Trump and the effect on pensions

Discussion

I’d estimate my total fund went down £15k when he announced his tariffs.

Now it’s back where it is but it’s gaining. 1000 a day at the moment. Is anyone else seeing such large gains?

I’ve probably got 8 years before I can retire but if it carries on like this (I know it won’t), I’ll be able to bring it forward a couple of years.

Now it’s back where it is but it’s gaining. 1000 a day at the moment. Is anyone else seeing such large gains?

I’ve probably got 8 years before I can retire but if it carries on like this (I know it won’t), I’ll be able to bring it forward a couple of years.

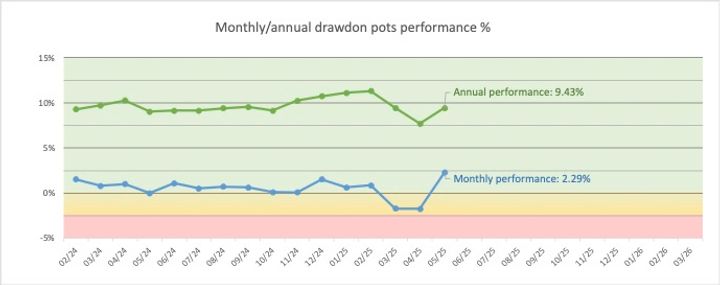

Being retired, I keep a close eye on my drawdown pot (I also have db and an annuity)

My pot dropped by 3.4% in value, but has already recovered most of that (for comparison, Truss was a 12.5% drop, that took 6 months to recover, which iit never did fully, taking into account the loss of 6 months of gains)

My drawdown is spread across four pension providers, with different blends of equitie, bonds and cash

My pot dropped by 3.4% in value, but has already recovered most of that (for comparison, Truss was a 12.5% drop, that took 6 months to recover, which iit never did fully, taking into account the loss of 6 months of gains)

My drawdown is spread across four pension providers, with different blends of equitie, bonds and cash

Edited by mikef on Friday 9th May 09:08

I think that I dipped about £70k on "liberation day" and I was unable to take advantage as my annual SIPP contributions were held up by back office approvals.

Overall, things have recovered but there's been a re-shuffling of 'winners'. Oilers & Vanguard funds are down. UK financials up. My main single holding right now is carrying the weight - GGP which transitioned from being a gold explorer to being a gold producer at the end of last year - perfect timing in terms of aligning with a rising gold price. They're due to cross list on the ASX in a few weeks, so it's been a lucky hedge.

I'm at the point that I can take my 25% tax free ... just biding my time ... but I'll probably take a portion of the allowance this year to reduce the mortgage. This is driven mostly by the desire to be mortgage free, and less because it's a sensible financial decision.

ETA: The gold play has been very helpful... I think that YE 2024 to 7th May 2025 - excluding contributions - I'm up 19.5%. I'm less exposed to US Tech stocks than I think others are.

Overall, things have recovered but there's been a re-shuffling of 'winners'. Oilers & Vanguard funds are down. UK financials up. My main single holding right now is carrying the weight - GGP which transitioned from being a gold explorer to being a gold producer at the end of last year - perfect timing in terms of aligning with a rising gold price. They're due to cross list on the ASX in a few weeks, so it's been a lucky hedge.

I'm at the point that I can take my 25% tax free ... just biding my time ... but I'll probably take a portion of the allowance this year to reduce the mortgage. This is driven mostly by the desire to be mortgage free, and less because it's a sensible financial decision.

ETA: The gold play has been very helpful... I think that YE 2024 to 7th May 2025 - excluding contributions - I'm up 19.5%. I'm less exposed to US Tech stocks than I think others are.

Edited by Chris Type R on Friday 9th May 10:06

Mr Pointy said:

Still 15% down from the peak & 10% down from the beginning of the year. Not good.

Similar for me, fx headwind isn't helping, gbp v usd. Another few weeks like the last 2 should see me back to break even on the year. All depends on what the tangerine turd comes out with.

Going to be interesting in a couple of months to see what happens regarding tariff wars re starting

Eta much better to state percentages, monetary sums don't give a good picture

Edited by dingg on Friday 9th May 10:56

Hoofy said:

Given how mental things are these days, I probably wouldn't post that.

I'm going by the dictionary definition:

https://dictionary.cambridge.org/dictionary/englis...

Gassing Station | Finance | Top of Page | What's New | My Stuff

t announced the tariffs.

t announced the tariffs.