Barclays - Good news for them

Discussion

Tim330 said:

As a premier customer I have a rainy day saver and avios rewards, will I loose the rainy day saver from September? I can't make sense of the updated terms

No - you keep the rainy day saver, but it’s moving to be part of premier so you no longer need the blue rewards option to have it. I don’t know about the avios, I don’t have this box ticked.

fourstardan said:

I've got Barclays Blue rewards and have had for the last couple of years.

I receive this;

Barclays Blue Rewards is changing – and there’s good news for you....

Good news that they'll remove my 5 pound a month for two direct debits!

Utter shambles, has anyone got another bank doing similar perks as I think I'll move now (Been with them for 30 years!)

Got that too. They removed the £5 but added some perks, one being a free subscription to Apple TV which is worth more. If you already use and pay for Apple TV, you’re quids in I receive this;

Barclays Blue Rewards is changing – and there’s good news for you....

Good news that they'll remove my 5 pound a month for two direct debits!

Utter shambles, has anyone got another bank doing similar perks as I think I'll move now (Been with them for 30 years!)

I received this email too. We are with Barclays for a joint account, primarily because we have a mortgage with Barclays, and it seemed to make sense to keep it all under one bank. Our Barclays mortgage expires in November, only a couple of months after this change.

The cash from the Blue Rewards has made a few evenings out cheaper over the past year and a bit.

I may well move the joint account to Santander who do cashback on bills and spending.

The cash from the Blue Rewards has made a few evenings out cheaper over the past year and a bit.

I may well move the joint account to Santander who do cashback on bills and spending.

Tim330 said:

As a premier customer I have a rainy day saver and avios rewards, will I loose the rainy day saver from September? I can't make sense of the updated terms

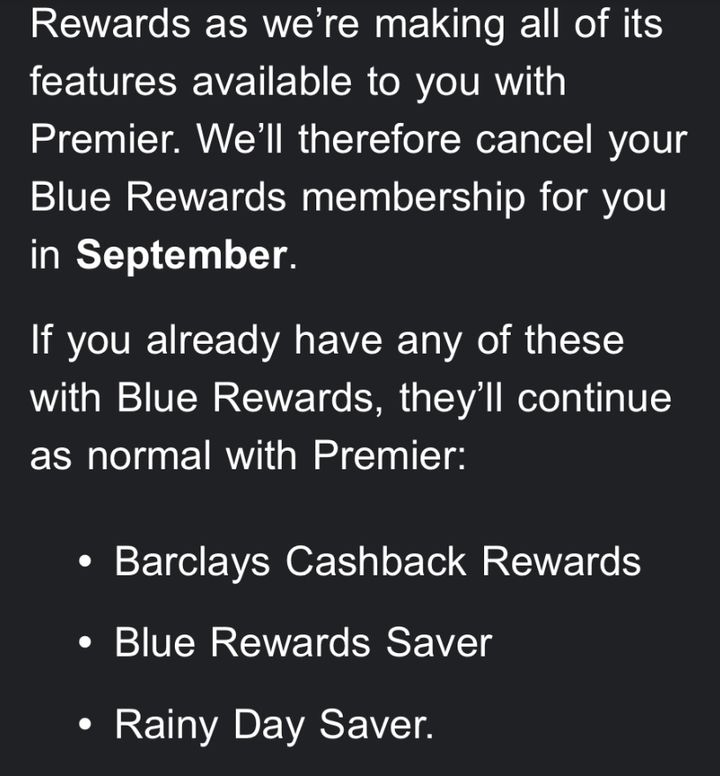

Didn’t your mail say this?Was clear on mine:-

To me, no loss, but I gain Free Apple Tv

All good

Been with them 40+ years

No intention of changing ever

They pay my wife a generous pension too, from her 10 years 1979-1989!

James6112 said:

Didn’t your mail say this?

Was clear on mine:-

To me, no loss, but I gain Free Apple Tv

All good

Been with them 40+ years

No intention of changing ever

They pay my wife a generous pension too, from her 10 years 1979-1989!

Well it could be your wife's pension that means they can't afford to give me 5 quid a month now Was clear on mine:-

To me, no loss, but I gain Free Apple Tv

All good

Been with them 40+ years

No intention of changing ever

They pay my wife a generous pension too, from her 10 years 1979-1989!

I became a Barclays customer in 1989, current then joint account (no mortgage) until moving overseas in 1999. Over the next 22 years they proved themselves incompetent, unresponsive and generally unsatisfactory as a financial institution for someone not resident in the UK. The zenith of their f kwittedness came in 2021 when they were unable to send a paper copy of a bank statement to my home address, in order for me to validate a destination account for a £>50k private pension withdrawal.

kwittedness came in 2021 when they were unable to send a paper copy of a bank statement to my home address, in order for me to validate a destination account for a £>50k private pension withdrawal.

I contacted them by phone, email and social media, but it was apparently a "security issue" which prevented them from sending an account holder a paper statement to the address they had held for the previous 19 years. After this fiasco I opened an (expensive) GBP account with UBS in Geneva (as a non-resident no other UK bank was willing to open a new account for me), and the transaction was executed in three days.

I finally found a solution for a few legacy insurance policy direct debits (via a Revolut pound account with a GBP IBAN), transferred out the remaining funds and told Barclays to go f k themselves last July. If I encountered the CEO of Barclays on fire, I wouldn't cross the road to piss on him/her.

k themselves last July. If I encountered the CEO of Barclays on fire, I wouldn't cross the road to piss on him/her.

kwittedness came in 2021 when they were unable to send a paper copy of a bank statement to my home address, in order for me to validate a destination account for a £>50k private pension withdrawal.

kwittedness came in 2021 when they were unable to send a paper copy of a bank statement to my home address, in order for me to validate a destination account for a £>50k private pension withdrawal.I contacted them by phone, email and social media, but it was apparently a "security issue" which prevented them from sending an account holder a paper statement to the address they had held for the previous 19 years. After this fiasco I opened an (expensive) GBP account with UBS in Geneva (as a non-resident no other UK bank was willing to open a new account for me), and the transaction was executed in three days.

I finally found a solution for a few legacy insurance policy direct debits (via a Revolut pound account with a GBP IBAN), transferred out the remaining funds and told Barclays to go f

k themselves last July. If I encountered the CEO of Barclays on fire, I wouldn't cross the road to piss on him/her.

k themselves last July. If I encountered the CEO of Barclays on fire, I wouldn't cross the road to piss on him/her. fourstardan said:

Nationwide seems to offer the most.

I actually need Roadside recovery, travel insurance (although in September) and I'll get 200 smackerooneys for signing up.

It's 13 quid a month, has it been this cost for a while?

If you have a Mrs make it a joint account and it covers you both. I think it is certainly fair value.I actually need Roadside recovery, travel insurance (although in September) and I'll get 200 smackerooneys for signing up.

It's 13 quid a month, has it been this cost for a while?

Cats_pyjamas said:

If you have a Mrs make it a joint account and it covers you both. I think it is certainly fair value.

Has it gone up much as the Platinum is going up £1.50 (which they are open about).It says won't need to do a joint for AA/Travel.

Also what's the credit interest offer about? Do I need a certain amount of threshold balance to gain the interest?

Gassing Station | Finance | Top of Page | What's New | My Stuff