House insurance 'Sum Insured' vs rebuild cost?

Discussion

Question about house insurance policies.

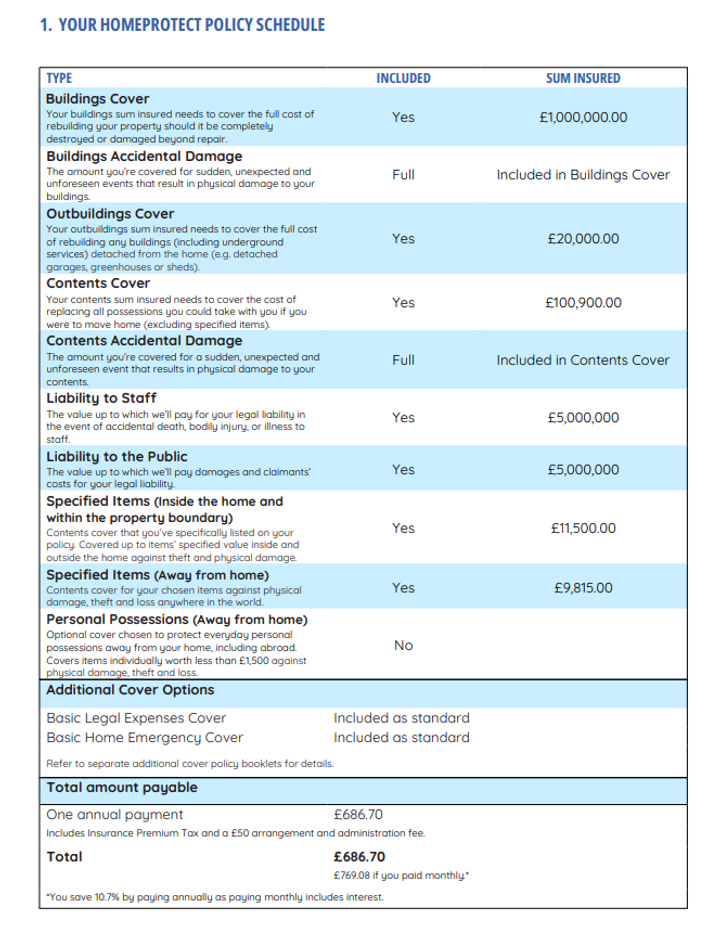

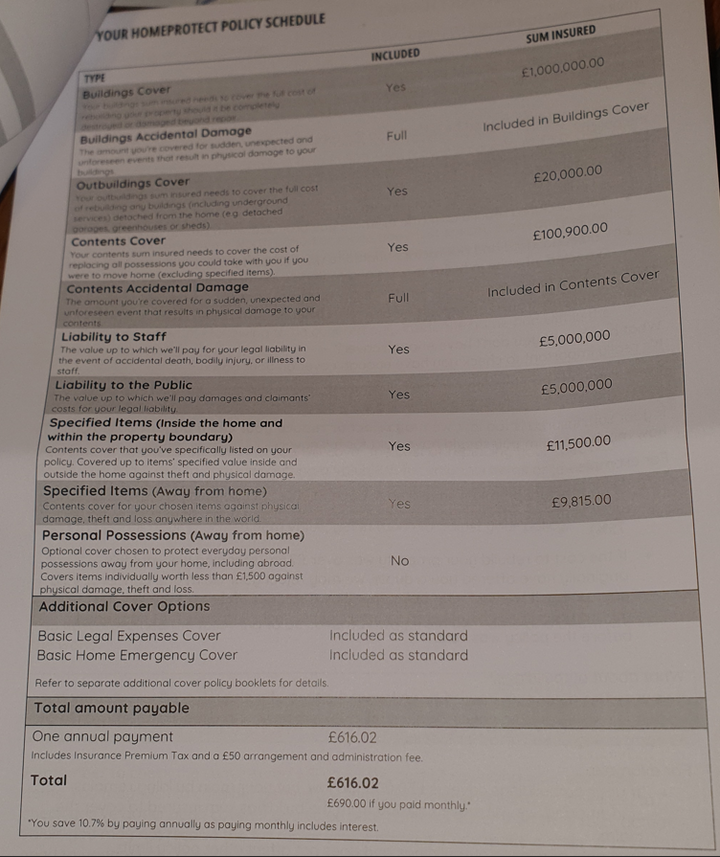

Insured with Home Protect (AXA) a year ago, and last week the renewal arrived and the price good, a slight reduction on last year and less than a new policy from them on confused.com, only snag is I can't remember what I declared as our property value and or rebuild cost last time as I knew I played around a bit with its effect on price as if nothing else the rebuild figure in particularly is at best a wideband estimate, especially as it's a period edwardian house so rebuilding anything like what's there now would be complicated.

Rang up, told they don't differentiate between value and rebuild, and it was £600k. Renewal cost is £616.02. Ok so far.

Asked them what the effect of increasing it would be, and could they quote at £800k. That came out at £686.70. Fine i'll take it.

However reviewing the documents retrospectively, both policy summaries state the sum insured is £1000k. Which I now remember we a selling point when I went with Home Protect a year ago.

Rang up to try and get confirmation of what I am getting for my extra £70 as there is nothing on the policy documents that details the £800k or 600k figure. However it rapidly became obvious that the guy on the end of the phone, and his manager, didn't really know the answer. Just lots of repeating related information and reading from bits of the poly documented about what would happen if you where under insured, etc.

Hence, over to you lot! Do we have anyone with any experience of this?

Insured with Home Protect (AXA) a year ago, and last week the renewal arrived and the price good, a slight reduction on last year and less than a new policy from them on confused.com, only snag is I can't remember what I declared as our property value and or rebuild cost last time as I knew I played around a bit with its effect on price as if nothing else the rebuild figure in particularly is at best a wideband estimate, especially as it's a period edwardian house so rebuilding anything like what's there now would be complicated.

Rang up, told they don't differentiate between value and rebuild, and it was £600k. Renewal cost is £616.02. Ok so far.

Asked them what the effect of increasing it would be, and could they quote at £800k. That came out at £686.70. Fine i'll take it.

However reviewing the documents retrospectively, both policy summaries state the sum insured is £1000k. Which I now remember we a selling point when I went with Home Protect a year ago.

Rang up to try and get confirmation of what I am getting for my extra £70 as there is nothing on the policy documents that details the £800k or 600k figure. However it rapidly became obvious that the guy on the end of the phone, and his manager, didn't really know the answer. Just lots of repeating related information and reading from bits of the poly documented about what would happen if you where under insured, etc.

Hence, over to you lot! Do we have anyone with any experience of this?

Just based on that photo of the coverage , providing your rebuild value / cost is no greater than £1m , you are fine.

Without seeing the rest of the t and c bit difficult to say what would happen in the event of a rebuild costing more than that but likelihood is they may apply what’s called average and pro rate down what they will pay.

Unfortunately unless you want to pay for a surveyor to give a bespoke rebuild valuation you need to go with your gut.

Rebuild costs over the past 5 years appear to have increased significantly.

Just depends on how much wriggle room you feel is there on the SI.

Without seeing the rest of the t and c bit difficult to say what would happen in the event of a rebuild costing more than that but likelihood is they may apply what’s called average and pro rate down what they will pay.

Unfortunately unless you want to pay for a surveyor to give a bespoke rebuild valuation you need to go with your gut.

Rebuild costs over the past 5 years appear to have increased significantly.

Just depends on how much wriggle room you feel is there on the SI.

It's a relatively easy answer if you're in a new build, as logically purchase price is going to be more than the build cost.

However, we're an early 1800s property and I have a memory of thinking about this when we last changed insurer. We're with Halifax and for their Silver / Gold tiers the table just says "Full rebuild cost" which makes things easier.

However, we're an early 1800s property and I have a memory of thinking about this when we last changed insurer. We're with Halifax and for their Silver / Gold tiers the table just says "Full rebuild cost" which makes things easier.

It's explained on page 10 of the policy wording.

(Yes, I've been doing this 20-odd years, I know full well none of you ever read the bloomin' policy wording!)

Makes it somewhat baffling that the call centre oppos couldn't figure it out either though.

'When taking out a policy, You are asked the amount it would take to completely rebuild Your Home, Outbuildings or replace Your Contents, specified items or general possessions (on a ‘new for old’ basis), the “sum insured” or, for individual items, their “worth”.

▪ If the “sum insured” isn’t enough, You are “underinsured”. This means that any claim that is settled will be reduced in proportion depending on how underinsured You are, regardless of the amount of the claim.'

Essentially, they're saying they'll cover your building up up to their max limit of £1m. But they'll only pay out what it costs to rebuild it. And if the figure you've given them is less than it would cost to rebuild, then they'll reduce their payment by the proportion you have underinsured.

It's an insurance principle called 'Average' which us professionals are taught early on. But not home insurance call centre oppos, clearly . . .

(Yes, I've been doing this 20-odd years, I know full well none of you ever read the bloomin' policy wording!)

Makes it somewhat baffling that the call centre oppos couldn't figure it out either though.

'When taking out a policy, You are asked the amount it would take to completely rebuild Your Home, Outbuildings or replace Your Contents, specified items or general possessions (on a ‘new for old’ basis), the “sum insured” or, for individual items, their “worth”.

▪ If the “sum insured” isn’t enough, You are “underinsured”. This means that any claim that is settled will be reduced in proportion depending on how underinsured You are, regardless of the amount of the claim.'

Essentially, they're saying they'll cover your building up up to their max limit of £1m. But they'll only pay out what it costs to rebuild it. And if the figure you've given them is less than it would cost to rebuild, then they'll reduce their payment by the proportion you have underinsured.

It's an insurance principle called 'Average' which us professionals are taught early on. But not home insurance call centre oppos, clearly . . .

Harpoon said:

It's a relatively easy answer if you're in a new build, as logically purchase price is going to be more than the build cost.

However, we're an early 1800s property and I have a memory of thinking about this when we last changed insurer. We're with Halifax and for their Silver / Gold tiers the table just says "Full rebuild cost" which makes things easier.

Not sure that’s true across the board. If you buy a semi-detached or a mews style new build then rebuilding that will incur additional costs over just building the block as one when new. Plus build cost is based on what a new-build housebuilder can source their materials / labour etc at, probably en masse, whereas your rebuild won’t be carried out by a large house building company. Wimpey or Barratt could build a house much cheaper than any other builders. However, we're an early 1800s property and I have a memory of thinking about this when we last changed insurer. We're with Halifax and for their Silver / Gold tiers the table just says "Full rebuild cost" which makes things easier.

@pistonbroker

i remember 'back in the day' working for a chartered surveyor and something he said stuck with me; rebuild costs should include everything from clearance of existing site through to completion of the rebuild. Presumably that's still a 'thing' ?

( he was citing back then worst case of say a fire, demolition, carting everything away and then obvs adding VAT - before even starting to think about what the rebuild costs woudl spin out at)

i remember 'back in the day' working for a chartered surveyor and something he said stuck with me; rebuild costs should include everything from clearance of existing site through to completion of the rebuild. Presumably that's still a 'thing' ?

( he was citing back then worst case of say a fire, demolition, carting everything away and then obvs adding VAT - before even starting to think about what the rebuild costs woudl spin out at)

greengreenwood7 said:

@pistonbroker

i remember 'back in the day' working for a chartered surveyor and something he said stuck with me; rebuild costs should include everything from clearance of existing site through to completion of the rebuild. Presumably that's still a 'thing' ?

( he was citing back then worst case of say a fire, demolition, carting everything away and then obvs adding VAT - before even starting to think about what the rebuild costs woudl spin out at)

Very much still a thing and coverage should normally be shown under the “ what is insured “ part of the key information page. i remember 'back in the day' working for a chartered surveyor and something he said stuck with me; rebuild costs should include everything from clearance of existing site through to completion of the rebuild. Presumably that's still a 'thing' ?

( he was citing back then worst case of say a fire, demolition, carting everything away and then obvs adding VAT - before even starting to think about what the rebuild costs woudl spin out at)

For instance my policy covers up to a further 25% of the building sum insured and so as above if the buildings some insurance is light the issue can get compounded.

Other coverage which people often don’t think about is the cost of alternative accommodation especially given a total loss.

Harpoon said:

It's a relatively easy answer if you're in a new build, as logically purchase price is going to be more than the build cost.

However, we're an early 1800s property and I have a memory of thinking about this when we last changed insurer. We're with Halifax and for their Silver / Gold tiers the table just says "Full rebuild cost" which makes things easier.

Nooope.However, we're an early 1800s property and I have a memory of thinking about this when we last changed insurer. We're with Halifax and for their Silver / Gold tiers the table just says "Full rebuild cost" which makes things easier.

I’m in a terrace.

Bought for £375k, selling for £400k, insured for £700k now.

Rebuilding it with a house attached at each side = £££ vs an empty site.

It’s all a load of stupidity in my view. The insurer should determine all that side of things for generic resi insurance, and take the risk (under/over insured blah blah)

z4RRSchris said:

the insurer should give you a calculator or advice as to how to calculate a rebuild cost, if they dont and they try and get you later for being under insured you have a get out.

AXA tried this trick with me when a 50m tree fell on the house.

Yeah, Home Protect / AXA point you to the ABI / BCIS rebuild calculator, which suggest the rebuild cost is £620k which is not a million miles off the value of the place, base on the age, floor area, broad materials of construction, postcode etc. While also caveating that significantly, and is going to exclude things like the half height oak panelling, and potentially doesn't fully factor in the polished mahogany bannister and period plaster coving, etc. AXA tried this trick with me when a 50m tree fell on the house.

However none of that is what I am here to ask about. I have done a reasonably amount of 'due diligence' here and hence decided £600k is a bit shy and I would be better at £700-800k hence I increased my declaration.

I also understand that if I am found to be under insured, even if I make a partial claim, I wont get the full claim paid out and that it will be pro-rataed down accordingly. Based I believe on the ratio of the respective premium cost. But again, that is not what I am here asking about.

I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

dhutch said:

I also understand that if I am found to be under insured, even if I make a partial claim, I wont get the full claim paid out and that it will be pro-rataed down accordingly. Based I believe on the ratio of the respective premium cost. But again, that is not what I am here asking about.

I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

Because that’s how the Insurer prefers to state coverage ie as a blanket maximum.I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

It helps their marketing too.

This way they believe they are helping the insured to avoid being under insured.

Sitting underneath this is a rating matrix which gives the different premiums for the requested limits.

Some companies ( one mentioned above ) even goes as far as providing so called unlimited cover.

dhutch said:

I also understand that if I am found to be under insured, even if I make a partial claim, I wont get the full claim paid out and that it will be pro-rataed down accordingly. Based I believe on the ratio of the respective premium cost. But again, that is not what I am here asking about.

I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

Is it as straight forward as I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

AndyAudi said:

Is it as straight forward as

The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

Yes, but what stops me declaring say £400k rebuild cost, getting a policy that covers upto £1000k, and then claiming £620k.The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

dhutch said:

I also understand that if I am found to be under insured, even if I make a partial claim, I wont get the full claim paid out and that it will be pro-rataed down accordingly. Based I believe on the ratio of the respective premium cost. But again, that is not what I am here asking about.

I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

The flip side of that would be the thread complaining that an insurer is ripping them off by insisting they are covered for £1m when their house is only worth £300k. See people moaning that their insurance for the 17 year old is 3 times the value of their car for example. I can also understand is that when I declared £600k rebuild cost, I get a quote of £616

And when I then ring and up the declaration to £800k rebuild cost, I get a quote of £696

But what I dont understand, is why in both cases, policy document that says I am insured upto £1000k. With no mention at all of the 600 or 800k figures.

dhutch said:

AndyAudi said:

Is it as straight forward as

The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

Yes, but what stops me declaring say £400k rebuild cost, getting a policy that covers upto £1000k, and then claiming £620k.The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

they did the same with us, i took them to the ombudsman, i won. The advice is very clear from the ombudsman. this was a £200k plus claim on a £1m plus house, that they claimed we were underinsured. by listening to a phone call between my mum and axa from 10 years ago it turns out the sum was based on their advise.

so if the calculator says £600k, use £600k

dhutch said:

Yes, but what stops me declaring say £400k rebuild cost, getting a policy that covers upto £1000k, and then claiming £620k.

I guess because their records will show the requested value and should the claim quantum be accepted you will be told you have under insured by a third. In reality few houses relatively speaking to an insurers complete portfolio are ever complete total losses and just because you are claiming an amount doesn’t mean their loss assessors will just accept that and send you a cheque.

z4RRSchris said:

dhutch said:

AndyAudi said:

Is it as straight forward as

The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

Yes, but what stops me declaring say £400k rebuild cost, getting a policy that covers upto £1000k, and then claiming £620k.The risk of them having to payout a higher figure under £1M is higher if the property value is higher

(In the same way two people are different risks for same car value)

they did the same with us, i took them to the ombudsman, i won. The advice is very clear from the ombudsman. this was a £200k plus claim on a £1m plus house, that they claimed we were underinsured. by listening to a phone call between my mum and axa from 10 years ago it turns out the sum was based on their advise.

so if the calculator says £600k, use £600k

Gassing Station | Finance | Top of Page | What's New | My Stuff