Tax code 1256L query

Discussion

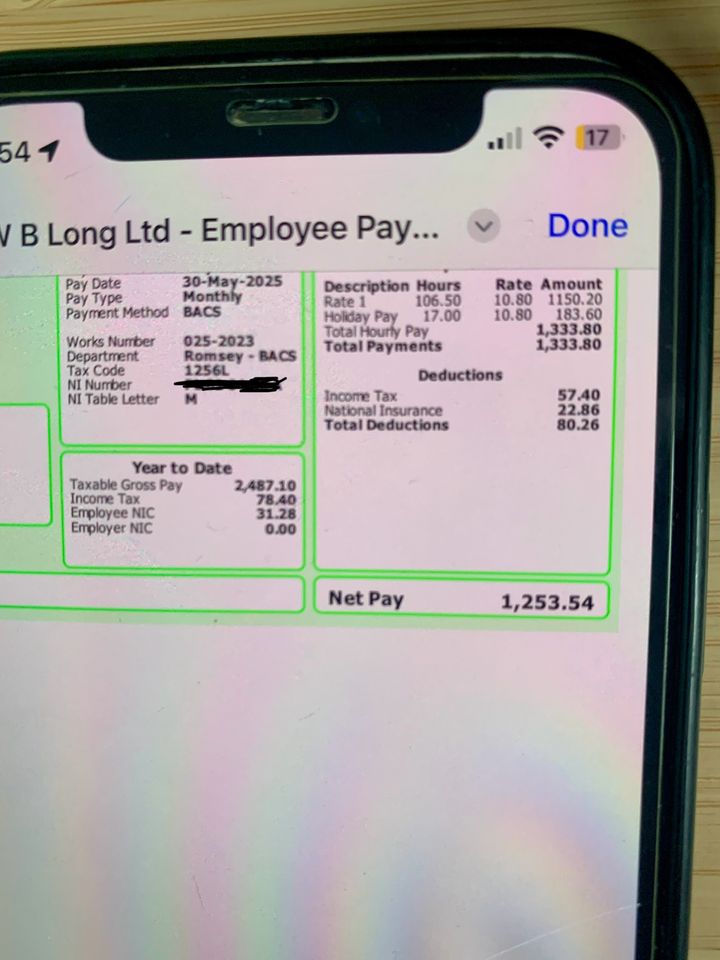

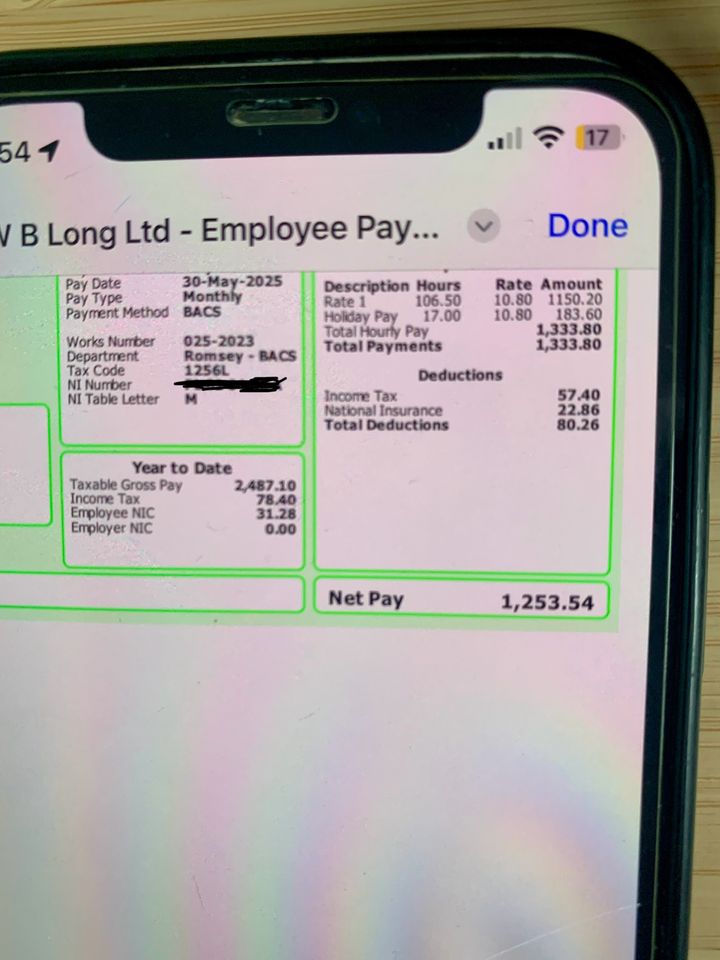

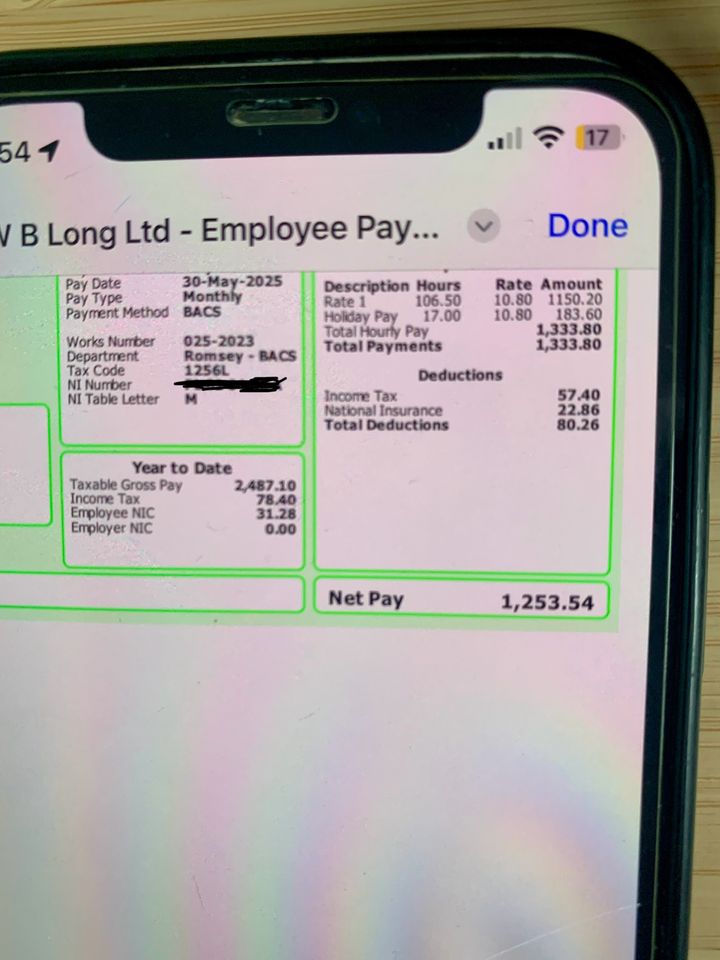

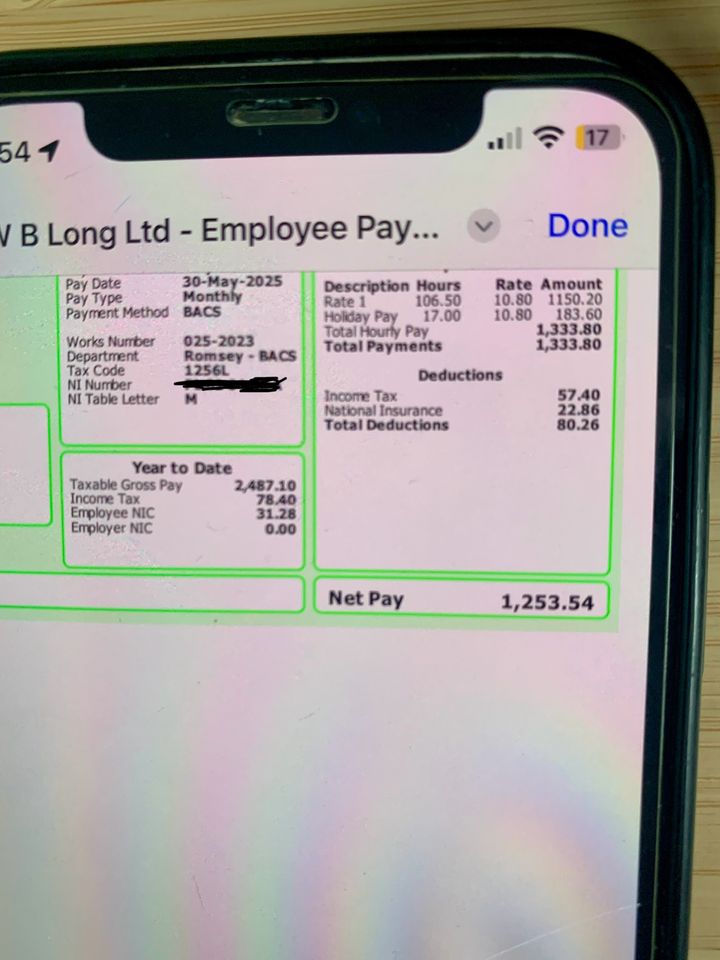

Can someone help me here. I’ve googled it but still not making much sense to me. Daughter has zero hours contract earning a bit to save for Uni. Last month did a few more hours than normal. Payslip shows £78 income tax paid, but tax code 1256L means she can earn up to £12560 before being taxed doesn’t it? She never earns that amount of money normally. Is it anticipating that based on this monthly payment she will be earning over the threshold and taxed accordingly? If she earns under that amount during this financial year does she get it back at some point? I am sure there is an easy answer. Thanks

sir humphrey appleby said:

Can someone help me here. I’ve googled it but still not making much sense to me. Daughter has zero hours contract earning a bit to save for Uni. Last month did a few more hours than normal. Payslip shows £78 income tax paid, but tax code 1256L means she can earn up to £12560 before being taxed doesn’t it? She never earns that amount of money normally. Is it anticipating that based on this monthly payment she will be earning over the threshold and taxed accordingly? If she earns under that amount during this financial year does she get it back at some point? I am sure there is an easy answer. Thanks

She will get it back automatically in net pay over the comming months when her monrhly pay drops back to normal.sir humphrey appleby said:

Can someone help me here. I’ve googled it but still not making much sense to me. Daughter has zero hours contract earning a bit to save for Uni. Last month did a few more hours than normal. Payslip shows £78 income tax paid, but tax code 1256L means she can earn up to £12560 before being taxed doesn’t it? She never earns that amount of money normally. Is it anticipating that based on this monthly payment she will be earning over the threshold and taxed accordingly? If she earns under that amount during this financial year does she get it back at some point? I am sure there is an easy answer. Thanks

1.Because she's gone over the threshold this month the payroll system assumes she'll be earning that much every month and has therefore taxed her2. She'll get it back when her earning drop

3. if for some reason she doesn't get it back before the end of the tax year then HMRC will automatically pay her back.

4. if for some reason they don't automatically pay her back she will need to contact them and ask for it back

https://www.gov.uk/claim-tax-refund

Countdown said:

sir humphrey appleby said:

Can someone help me here. I’ve googled it but still not making much sense to me. Daughter has zero hours contract earning a bit to save for Uni. Last month did a few more hours than normal. Payslip shows £78 income tax paid, but tax code 1256L means she can earn up to £12560 before being taxed doesn’t it? She never earns that amount of money normally. Is it anticipating that based on this monthly payment she will be earning over the threshold and taxed accordingly? If she earns under that amount during this financial year does she get it back at some point? I am sure there is an easy answer. Thanks

1.Because she's gone over the threshold this month the payroll system assumes she'll be earning that much every month and has therefore taxed her2. She'll get it back when her earning drop

3. if for some reason she doesn't get it back before the end of the tax year then HMRC will automatically pay her back.

4. if for some reason they don't automatically pay her back she will need to contact them and ask for it back

https://www.gov.uk/claim-tax-refund

Gassing Station | Finance | Top of Page | What's New | My Stuff