she'd be happy to fix for 5 years btw.

Thanks.

Unless you have a tardis, difficult - NS&I RPI + 1% tax-free certificates now withdrawn though some building societies have offered (less than AAA rated) bonds to keep up with RPI - they tend to sell out within days. One possibility is to look at an equity ISA for the first £10.2k with blue chip companies yielding good (still sub-RPI) returns - but BP was a prime example of those until it hit the blow-out field in the Gulf of Mexico, and whilst the movement in the market over the last couple of weeks would have given a big head start, it may not continue its bull run. Not sure that you can get any risk-averse inflation proof investments at present. She can't put it against credit card debts or mortgage payments by reducing capital by any chance? - that would effectively provide above RPI returns for almost any recent mortgage, even for a lower rate taxpayer.

musclecarmad said:

rudecherub said:

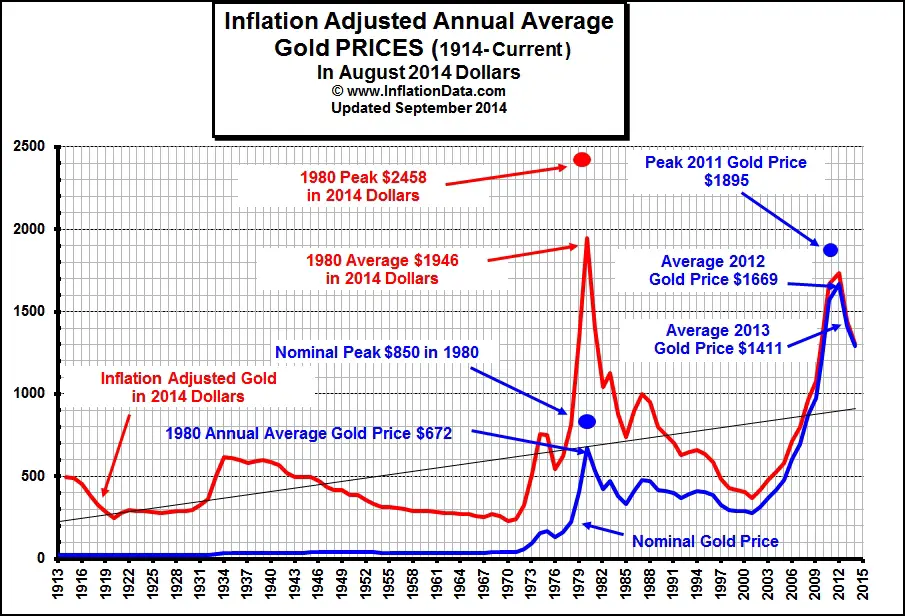

Gold.

why do you suggest someone should invest when it's the highest it has ever been?this guy DOESNT want risk

It's high because people are buying it because the world economy is shaky, and there isn't any reason to think it's getting better soon.

QE in US and UK is going to drive up inflation.

ringram said:

Gold has a very low intrinsic value. There are plenty of substitutes. Its good for conduction etc. But anyone with experience of tulip bulbs would know that Gold is not a store of value. Its a metal with limited uses. Plain and simple like its owners.

Gordon how are you doing? Going to turn up at Westminster and do the job you're being paid for maybe?If you mean there are other precious metals that are used in specific stuff, say batteries, tech, etc, sure they would be a good hedge at the moment too.

But the OP has £15k and wants low risk. He could buy a couple of acres I suppose. But Gold keeps it simple.

ringram said:

Gold has a very low intrinsic value. There are plenty of substitutes. Its good for conduction etc. But anyone with experience of tulip bulbs would know that Gold is not a store of value. Its a metal with limited uses. Plain and simple like its owners.

It does have a rather better track record than tulips or paper, claiming that gold is not a store of value is plainly wrong. The fact that Gordon Brown didn't want it is probably a good enough reason to buy it.Whether now is a good time to buy with prices at record highs is a different matter.

Edited by Fittster on Wednesday 15th September 20:01

NoelWatson said:

rudecherub said:

But the OP has £15k and wants low risk. He could buy a couple of acres I suppose. But Gold keeps it simple.

Can you explain why Gold is low risk please?Note: I'm not saying buy gold. The problem with a commodities is valuing them, gold may or may not be overvalued.

Edited by Fittster on Wednesday 15th September 22:10

Gassing Station | Finance | Top of Page | What's New | My Stuff

.

.