Child Trust Fund maturing

Discussion

My sons government issued Child Trust Fund matures next week and I have just received a valuation of £2,600

It was started with a £250 payment from the government when he was born, and some years ago (and I can't remember when) it was automatically taken over by Foresters Financial. It never really looked like the fund was doing anything and with annual fees it seemed to start losing money so I started contributing £10/month into it. This was increased to £14/month at some point.

Overall I don't think the Trust Fund investment has performed particularly well. Thankfully Hargreaves Lansdown shares investment I started for him has done much better, but if nothing else the Child Trust Fund did provide another method of saving and £2.6K is a nice gift for his 18th birthday to go towards his first car maybe.

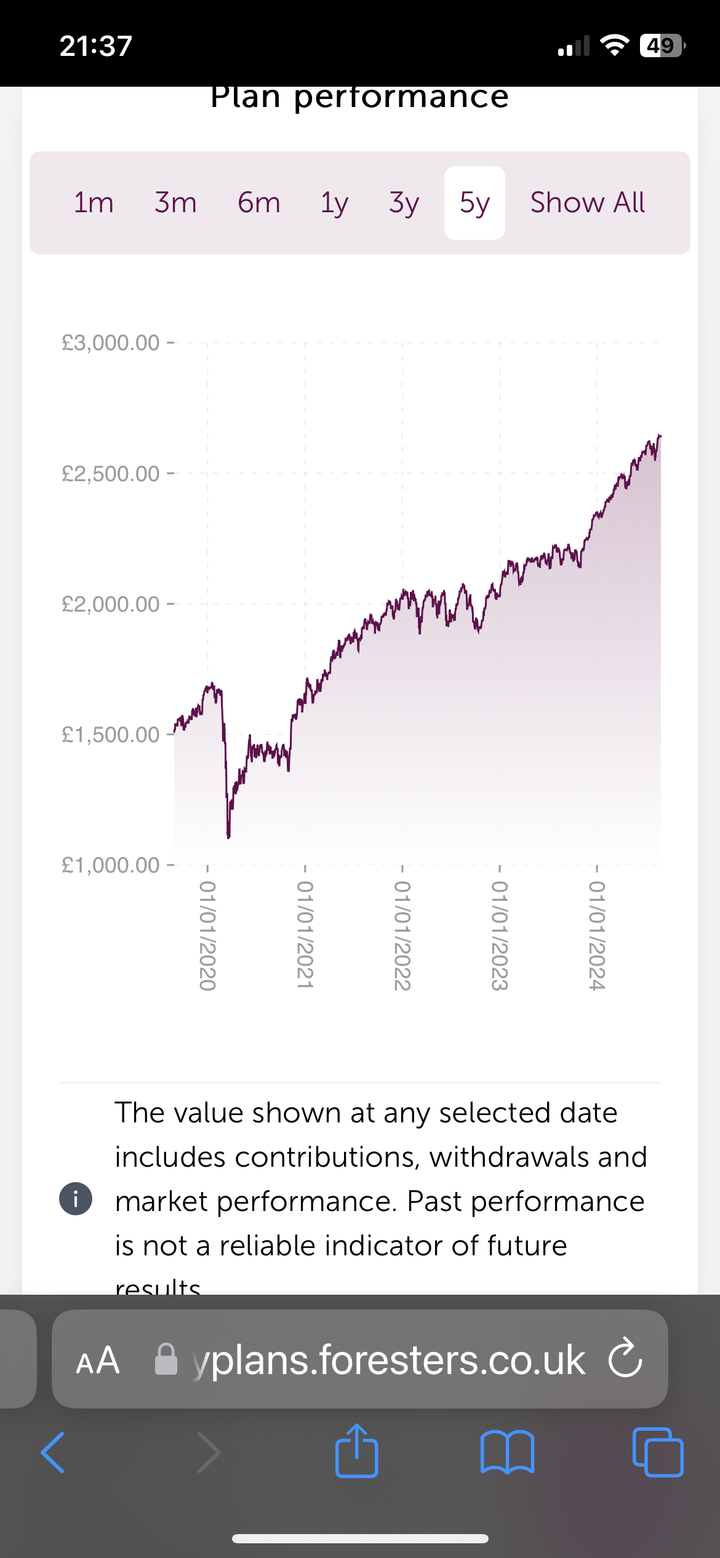

This graph shows the last 4yrs growth, after quite a dire fall there's quite a steady increase in value but maybe most of that is maybe the additional contributions?

It was started with a £250 payment from the government when he was born, and some years ago (and I can't remember when) it was automatically taken over by Foresters Financial. It never really looked like the fund was doing anything and with annual fees it seemed to start losing money so I started contributing £10/month into it. This was increased to £14/month at some point.

Overall I don't think the Trust Fund investment has performed particularly well. Thankfully Hargreaves Lansdown shares investment I started for him has done much better, but if nothing else the Child Trust Fund did provide another method of saving and £2.6K is a nice gift for his 18th birthday to go towards his first car maybe.

This graph shows the last 4yrs growth, after quite a dire fall there's quite a steady increase in value but maybe most of that is maybe the additional contributions?

Edited by The Gauge on Thursday 29th August 21:46

Both my children have CTFs, both of which got taken over by Forresters.

I was paying in a little each month until I realised if I had put the money in a draw I would have out performed them.

The high fees they charge means it is virtually impossible for the fund to grow.

I wish I had just put the money into a Vanguard LS100 instead.

Forresters are absolutely useless if you ask me.

I was paying in a little each month until I realised if I had put the money in a draw I would have out performed them.

The high fees they charge means it is virtually impossible for the fund to grow.

I wish I had just put the money into a Vanguard LS100 instead.

Forresters are absolutely useless if you ask me.

Agree with the above.

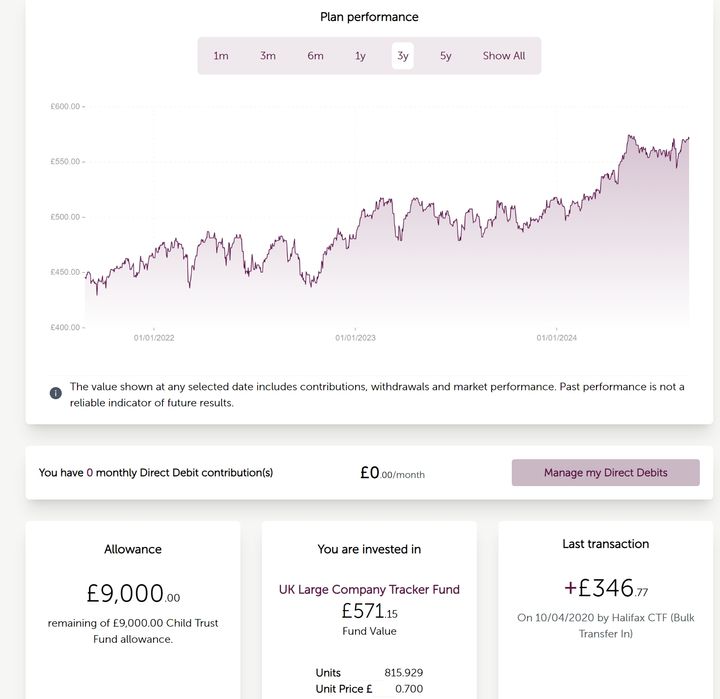

My son is coming up to 15 years in October.

His CTF was with Halifax and then moved to Foresters.

Moved house and forgot about it for 10 years until I recently contacted Foresters.

I have no plans to pay into it and I suppose if he has a few quid from it in 3 years time, then it will be a bonus.

My son is coming up to 15 years in October.

His CTF was with Halifax and then moved to Foresters.

Moved house and forgot about it for 10 years until I recently contacted Foresters.

I have no plans to pay into it and I suppose if he has a few quid from it in 3 years time, then it will be a bonus.

ThingsBehindTheSun said:

Both my children have CTFs, both of which got taken over by Forresters.

I was paying in a little each month until I realised if I had put the money in a draw I would have out performed them.

The high fees they charge means it is virtually impossible for the fund to grow.

I wish I had just put the money into a Vanguard LS100 instead.

Forresters are absolutely useless if you ask me.

I transferred my sons into a junior isa with Vanguard and put it all in LS100. we didn’t add anything whilst it was a CTF but did once it was in LS100. It did rather nicely and he has touched it so continues to do so. I was paying in a little each month until I realised if I had put the money in a draw I would have out performed them.

The high fees they charge means it is virtually impossible for the fund to grow.

I wish I had just put the money into a Vanguard LS100 instead.

Forresters are absolutely useless if you ask me.

After Uni it should set him up quite nicely.

My advice to any parent with a Foresters Child Trust Fund who wants some element of control over the money once it has matured is to log into their website on your phone as if you are your child so that they (you) have an online account with them. Do this before they turn 18, that way when they become 18 you can log in and see a new icon for withdrawing the money and can specify an account (in the child's name) to transfer it to.

Of course your child can do this but I've set my sons up this way so I can access the money. I'm going to be withdrawing it into a bank account I have for him and then transfer it to his HL shares account (which he doesn't know about) where it can hopefully grow. I'll tell my son how much is in the Trust Fund but I wont be telling him about the HL account. That will come as an extra surprise for him a little later in life.

Of course your child can do this but I've set my sons up this way so I can access the money. I'm going to be withdrawing it into a bank account I have for him and then transfer it to his HL shares account (which he doesn't know about) where it can hopefully grow. I'll tell my son how much is in the Trust Fund but I wont be telling him about the HL account. That will come as an extra surprise for him a little later in life.

Edited by The Gauge on Thursday 29th August 23:49

I have 2 daughters. First has a CTF that is with Foresters. Second was born after CTFs were stopped. So that is a JISA which is also with Foresters.

I’ve often looked at the performance and it’s always seemed rather weak compared to my pensions. But until now I’ve not done anything. So can I move the CTF anywhere better? I assume the JISA is easier and could go to Vanguard / HL???

Cheers

Pablo

I’ve often looked at the performance and it’s always seemed rather weak compared to my pensions. But until now I’ve not done anything. So can I move the CTF anywhere better? I assume the JISA is easier and could go to Vanguard / HL???

Cheers

Pablo

The Gauge said:

My advice to any parent with a Foresters Child Trust Fund who wants some element of control over the money once it has matured is to log into their website on your phone as if you are your child so that they (you) have an online account with them. Do this before they turn 18, that way when they become 18 you can log in and see a new icon for withdrawing the money and can specify an account (in the child's name) to transfer it to.

Of course your child can do this but I've set my sons up this way so I can access the money. I'm going to be withdrawing it into a bank account I have for him and then transfer it to his HL shares account (which he doesn't know about) where it can hopefully grow. I'll tell my son how much is in the Trust Fund but I wont be telling him about the HL account. That will come as an extra surprise for him a little later in life.

So if the account is in my name (rather than the child) I won't see the icon which allows me to withdraw the money (when he turns 18)?Of course your child can do this but I've set my sons up this way so I can access the money. I'm going to be withdrawing it into a bank account I have for him and then transfer it to his HL shares account (which he doesn't know about) where it can hopefully grow. I'll tell my son how much is in the Trust Fund but I wont be telling him about the HL account. That will come as an extra surprise for him a little later in life.

Edited by The Gauge on Thursday 29th August 23:49

If so, can the child create their own account alongside mine?

Seems a bit of a hassle given that most accounts would surely be created by the parent in their own name when the child is young.

Pablo_Picasso said:

I have 2 daughters. First has a CTF that is with Foresters. Second was born after CTFs were stopped. So that is a JISA which is also with Foresters.

I’ve often looked at the performance and it’s always seemed rather weak compared to my pensions. But until now I’ve not done anything. So can I move the CTF anywhere better? I assume the JISA is easier and could go to Vanguard / HL???

Cheers

Pablo

I moved both my kids CTF's to vanguard LS80 about 4 years ago. It was a bit of a faff, as Vanguard didn't accept direct CTF transfers. I had to first transfer them to NS & I, and then onto Vanguard. I’ve often looked at the performance and it’s always seemed rather weak compared to my pensions. But until now I’ve not done anything. So can I move the CTF anywhere better? I assume the JISA is easier and could go to Vanguard / HL???

Cheers

Pablo

So far it seems to have been worth it.

andy118run said:

So if the account is in my name (rather than the child) I won't see the icon which allows me to withdraw the money (when he turns 18)?

If so, can the child create their own account alongside mine?

Seems a bit of a hassle given that most accounts would surely be created by the parent in their own name when the child is young.

We are talking about setting up an account with their website, to be able to log in and see the Trust Fund details. You will only be able to do this in your childs name as the details have to match those on the Trust Fund.If so, can the child create their own account alongside mine?

Seems a bit of a hassle given that most accounts would surely be created by the parent in their own name when the child is young.

I rang Foresters to try and nominate an account for the money to be transferred into in advance of it maturing, but they said my son would need to go to their website, create a website account with password and log in, and then on his 18th birthday he could log in and see an icon for transferring the money out. So I went and did the above whilst pretending to be my son, setting the website account up in his name etc. When he's 18 later this week I'll log in and transfer the money out to one of his bank accounts. They will lonely allow the money to be transferred to an account in your childs name.

On an email I recently received from Foresters, they said that at the point of my son turning 18 they stop taking the monthly direct debit that I set up to top up the trust fund. Once the funds have been transferred out I'll probably also cancel the direct debit from my bank account to be safe.

The Gauge said:

My advice to any parent with a Foresters Child Trust Fund who wants some element of control over the money once it has matured is to log into their website on your phone as if you are your child so that they (you) have an online account with them. Do this before they turn 18, that way when they become 18 you can log in and see a new icon for withdrawing the money and can specify an account (in the child's name) to transfer it to.

Of course your child can do this but I've set my sons up this way so I can access the money. I'm going to be withdrawing it into a bank account I have for him and then transfer it to his HL shares account (which he doesn't know about) where it can hopefully grow. I'll tell my son how much is in the Trust Fund but I wont be telling him about the HL account. That will come as an extra surprise for him a little later in life.

That's sort of what I'm hoping to do. Of course your child can do this but I've set my sons up this way so I can access the money. I'm going to be withdrawing it into a bank account I have for him and then transfer it to his HL shares account (which he doesn't know about) where it can hopefully grow. I'll tell my son how much is in the Trust Fund but I wont be telling him about the HL account. That will come as an extra surprise for him a little later in life.

Edited by The Gauge on Thursday 29th August 23:49

Don't really want them to have access to it at 18, which I understand you can't really stop them so need them not to know about it.

30 years or so of growth should see them with a useful sum of money and enough maturity not to piss it all up the wall.

My daughter's Natwest CTF matures later this month and she has just had the valuation through of about £30k. She is going to open a Premium Bond account and dump it in there I think. The money is for when she is at Uni in 2025 (hopefully) to live off (hopefully).....and if she wins the big prize have one hell of a 3 years :-)

Grumbler said:

My daughter got one of these back 2007. When it matured it was worth significantly less than the initial amount. Someone made a killing off these but it wasn’t the kids.

Yeh the annual fees really could eat into the capital with these trust funds unless parents topped them up. So basically the tax payer handed lots of money over to private investment companies via the government who acted as kind of a middle man.alfabeat said:

My daughter's Natwest CTF matures later this month and she has just had the valuation through of about £30k. She is going to open a Premium Bond account and dump it in there I think. The money is for when she is at Uni in 2025 (hopefully) to live off (hopefully).....and if she wins the big prize have one hell of a 3 years :-)

how much did you pay in?Gassing Station | Finance | Top of Page | What's New | My Stuff