Thoughts regarding diversification?

Discussion

A bit of background; I have a Vanguard Lifestyle 80 ISA, which is always maxed out every year and has performed really well (c.12% returns on average over last few years).

This May I will have c.£100k to put into a new GIA, and I just need to work out what funds that should hold. My initial thoughts are that I just go again with the LS80, but is that putting all my eggs in matching baskets? Would it be better to choose something wildly different so that if one's down the other is (hopefully) up, or is the LS80 fund so well diversified anyway that I'm better just sticking with it for both accounts as it generally will be reasonably good overall?

Would appreciate the thoughts of the PH hive mind!

This May I will have c.£100k to put into a new GIA, and I just need to work out what funds that should hold. My initial thoughts are that I just go again with the LS80, but is that putting all my eggs in matching baskets? Would it be better to choose something wildly different so that if one's down the other is (hopefully) up, or is the LS80 fund so well diversified anyway that I'm better just sticking with it for both accounts as it generally will be reasonably good overall?

Would appreciate the thoughts of the PH hive mind!

A lot of answers would depend on your age, risk profile, your intentions regarding what you intend to draw and when etc .

Putting that aside and reflecting what I do . I keep MAINLY the same funds in my ISA and GIA . However, I do if I want o hold more risk, put the ( in theory) risker funds in my ISA as they also tend to have higher gains. Leaving the space for lower risk funds in the GIA

Eg .. UP risk your lifestyle fund to 100 equity in the ISA and for example keep Lifestyle 80 or 60 in your GIA. The balance would depend on size of GIA vs ISA

I don't use any bonds , but keep my money market ( comfort fund ) and a global fund in GIA ....but 100% equity ISA ( mix of a global and UK fund )

Putting that aside and reflecting what I do . I keep MAINLY the same funds in my ISA and GIA . However, I do if I want o hold more risk, put the ( in theory) risker funds in my ISA as they also tend to have higher gains. Leaving the space for lower risk funds in the GIA

Eg .. UP risk your lifestyle fund to 100 equity in the ISA and for example keep Lifestyle 80 or 60 in your GIA. The balance would depend on size of GIA vs ISA

I don't use any bonds , but keep my money market ( comfort fund ) and a global fund in GIA ....but 100% equity ISA ( mix of a global and UK fund )

I have put some money into this one recently:

https://www.trustnet.com/factsheets/O/JXZ0/artemis...

But only a small percentage in comparison to the rest of the portfolio.

https://www.trustnet.com/factsheets/O/JXZ0/artemis...

But only a small percentage in comparison to the rest of the portfolio.

It also depends what proportion of your portfolio the £100k represents and obviously how many years you will still be in the accumulation phase. I always dedicated around 20% to medium to high risk stuff. I should have de risked it by now but I keep getting good years so I end up never doing it which is stupid I know...

You could split the £100k over a selection of funds with varying different risk levels?

You could split the £100k over a selection of funds with varying different risk levels?

Thanks for all the thoughts so far.

Just as a bit more background, the £100k would represent about 10% of my total holdings (mostly made up of pensions and ISAs) so could be played with a bit, but I’d probably be looking at about 5 years before I wanted to stop accumulating, so not looking for anything crazy high risk (I already have a bit of crypto to cover that end of the spectrum!)

Just as a bit more background, the £100k would represent about 10% of my total holdings (mostly made up of pensions and ISAs) so could be played with a bit, but I’d probably be looking at about 5 years before I wanted to stop accumulating, so not looking for anything crazy high risk (I already have a bit of crypto to cover that end of the spectrum!)

If its any help these are my funds (ISA and SIPP)...

Artemis Global Income

Fidelity Global Technology

Artemis UK Select

GS Japan Equity Portfolio Partners

Vanguard Life Strategy 100% Equity

Legal and General Global Technology Index Trust

Legal and General International Index Trust

Fidelity Index World

Man Japan CoreAlpha Equity

Probably too much Tech and US even though Artemis UK and Man Japan have been added recently

Artemis Global Income

Fidelity Global Technology

Artemis UK Select

GS Japan Equity Portfolio Partners

Vanguard Life Strategy 100% Equity

Legal and General Global Technology Index Trust

Legal and General International Index Trust

Fidelity Index World

Man Japan CoreAlpha Equity

Probably too much Tech and US even though Artemis UK and Man Japan have been added recently

Haven't been one for ETF's/Funds til now, but will gradually swap out some stocks into energy & materials etf's through the year. Software is getting hammered and will likely continue to bleed - some areas of tech will do ok, but energy/materials scarcity shd do well for next few years

i use my GIA for longer term holds, so as not to trigger too many CGT events, and look to spin out income from calls or just make use of the margin which builds up as the assets grow.

Isa is for more 'racey' stuff....

i use my GIA for longer term holds, so as not to trigger too many CGT events, and look to spin out income from calls or just make use of the margin which builds up as the assets grow.

Isa is for more 'racey' stuff....

I probably would diversify, but I wouldn't do so by buying whatever active fund is top of the performance tables as some suggest - as we all know how that ends.

I'd be looking at a similar 80% or so multi asset fund if that's your risk appetite, but non market cap weighted variant. L&G, Aberdeen etc all have a range, constructed using modern portfolio theory and expected returns rather than simply market cap weighting. Good way to diversify - thousands of individual stocks, some exposure to infra, real estate, high yield etc and no active stock selection risk which active equity funds come with.

A lot of this type of fund has say 20-30% in the US rather than 60-70% as per market cap weighting. If the US continues to dominate returns expect these funds to be left behind, or if what history shows is a more likely outcome in so much as a period of outperformance being followed by a period of underperformance, then these funds will dampen that impact due to higher weightings to other markets - emerging markets, UK, other asset classes etc.

I'd be looking at a similar 80% or so multi asset fund if that's your risk appetite, but non market cap weighted variant. L&G, Aberdeen etc all have a range, constructed using modern portfolio theory and expected returns rather than simply market cap weighting. Good way to diversify - thousands of individual stocks, some exposure to infra, real estate, high yield etc and no active stock selection risk which active equity funds come with.

A lot of this type of fund has say 20-30% in the US rather than 60-70% as per market cap weighting. If the US continues to dominate returns expect these funds to be left behind, or if what history shows is a more likely outcome in so much as a period of outperformance being followed by a period of underperformance, then these funds will dampen that impact due to higher weightings to other markets - emerging markets, UK, other asset classes etc.

simon800 said:

I probably would diversify, but I wouldn't do so by buying whatever active fund is top of the performance tables as some suggest - as we all know how that ends.

That's IMO a strange comment in the context of diversification. Those funds get to the top by being the top performer and they might well stay at or near the top for a while. Bear in mind this guy holds crypto, which some of us wouldn't touch with a barge pole.Check out, for instance, Artemis Global Income Fund.

Or they might not....

Remember when everyone was going wild for Baillie Gifford funds and Scottish Mortgage Trust was seen as a must have? Fundsmith. India funds. Etc Etc.

In the context of diversification, buying a highly concentrated active equity fund with 30-40 stocks and active manager risk isn't the answer.

Remember when everyone was going wild for Baillie Gifford funds and Scottish Mortgage Trust was seen as a must have? Fundsmith. India funds. Etc Etc.

In the context of diversification, buying a highly concentrated active equity fund with 30-40 stocks and active manager risk isn't the answer.

I am a novice but I started using LifeStrategy funds a few years ago and did compare it to some other funds at the time.

They are intended to pretty much be an all-in-one fund which you can basically stick your whole pension in, only having to choose the proportion you allocate to fixed income (bonds and U.K. Gilts). They differ from e.g. 'Target Retirement' funds in that those proportions remain the same unless you change them.

They are globally diversified, investing in IIRC 2,500+ companies worldwide.

The main criticism of LifeStrategy funds has been that they feature a heavy home bias. The equities portion is ~20% U.K. when a more proportional U.K. representation would be ITRO 4%. Some people are in favour of a bit of home bias, some people aren't.

Vanguard have recently launched the 'LifeStrategy Global' range for people who want a more agnostic global cap weighting.

Personally I like LifeStrategy. It's good for the purpose of having a very simple, single-fund approach which is low intervention. It self-balances. You can just set it and forget it for years and years.

LifeStrategy wasn't available on my platform of choice so I had to do something else, and in doing so I did learn that you can pretty much achieve the same end with a lower total fee if you are willing to distribute your money across a few different funds yourself and periodically rebalance them.

They are intended to pretty much be an all-in-one fund which you can basically stick your whole pension in, only having to choose the proportion you allocate to fixed income (bonds and U.K. Gilts). They differ from e.g. 'Target Retirement' funds in that those proportions remain the same unless you change them.

They are globally diversified, investing in IIRC 2,500+ companies worldwide.

The main criticism of LifeStrategy funds has been that they feature a heavy home bias. The equities portion is ~20% U.K. when a more proportional U.K. representation would be ITRO 4%. Some people are in favour of a bit of home bias, some people aren't.

Vanguard have recently launched the 'LifeStrategy Global' range for people who want a more agnostic global cap weighting.

Personally I like LifeStrategy. It's good for the purpose of having a very simple, single-fund approach which is low intervention. It self-balances. You can just set it and forget it for years and years.

LifeStrategy wasn't available on my platform of choice so I had to do something else, and in doing so I did learn that you can pretty much achieve the same end with a lower total fee if you are willing to distribute your money across a few different funds yourself and periodically rebalance them.

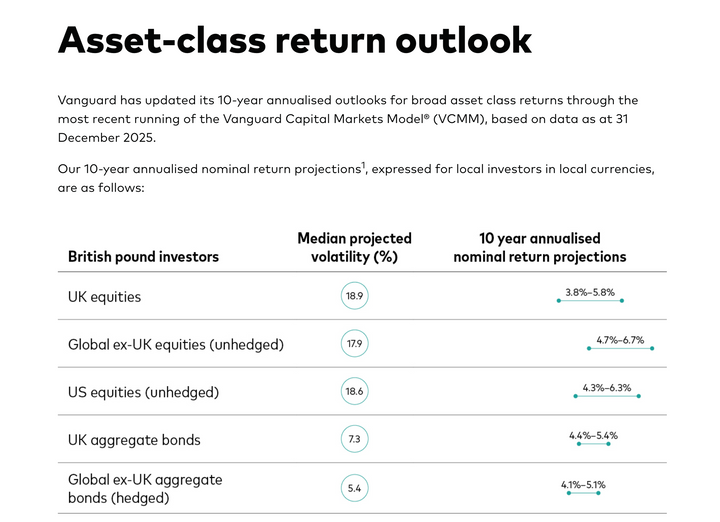

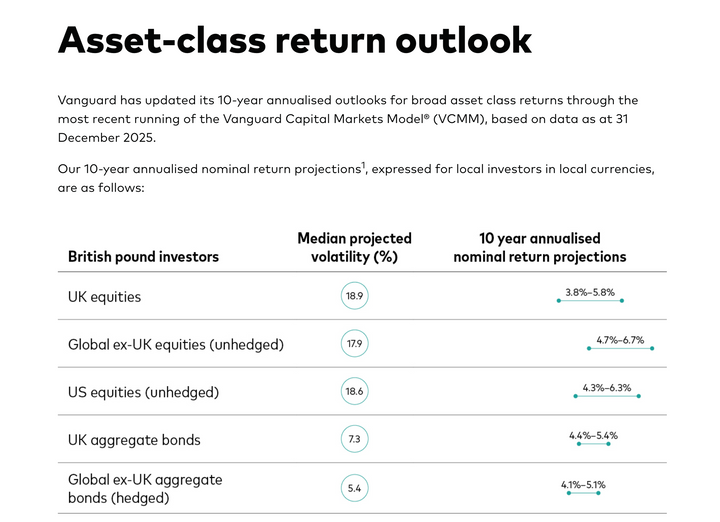

As ever DYOR but as we are talking Vanguard it might be of interest to look at their economic and market update published yesterday. Pay attention to volatility but again, DYOR

https://www.vanguard.co.uk/professional/insights/v...

https://www.vanguard.co.uk/professional/insights/v...

Hustle_ said:

I baulked at the prospect of being 60%+ US. It may be the most agnostic position but I didn't like it. I decided to keep a LifeStrategy style UK tilt. Another way to reduce your bet on the hype train is to go equal weighted as Simon suggests.

Personally I think equal weighted is a questionable solution. Superficially attractive but once you look into it I don't think it makes much sense. I'm not clever enough to construct a short explanation myself but this is what AI says about it, "Equal-weighted strategies often underperform during large-cap bull markets, carry higher volatility due to increased small-cap exposure, and incur higher transaction costs from frequent rebalancing. They can be less liquid and may not provide the same market-representative performance as market-cap-weighted indices, making them potentially riskier during market downturns."

To my simple mind diversification can't be achieved by sticking all your money in one place and relying on that place to be diversified. I recognise many people like the simplicity of the approach, and results are often at least on a par with "average" performance, but it's not for me.

As always with anything in the world of investment, ask me afterwards and I'll tell you how it went, all of these decisions being made into an uncertain future.

Phooey said:

As ever DYOR but as we are talking Vanguard it might be of interest to look at their economic and market update published yesterday. Pay attention to volatility but again, DYOR

https://www.vanguard.co.uk/professional/insights/v...

I knew we were expecting equities returns to be somewhat weak, but blimey! https://www.vanguard.co.uk/professional/insights/v...

Hustle_ said:

I knew we were expecting equities returns to be somewhat weak, but blimey!

Nominal too. Just for fun: throw in 30 x 5% pullbacks, 10 x 10% corrections, 2 x 15% declines, 1 or 2 x 20% bear markets, maybe a recession, probably a dozen or so new geopolitical events, and if Vanguard are anywhere near accurate it could be quite the ride

Gassing Station | Finance | Top of Page | What's New | My Stuff