Reform UK - A symptom of all that is wrong?

Discussion

skwdenyer said:

Elysium said:

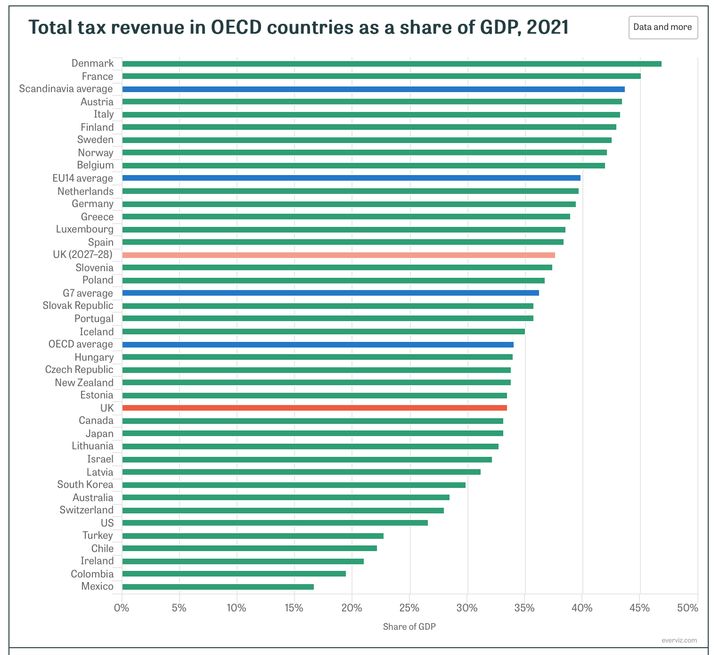

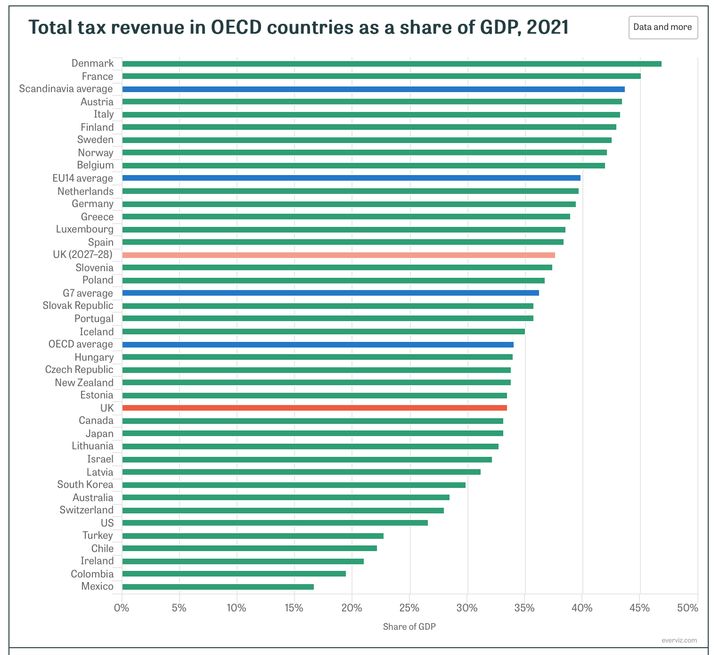

We are only ‘slightly below average’ for the G7 and OECD. The sad truth is that it is mostly tax on median incomes where we are lower. Frozen tax bands are set to drag us above average:

https://ifs.org.uk/taxlab/taxlab-key-questions/how...

Given the amount we already pay we should expect public services to function.

20% lower than EU14 levels, many of which also have *additional* private healthcare burdens.https://ifs.org.uk/taxlab/taxlab-key-questions/how...

Given the amount we already pay we should expect public services to function.

OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

.

cheesejunkie said:

"The organisation" is the tory party not the civil service.

Unfortunately, I think they’re both the issue.I agree with the manifold criticism of Tory policies and greed, but the various inflexibilities, incompetences and inefficiencies of the public sector are a critical issue. Why else, for example does our bureaucracy result in us having what it widely held to be the highest infrastructure building costs due to planning?

skwdenyer said:

20% lower than EU14 levels, many of which also have *additional* private healthcare burdens.

OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

You don't fancy starting a political party by any chance ? Could call it the Real Reform. I could add a few more negatives that are costing us all a packet but you have summed up the general gist of where we are and sadly probably where we are headed.

You don't fancy starting a political party by any chance ? Could call it the Real Reform. I could add a few more negatives that are costing us all a packet but you have summed up the general gist of where we are and sadly probably where we are headed.skwdenyer said:

20% lower than EU14 levels, many of which also have *additional* private healthcare burdens.

OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

Great post!OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

I know that nobody ever changes their opinion on here but fwiw, as someone who hates paying tax, this ha actually changed my view on it. Very thought provoking and intelligent post.

Disastrous said:

skwdenyer said:

20% lower than EU14 levels, many of which also have *additional* private healthcare burdens.

OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

Great post!OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

I know that nobody ever changes their opinion on here but fwiw, as someone who hates paying tax, this ha actually changed my view on it. Very thought provoking and intelligent post.

skwdenyer said:

Elysium said:

We are only ‘slightly below average’ for the G7 and OECD. The sad truth is that it is mostly tax on median incomes where we are lower. Frozen tax bands are set to drag us above average:

https://ifs.org.uk/taxlab/taxlab-key-questions/how...

Given the amount we already pay we should expect public services to function.

20% lower than EU14 levels, many of which also have *additional* private healthcare burdens.https://ifs.org.uk/taxlab/taxlab-key-questions/how...

Given the amount we already pay we should expect public services to function.

OECD is a terrible measure. Comparisons with countries with fundamentally different healthcare systems are pointless and misleading.

We don’t raise enough tax. Furthermore, health and care services aren’t month-to-month businesses. The chronic under-investment over decades doesn’t go away. All those years of low taxes and risible investment come home to roost; much of that historical under-investment needs catching up with.

I agree with you about tax burden to a degree, but don’t forget we have a lot of very regressive consumption taxes, which disproportionately impact lower earners. The real world tax burden isn’t necessarily as bad as you seem to think.

Our problem isn’t tax; it is that we have poor services (because too little tax and spending); we have privatised utilities (sucking cash out of the economy for no gain); we have poor productivity (thanks to myopic service-industry-first policies); we’ve a deliberately-inflated housing market (causing more economic pain to ordinary folk); we’ve a major pension and social care problem; we don’t tax the elderly enough (no proper asset taxes); we thought ourselves awfully clever by adopting third-world inflation-linked borrowings that are eating us alive; we’ve never invested national wealth for the future; and so on.

So many cling to a utopian idea that a low-tax, high-prosperity, high-growth future exists. It doesn’t. There’s no comparable economy in the world that has managed that trick. Low taxes create poor outcomes that in turn create a spiral to the bottom. We’ve already cut regulation and enforcement in this country to the extent that individuals and small businesses simply can’t trust service-providers, contractors, not to rip them off, which in turn limits spending and investment; we can’t manage basic level detection and prevention of crime; fraud is at epidemic levels; etc.

Prosperous economies require trust, faith, certainty and hope; they need good regulation and proper enforcement to establish a level playing field which in turn encourages investment and spending. Instead the UK is now a playground for money launderers, fraudsters, international tax avoiders, and seemingly deliberately set up to funnel the maximum amount of wealth offshore.

We can’t even run a proper border system, meaning crooked tax evaders are destroying the competitive landscape.

A well-regulated market requires regulation and enforcement. A prosperous economy requires a healthy, treated workforce made up of well-educated people conditioned to strive for legitimate success, not cheat steal or deal drugs to get ahead.

Taxation is a sign of taking those things seriously. Promising lower taxes is acquiescence to a worse, less prosperous future for everyday British citizens.

But I think this is also about productivity, the proportion of the population that pays tax, the equity of the tax system and the scale and efficiency of the state.

I don’t necessarily want to live in a low tax economy, I just think that our perpetual cycle of “crisis, debt, taxation” has to end. Tax cannot be a continual one way escalator.

I also find the rhetoric on tax to be desperately cynical. This comes from Labour in particular, but the Tories have not been all that different. It’s difficult to disagree with the argument that we should all pay more tax if we want better public services, but that isn’t where we end up. The political view is always that higher earners should pay more tax, as if they are not already propping up the system. Or we go for complex inequitable or damaging taxation, like high levels of stamp duty, inheritance taxes or tapering of personal and pension allowances.

No party is saying tax should be higher for median incomes, because that loses votes.

skwdenyer doesn't really paint a truthful picture there, without any government rebates in Spain my house hold would pay 1% more tax in Spain than in the UK and this is a socialist country with actual communist politicians.

I have permanent rebates against private schooling and it's vat free. It's the same nationally.

That's without any sweetheart deal, anyone can get the same deal. Yes I have a 5 year discount seperate to that but that will eventually expire and I probably won't leave.

I have permanent rebates against private schooling and it's vat free. It's the same nationally.

That's without any sweetheart deal, anyone can get the same deal. Yes I have a 5 year discount seperate to that but that will eventually expire and I probably won't leave.

I feel that the likely outcome of Reform will be a good amount of votes but very few seats (3 at most).

This is of course down to our 1st past the post system that has served us well for decades but is something smaller parties always complain about..

With that in mind I can see that there could well be a formal merging of Reform UK and The Liberal Democrats.

The Reform Liberal Democrats has a ring about it.

This is of course down to our 1st past the post system that has served us well for decades but is something smaller parties always complain about..

With that in mind I can see that there could well be a formal merging of Reform UK and The Liberal Democrats.

The Reform Liberal Democrats has a ring about it.

Elysium said:

More like 15% lower than EU14 based on the numbers from the IFS in the link above, which the fiscal drag due to freezing of tax bands will potentially close to 5% by 2027/28:

But I think this is also about productivity, the proportion of the population that pays tax, the equity of the tax system and the scale and efficiency of the state.

I don’t necessarily want to live in a low tax economy, I just think that our perpetual cycle of “crisis, debt, taxation” has to end. Tax cannot be a continual one way escalator.

I also find the rhetoric on tax to be desperately cynical. This comes from Labour in particular, but the Tories have not been all that different. It’s difficult to disagree with the argument that we should all pay more tax if we want better public services, but that isn’t where we end up. The political view is always that higher earners should pay more tax, as if they are not already propping up the system. Or we go for complex inequitable or damaging taxation, like high levels of stamp duty, inheritance taxes or tapering of personal and pension allowances.

No party is saying tax should be higher for median incomes, because that loses votes.

Taxation in general isn't really a subject for this thread. Reform won't be in a position to influence it nor does it have anything remotely serious to offer. However, I do agree on pne aspect of the above. We have the highest debt in decades, almost record tax levels and yet public services noticeably struggling, enormous debt interest payments, a swelling welfare bills, an ageing population that will require increases in health spending & defence budgets going up & all while the economy is subdued.But I think this is also about productivity, the proportion of the population that pays tax, the equity of the tax system and the scale and efficiency of the state.

I don’t necessarily want to live in a low tax economy, I just think that our perpetual cycle of “crisis, debt, taxation” has to end. Tax cannot be a continual one way escalator.

I also find the rhetoric on tax to be desperately cynical. This comes from Labour in particular, but the Tories have not been all that different. It’s difficult to disagree with the argument that we should all pay more tax if we want better public services, but that isn’t where we end up. The political view is always that higher earners should pay more tax, as if they are not already propping up the system. Or we go for complex inequitable or damaging taxation, like high levels of stamp duty, inheritance taxes or tapering of personal and pension allowances.

No party is saying tax should be higher for median incomes, because that loses votes.

Neither main party are addressing these issues, you won't find answers in the manifestos but the reality is either raise taxes again, borrow more or increase debt, the infamous trilemma. I know which way I think it will go & it's not a tax holiday for NHS staff.

President Merkin said:

Taxation in general isn't really a subject for this thread. Reform won't be in a position to influence it nor does it have anything remotely serious to offer. However, I do agree on pne aspect of the above. We have the highest debt in decades, almost record tax levels and yet public services noticeably struggling, enormous debt interest payments, a swelling welfare bills, an ageing population that will require increases in health spending & defence budgets going up & all while the economy is subdued.

Neither main party are addressing these issues, you won't find answers in the manifestos but the reality is either raise taxes again, borrow more or increase debt, the infamous trilemma. I know which way I think it will go & it's not a tax holiday for NHS staff.

The relevance to this thread is in your comment that neither main party is addressing the issues. Neither main party are addressing these issues, you won't find answers in the manifestos but the reality is either raise taxes again, borrow more or increase debt, the infamous trilemma. I know which way I think it will go & it's not a tax holiday for NHS staff.

Like it or not, reform is filling that vacuum.

President Merkin said:

Not in the real world they're not. They won't form a government, their economic policy is fantasy.

And yet their supporters still celebrate an economic policy with more holes than substance, which requires us to harvest the magic money tree. It's political and social regression.Vasco said:

Quite.

Labour and the Conservatives have little in the way of worthwhile solutions, so people will ignore much of their boring waffle. The obvious way forward for the over-60s and those without any education this year will be a protest vote for a party whose manifesto is a work of fiction.

FTFY.Labour and the Conservatives have little in the way of worthwhile solutions, so people will ignore much of their boring waffle. The obvious way forward for the over-60s and those without any education this year will be a protest vote for a party whose manifesto is a work of fiction.

President Merkin said:

Elysium said:

More like 15% lower than EU14 based on the numbers from the IFS in the link above, which the fiscal drag due to freezing of tax bands will potentially close to 5% by 2027/28:

But I think this is also about productivity, the proportion of the population that pays tax, the equity of the tax system and the scale and efficiency of the state.

I don’t necessarily want to live in a low tax economy, I just think that our perpetual cycle of “crisis, debt, taxation” has to end. Tax cannot be a continual one way escalator.

I also find the rhetoric on tax to be desperately cynical. This comes from Labour in particular, but the Tories have not been all that different. It’s difficult to disagree with the argument that we should all pay more tax if we want better public services, but that isn’t where we end up. The political view is always that higher earners should pay more tax, as if they are not already propping up the system. Or we go for complex inequitable or damaging taxation, like high levels of stamp duty, inheritance taxes or tapering of personal and pension allowances.

No party is saying tax should be higher for median incomes, because that loses votes.

Taxation in general isn't really a subject for this thread.But I think this is also about productivity, the proportion of the population that pays tax, the equity of the tax system and the scale and efficiency of the state.

I don’t necessarily want to live in a low tax economy, I just think that our perpetual cycle of “crisis, debt, taxation” has to end. Tax cannot be a continual one way escalator.

I also find the rhetoric on tax to be desperately cynical. This comes from Labour in particular, but the Tories have not been all that different. It’s difficult to disagree with the argument that we should all pay more tax if we want better public services, but that isn’t where we end up. The political view is always that higher earners should pay more tax, as if they are not already propping up the system. Or we go for complex inequitable or damaging taxation, like high levels of stamp duty, inheritance taxes or tapering of personal and pension allowances.

No party is saying tax should be higher for median incomes, because that loses votes.

President Merkin said:

Reform won't be in a position to influence it nor does it have anything remotely serious to offer.

An impartial wish list if ever there was one. Written as though it was factual too, good stuff.

Farage never achieved anything so it'll be more of the same? Remember brexit? For 8 years you haven't forgetten it - until now. Sure! No directly elected MPs, and the UK leaves the EU. NF in the HoC and two or three more MPs, with constant MSM coverage and social media on top, that's the epitome of influence. We'll see in due course from July 5.

Dave200 said:

Vasco said:

Quite.

Labour and the Conservatives have little in the way of worthwhile solutions, so people will ignore much of their boring waffle. The obvious way forward for the over-60s and those without any education this year will be a protest vote for a party whose manifesto is a work of fiction.

FTFY.Labour and the Conservatives have little in the way of worthwhile solutions, so people will ignore much of their boring waffle. The obvious way forward for the over-60s and those without any education this year will be a protest vote for a party whose manifesto is a work of fiction.

.

anonymoususer said:

I feel that the likely outcome of Reform will be a good amount of votes but very few seats (3 at most).

This is of course down to our 1st past the post system that has served us well for decades but is something smaller parties always complain about..

With that in mind I can see that there could well be a formal merging of Reform UK and The Liberal Democrats.

The Reform Liberal Democrats has a ring about it.

Oil and water.This is of course down to our 1st past the post system that has served us well for decades but is something smaller parties always complain about..

With that in mind I can see that there could well be a formal merging of Reform UK and The Liberal Democrats.

The Reform Liberal Democrats has a ring about it.

Vanden Saab said:

Evenn more surprisingly you two think you are the 'good guys'

You make a good point. Maybe we should be more like the guy standing in Salisbury who seems to have forgotten what happened there a few years back, in his rush to positively compare Putin to Hitler.https://www.salisburyjournal.co.uk/news/24407670.r...

I'm well aware people like you are completely impervious to this stuff & would still vote Reform if it emerged Farage had a secret hobby of kicking orphan's puppies but it's not that easy to take moral judgments from the likes of you when this kind of s

t comes out every single day.

t comes out every single day.turbobloke said:

An impartial wish list if ever there was one. Written as though it was factual too, good stuff.

Farage never achieved anything so it'll be more of the same? Remember brexit? For 8 years you haven't forgetten it - until now. Sure! No directly elected MPs, and the UK leaves the EU. NF in the HoC and two or three more MPs, with constant MSM coverage and social media on top, that's the epitome of influence. We'll see in due course from July 5.

"NF in the HoC" is quite the slip.Farage never achieved anything so it'll be more of the same? Remember brexit? For 8 years you haven't forgetten it - until now. Sure! No directly elected MPs, and the UK leaves the EU. NF in the HoC and two or three more MPs, with constant MSM coverage and social media on top, that's the epitome of influence. We'll see in due course from July 5.

You'll forgive me not getting quite so excited about the prospect of Nige the Liar attention-whoring in the commons with no real substance to anything he's offering. I feel like we deserve more from MPs.

But sure, having a similar number of seats to the Greens and Plaid really screams "influence".

Edited by Dave200 on Tuesday 25th June 08:54

Gassing Station | News, Politics & Economics | Top of Page | What's New | My Stuff