Has my employer not paid my NI?

Discussion

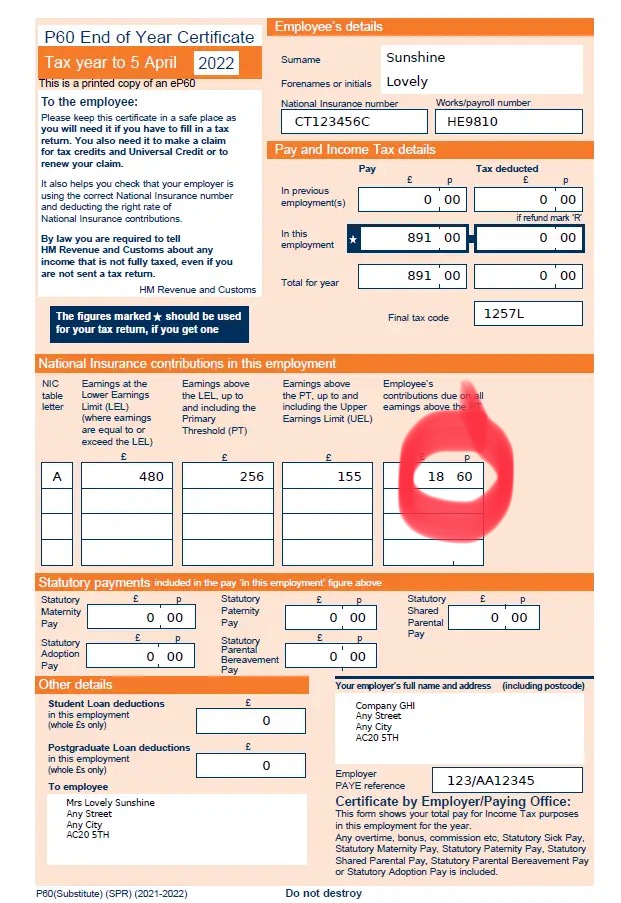

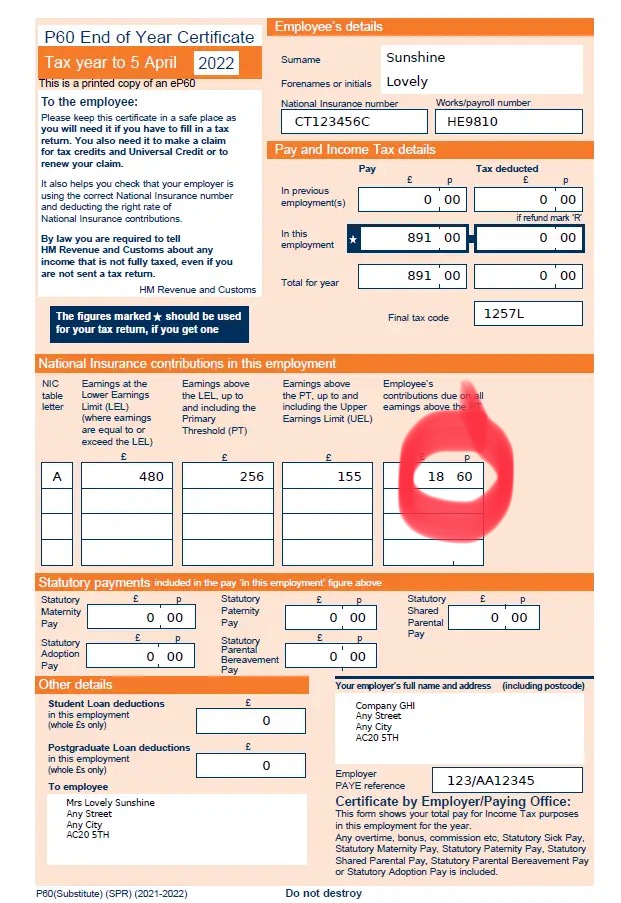

Hi all, off work with a health problem currently, and have been for a good few months now. My statutory sick pay has stopped now (max of 28 weeks). I have applied for the Employment Support Allowance (ESA) but have been turned down as my NI contributions have not been high enough for the past 2/3 years. I couldn’t believe this as I’ve been employed full-time. I looked at my P60 for each of these years before I rang them and it seems they are right. This is a sample obviously in the pic but the ringed box in my case shows £0.00 on the last three years’ P60s.

So presumably this means my employer for whatever reason, has NOT paid the due NI to HMRC.

Not spoken to the finance/wages dept as only looked at the P60s a couple of hours ago but presume they’ll say you’ve had the money instead of paying it as NI - maybe they have paid it to me, maybe they haven’t. Either way, they’ve cost me a grand in ESA - I hope to be back at work in December at any rate but the claim was backdated to the start of September.

As you’ll have gathered I’m not one for studying my wage slips/P60 too hard in the past!

So presumably this means my employer for whatever reason, has NOT paid the due NI to HMRC.

Not spoken to the finance/wages dept as only looked at the P60s a couple of hours ago but presume they’ll say you’ve had the money instead of paying it as NI - maybe they have paid it to me, maybe they haven’t. Either way, they’ve cost me a grand in ESA - I hope to be back at work in December at any rate but the claim was backdated to the start of September.

As you’ll have gathered I’m not one for studying my wage slips/P60 too hard in the past!

WouldBWelder said:

Yes, I’ve checked it and it says not enough was paid in, in those respective years. My real question is, if that ringed box shows zero, it’s not been paid.

You will need your P60s for the relevant period to give the NI helpline a copy.Phone them on 0300 200 3500.

Best of luck, it looks like your employer has erred.

I genuinely need glasses. That is indeed the annual amount of Employee NI paid.

I just cross-checked with my last P60.

Edited by CraigyMc on Monday 4th November 21:51

WouldBWelder said:

Yes, I’ve checked it and it says not enough was paid in, in those respective years. My real question is, if that ringed box shows zero, it’s not been paid.

The ringed box is "Employee's NI deductions!" - it is what has been deducted from your payslip. if it says zero then, in simple terms, your earnings were below the NI threshold (£242 per week I think).I would check your March payslip which should show the cumulative Ers and Ees deductions and then compare these to what your P60 for the year says. To be honest it's all automated and its very hard to make a mistake unless your payroll team is incompetent.

The GOV.UK website is populated from the payroll system returns so my guess is that, according to your payroll system, you havent earned enough to have any Ees NI deducted.

WouldBWelder said:

So presumably this means my employer for whatever reason, has NOT paid the due NI to HMRC.

The amount of NI shown on the P60 is what should have been deducted from your pay. It is not necessarily the amount paid by your employer to HMRC. in very simple terms1. Every time payroll is run there are multiple payments and deductions from Employees pay packets (Tax, NI, SSP, SMP, Student Laons)

2. An electronic file of all statutory payments / deductions for each employee is submitted to HMRC. There is a sum total figure which the Employer owes to HMRC. They need to pay this by the 19th of the following month.

3, As far as the employees' tax records are concerned it doesn't matter if or when the employer pays over this money. HMRC will chase them for the outstanding amounts.

Countdown said:

The ringed box is "Employee's NI deductions!" - it is what has been deducted from your payslip. if it says zero then, in simple terms, your earnings were below the NI threshold (£242 per week I think).

The GOV.UK website is populated from the payroll system returns so my guess is that, according to your payroll system, you havent earned enough to have any Ees NI deducted.

I’ve certainly earned more than £242 a week. What is strange is that on payslips, I’ve always previously seen the PAYE (tax) and NI amounts listed separately as deductions. On my payslip it shows only the PAYE figure - no mention of NI on the deductions side at all.The GOV.UK website is populated from the payroll system returns so my guess is that, according to your payroll system, you havent earned enough to have any Ees NI deducted.

It’s a weird one. It’ll be interesting to see what the finance/payroll dept have to say.

WouldBWelder said:

I’ve certainly earned more than £242 a week. What is strange is that on payslips, I’ve always previously seen the PAYE (tax) and NI amounts listed separately as deductions. On my payslip it shows only the PAYE figure - no mention of NI on the deductions side at all.

It’s a weird one. It’ll be interesting to see what the finance/payroll dept have to say.

Have you actually HAD any NI deducted? What i mean is - if you take your gross pay, minus the tax, does that equal your net pay?It’s a weird one. It’ll be interesting to see what the finance/payroll dept have to say.

My March 2023 payslip shows an NI payment from my employer of £170.71 for that month. It shows three things on the debit side, PAYE, pension and union. No mention of NI on the debit side as a separate entry, as there hasn’t been since I started working there in May 2021.

It shows two figures in a box on the bottom left, NIable pay and Taxable pay - these amounts are the same on every payslip.

It shows two figures in a box on the bottom left, NIable pay and Taxable pay - these amounts are the same on every payslip.

WouldBWelder said:

My March 2023 payslip shows an NI payment from my employer of £170.71 for that month. It shows three things on the debit side, PAYE, pension and union. No mention of NI on the debit side as a separate entry, as there hasn’t been since I started working there in May 2021.

It shows two figures in a box on the bottom left, NIable pay and Taxable pay - these amounts are the same on every payslip.

That is strange. It shows two figures in a box on the bottom left, NIable pay and Taxable pay - these amounts are the same on every payslip.

At least your payroll agrees to your P60 and both agree to your GOV.UK records. Its a question for your payroll team as to why you havent had any Employees NI deducted.

Countdown said:

If OP was CIS he would be self-employed as far as I'm aware, not on the payroll

It was just a thought. Otherwise, what the OP’s employer has done (or rather, not done) is baffling. As others have suggested, the payroll software should figure it all out.

Gassing Station | Jobs & Employment Matters | Top of Page | What's New | My Stuff