Move it all to a high income fund ??

Discussion

Having had some decent returns from the likes of Aviva and L&G, I'm wondering if I should move everything into a / some Equity Income funds like say UBS Global Enhanced Equity Income fund that has a dividend of around 10%.

https://www.hl.co.uk/funds/fund-discounts,-prices-...

I'm retired with a reasonable pension that covers my day to day costs, 2 years away from State Pension, mortgage free and no big purchases required in the forseeable future. Reasonable amount in SIPP and ISA that I can call on as and when required for holidays etc.

So I don't think I need the capital growth as I reckon my pot will see me out with some to spare, my logic is that why not put it all in high income funds with pretty much solid nailed on dividend returns without the ups and downs of the stock market, I could get 8-10% per year and not care if the share prices increase as reinvesting the dividends would compound

Am I mad ?

TIA

https://www.hl.co.uk/funds/fund-discounts,-prices-...

I'm retired with a reasonable pension that covers my day to day costs, 2 years away from State Pension, mortgage free and no big purchases required in the forseeable future. Reasonable amount in SIPP and ISA that I can call on as and when required for holidays etc.

So I don't think I need the capital growth as I reckon my pot will see me out with some to spare, my logic is that why not put it all in high income funds with pretty much solid nailed on dividend returns without the ups and downs of the stock market, I could get 8-10% per year and not care if the share prices increase as reinvesting the dividends would compound

Am I mad ?

TIA

This is an old/ish video but it mostly reflects my thoughts.

Going for dividend stocks can seem attractive as you get 'passive income'. But the share price is just reduced by the amount paid as the dividend. You would get the same practical result by selling shares as necessary to achieve the income you want from your 'growth' portfolio, and often with a better overall return (because growth could well be higher).

I'd suggest focusing on the level of volatility you are comfortable with from your portfolio, rather than looking for a high dividend ETF or mutual fund.

https://www.youtube.com/watch?v=UpXI_Vd51dA

Click the radio button that flips the graph from "total return" to "price".

This is the share price over the past 10 years https://webfund6.financialexpress.net/clients/Harg...

You're looking at a fund that converts capital to dividends. Great if you want, but I'd rather have something more balanced and consciously sell units if I need more income.

This is the share price over the past 10 years https://webfund6.financialexpress.net/clients/Harg...

You're looking at a fund that converts capital to dividends. Great if you want, but I'd rather have something more balanced and consciously sell units if I need more income.

Thanks both,

I get that I could just sell shares to provide cash as and when needed, but my thinking was that I've got enough capital for my needs and the steady dividends coming from said UBS fund or similar would in some ways get over the potential fluctuations in values of more growth orientated stocks / ETF / Trackers.

I'll have a watch of the video and do some more thinking .

I get that I could just sell shares to provide cash as and when needed, but my thinking was that I've got enough capital for my needs and the steady dividends coming from said UBS fund or similar would in some ways get over the potential fluctuations in values of more growth orientated stocks / ETF / Trackers.

I'll have a watch of the video and do some more thinking .

Have a look at https://webfund6.financialexpress.net/clients/Harg...

Red is UBS Global Enhanced......

Green is a Vanguard all world equity ETF - VWRL

Red is Blue Whale which I picked as an exciting growth targeting fund.

All with dividends reinvested, or as accumulator units. Certainly over the past eight years, you would have given up a lot of return compared to the all world ETF, without experiencing that much less volatility.

Red is UBS Global Enhanced......

Green is a Vanguard all world equity ETF - VWRL

Red is Blue Whale which I picked as an exciting growth targeting fund.

All with dividends reinvested, or as accumulator units. Certainly over the past eight years, you would have given up a lot of return compared to the all world ETF, without experiencing that much less volatility.

Psychologically holding 'steady dividend' stocks might feel different, but the dividend is coming directly off the share price, so it's really the same as selling some shares.

And if you think about it, businesses which return high dividends are often just saying they don't know what else to do with the money. And so those companies might not achieve as good growth in the long term vs those companies who are reinvesting their profit into growing market share, developing new markets, new products etc. And of course, that will ultimately be reflected in the share price, which in turn directly relates to the effective 'income' you can derive by gradually selling those shares.

But mitigating fluctuations in the value of your portfolio is a different (and I think very important) point. The obvious answer to reducing volatility is diversification. But many markets are correlated together, often tied to the US market, so it's important to check that the ETF or mutual fund you buy instead is giving you actual diversification. It's why many people just end up with a 'world tracker' of some kind because it can get complicated.

And if you think about it, businesses which return high dividends are often just saying they don't know what else to do with the money. And so those companies might not achieve as good growth in the long term vs those companies who are reinvesting their profit into growing market share, developing new markets, new products etc. And of course, that will ultimately be reflected in the share price, which in turn directly relates to the effective 'income' you can derive by gradually selling those shares.

But mitigating fluctuations in the value of your portfolio is a different (and I think very important) point. The obvious answer to reducing volatility is diversification. But many markets are correlated together, often tied to the US market, so it's important to check that the ETF or mutual fund you buy instead is giving you actual diversification. It's why many people just end up with a 'world tracker' of some kind because it can get complicated.

happytobealive said:

Psychologically holding 'steady dividend' stocks might feel different, but the dividend is coming directly off the share price, so it's really the same as selling some shares.

And if you think about it, businesses which return high dividends are often just saying they don't know what else to do with the money. And so those companies might not achieve as good growth in the long term vs those companies who are reinvesting their profit into growing market share, developing new markets, new products etc. And of course, that will ultimately be reflected in the share price, which in turn directly relates to the effective 'income' you can derive by gradually selling those shares.

But mitigating fluctuations in the value of your portfolio is a different (and I think very important) point. The obvious answer to reducing volatility is diversification. But many markets are correlated together, often tied to the US market, so it's important to check that the ETF or mutual fund you buy instead is giving you actual diversification. It's why many people just end up with a 'world tracker' of some kind because it can get complicated.

Thanks !And if you think about it, businesses which return high dividends are often just saying they don't know what else to do with the money. And so those companies might not achieve as good growth in the long term vs those companies who are reinvesting their profit into growing market share, developing new markets, new products etc. And of course, that will ultimately be reflected in the share price, which in turn directly relates to the effective 'income' you can derive by gradually selling those shares.

But mitigating fluctuations in the value of your portfolio is a different (and I think very important) point. The obvious answer to reducing volatility is diversification. But many markets are correlated together, often tied to the US market, so it's important to check that the ETF or mutual fund you buy instead is giving you actual diversification. It's why many people just end up with a 'world tracker' of some kind because it can get complicated.

Ongoing costs looks a bit toppy (UBS fundsheet says 0.60% and HL says 0.79%). In anyway, anything more than 0.40% I find it over priced.

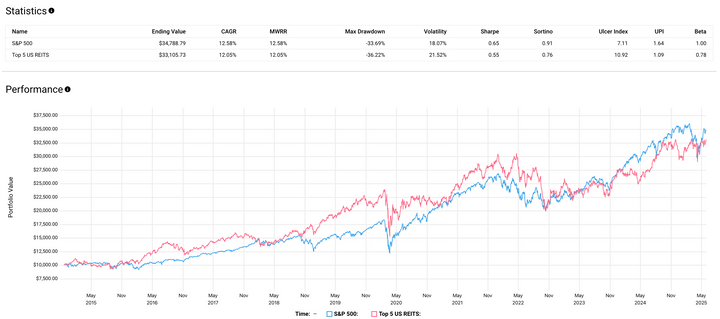

It is basically monthly dividend fund, isnt it and looking at the portfolio they are holding some REITS (equity and mortgage) so income is more secure. I think someone would have perhaps achieved more than that by just holding top 5 US REITS in terms of market cap, very quick sketchy analysis below.

It is basically monthly dividend fund, isnt it and looking at the portfolio they are holding some REITS (equity and mortgage) so income is more secure. I think someone would have perhaps achieved more than that by just holding top 5 US REITS in terms of market cap, very quick sketchy analysis below.

- Inflation not factored above

Gassing Station | Finance | Top of Page | What's New | My Stuff