Leaving job, what to do with workplace pension

Discussion

I'm due to leave my job in a couple of weeks and as part of the 'offboarding' process I have been given the phone number of the pension provider "should I wish to contact them". Which presumably I do but I've no idea what to talk to them about.

I've looked at a couple of sites like PensionBee, Aviva, Standard Life and so on, so it seems my options are 1. keep the pension where it is or 2. transfer it to a personal pension of some variety, which I don't currently have. Right now I'm not moving to a new job so there's no 'transfer it to the workplace pension there' option.

What are the questions I need to ask my current provider so I informed enough to make a decision as to whether it's better to leave it as is, or move?

I've got:

fees (current to compare with new provider)

exit / transfer fees from current provider

performance of the current pension given what funds it has

Please treat me like the financial numpty that I am. And to be honest, leave it where it is is what I'm leaning towards.

I've looked at a couple of sites like PensionBee, Aviva, Standard Life and so on, so it seems my options are 1. keep the pension where it is or 2. transfer it to a personal pension of some variety, which I don't currently have. Right now I'm not moving to a new job so there's no 'transfer it to the workplace pension there' option.

What are the questions I need to ask my current provider so I informed enough to make a decision as to whether it's better to leave it as is, or move?

I've got:

fees (current to compare with new provider)

exit / transfer fees from current provider

performance of the current pension given what funds it has

Please treat me like the financial numpty that I am. And to be honest, leave it where it is is what I'm leaning towards.

I have moved several pensions and I have left several pensions where they are after leaving employers (i.e. I've done both).

It comes down to a) the fees and b) the fund choices for me.

i.e. if it is with someone like Nest (other rubbish providers also available), then the fees are high and the fund choices poor - it's a no brainer to move it....

but if it is in a more traditional provider with a decent fee structure and access to a wide range of funds, then you might decide to leave it where it is - e.g. I have one with Standard Life that I have never moved because there was a 0.5% discount on the fee rate agreed with the employer at the time which means that it's pretty cheap, and easy to manage. It's done well since I left 10 years ago. I could move it, but haven't as it is OK where it is.

My personal rule of thumb for fees is that they need to be less than 0.4% to be cheap enough to consider leaving it where it is, whereas anything nearer 1% should definitely be moved.

In terms of those moved, (I'm moving one from Aviva (at 1%) right now), then I have moved mine to a Vanguard SIPP and fees here are in the order of 0.2% depending on where it is invested.

It comes down to a) the fees and b) the fund choices for me.

i.e. if it is with someone like Nest (other rubbish providers also available), then the fees are high and the fund choices poor - it's a no brainer to move it....

but if it is in a more traditional provider with a decent fee structure and access to a wide range of funds, then you might decide to leave it where it is - e.g. I have one with Standard Life that I have never moved because there was a 0.5% discount on the fee rate agreed with the employer at the time which means that it's pretty cheap, and easy to manage. It's done well since I left 10 years ago. I could move it, but haven't as it is OK where it is.

My personal rule of thumb for fees is that they need to be less than 0.4% to be cheap enough to consider leaving it where it is, whereas anything nearer 1% should definitely be moved.

In terms of those moved, (I'm moving one from Aviva (at 1%) right now), then I have moved mine to a Vanguard SIPP and fees here are in the order of 0.2% depending on where it is invested.

I assume this is a DC ( Defined contribution ) Pension as opposed to a DB ( Defined benefits aka Final Salary Scheme aka Gold plated scheme ) ?

One additional thing to ascertain might be is the scheme fully funded ie no shortfalls ?

Assuming it is then leaving it where it is is obviously "easier " but would you happy with this ie with no visible control over it or Is there a portal where you will be able to log on after you have left to keep tabs on it ?

How many years do you intend to see it frozen for before you need to withdraw down on it ?

One additional thing to ascertain might be is the scheme fully funded ie no shortfalls ?

Assuming it is then leaving it where it is is obviously "easier " but would you happy with this ie with no visible control over it or Is there a portal where you will be able to log on after you have left to keep tabs on it ?

How many years do you intend to see it frozen for before you need to withdraw down on it ?

alscar said:

I assume this is a DC ( Defined contribution ) Pension as opposed to a DB ( Defined benefits aka Final Salary Scheme aka Gold plated scheme ) ?

One additional thing to ascertain might be is the scheme fully funded ie no shortfalls ?

Assuming it is then leaving it where it is is obviously "easier " but would you happy with this ie with no visible control over it or Is there a portal where you will be able to log on after you have left to keep tabs on it ?

How many years do you intend to see it frozen for before you need to withdraw down on it ?

If it's a DC scheme the OP will have his own pot of money so this concept does not apply.One additional thing to ascertain might be is the scheme fully funded ie no shortfalls ?

Assuming it is then leaving it where it is is obviously "easier " but would you happy with this ie with no visible control over it or Is there a portal where you will be able to log on after you have left to keep tabs on it ?

How many years do you intend to see it frozen for before you need to withdraw down on it ?

I rolled up a couple of previous pensions into my current pension plan. On my latest attempt the administrator flagged it as 'amber' as I was transferring from a fee-free pension plan to one with fees. I have decided to leave it as it is. I had already filled in 20 forms and an interview by that stage. Still better to be safe than sorry.

As fatbob says, fees are one the key indicators...

I left my last employer 15 years ago and I left my pension in the company fund (which has had a number of providers since) where the agreed fee rate is 0.06% (on the draw down fund, its actually free on the savings part of the plan).

Given the providers normal rate is just under 1%, I reckon I've saved approaching £100k in that time.

Of course, ensuring the fund returns are acceptable is just as important - possible more so if you look at the spread of returns available.

Vanguard seem to have quite low fees - Mrs T's ISA is with them and has done well.

I left my last employer 15 years ago and I left my pension in the company fund (which has had a number of providers since) where the agreed fee rate is 0.06% (on the draw down fund, its actually free on the savings part of the plan).

Given the providers normal rate is just under 1%, I reckon I've saved approaching £100k in that time.

Of course, ensuring the fund returns are acceptable is just as important - possible more so if you look at the spread of returns available.

Vanguard seem to have quite low fees - Mrs T's ISA is with them and has done well.

Some numbers ...

The fund's inception date is 1 October 2012. Performance inclusive of management fees since inception is average annual return of 8.55%. I joined at the end of 2021 and the intent is to retire at 65ish.

The Fund management Annual Management Charge 0.21% is per annum.

The Total Expense Ratio is 0.23% per annum., which is inclusive of the annual management charge, the Mobius Life platform charge, and additional fund expenses.

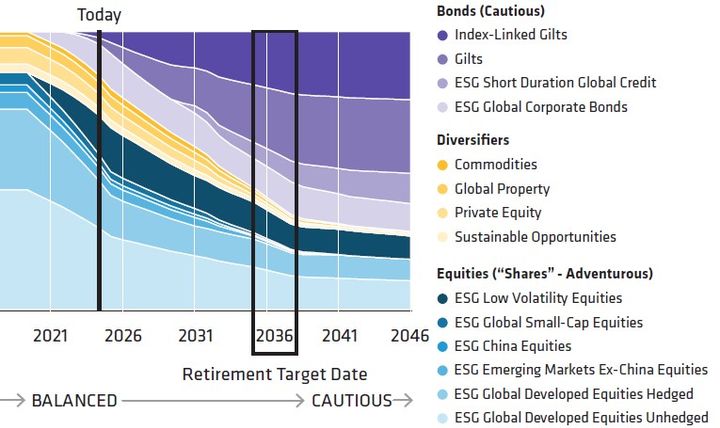

Snazzy image from the factsheet ..

I'm going to keep it where it is until such time as I get another job (he says, fingers crossed).

The fund's inception date is 1 October 2012. Performance inclusive of management fees since inception is average annual return of 8.55%. I joined at the end of 2021 and the intent is to retire at 65ish.

The Fund management Annual Management Charge 0.21% is per annum.

The Total Expense Ratio is 0.23% per annum., which is inclusive of the annual management charge, the Mobius Life platform charge, and additional fund expenses.

Snazzy image from the factsheet ..

I'm going to keep it where it is until such time as I get another job (he says, fingers crossed).

rustyuk said:

I must have transferred maybe 5 pensions from an old employer to my own SIPP. Maybe they have been hidden but I've never noticed being charged a fee when I exit.

My SIPP is on a platform provided by II.co.uk. The fees are low and as a platform it's ok.

My son has done similar - since leaving uni he's changed jobs a few times and each time he's transferred from the Employer DC scheme into his own vanguard SIPP.My SIPP is on a platform provided by II.co.uk. The fees are low and as a platform it's ok.

Gassing Station | Finance | Top of Page | What's New | My Stuff