Back Claiming WFH Tax Relief?

Discussion

Sorry if this has been asked before, but my search didn't come up with much.

I'm PAYE, and kept forgetting to claim the £6/week tax relief for WFH during lockdown. Prior to covid I was working in the office, and my empolyer has not provided any expensis for WFH.

I've gone through the HRMC microservice and trying to claim for previous financial years doesn't present any obvious options for where I can claim. I've found a number of walk-throughs showing how to claim for the current financial year where if asked about when you started working from home, and then adjusts your tax code, but the options available for previous years don't seem to cover it. Does anyone know which section you need to claim under, and what what values to use? £312 (52 x £6) or the 20%/ 40% of that?

Also I was working from home due to COVID from the beginning, before 6th April 2020, so can I claim for 2019/2020 financial year at £4/ week, or is that only under certain circumstances?

Thanks for any help.

I'm PAYE, and kept forgetting to claim the £6/week tax relief for WFH during lockdown. Prior to covid I was working in the office, and my empolyer has not provided any expensis for WFH.

I've gone through the HRMC microservice and trying to claim for previous financial years doesn't present any obvious options for where I can claim. I've found a number of walk-throughs showing how to claim for the current financial year where if asked about when you started working from home, and then adjusts your tax code, but the options available for previous years don't seem to cover it. Does anyone know which section you need to claim under, and what what values to use? £312 (52 x £6) or the 20%/ 40% of that?

Also I was working from home due to COVID from the beginning, before 6th April 2020, so can I claim for 2019/2020 financial year at £4/ week, or is that only under certain circumstances?

Thanks for any help.

Hmm interesting I assumed I was still getting it. On checking thanks to you, I applied jan 2020 and my tax code went to 1282L for feb and March 2020. Then the 1st new cycle ie April 2020 it reverted to 1250L. So the new financial year rescinded it. So I got 2 months worth out of it.

I shall reapply. b ds.

ds.

So like you I want to claim for 2020\21 ie the whole previous financial year. I just did it, I just ticked both years as it allowed me to. I got

“ Claim complete

We will change your tax code”

So hopefully I’ll get something

I only got the choice of 2 radio buttons one was claiming for this year only 22/23 the other was for 21/22 and 22/23 so I clicked that one. So like you, I didn’t have the option to claim for earlier year.

I shall reapply. b

ds.

ds.So like you I want to claim for 2020\21 ie the whole previous financial year. I just did it, I just ticked both years as it allowed me to. I got

“ Claim complete

We will change your tax code”

So hopefully I’ll get something

I only got the choice of 2 radio buttons one was claiming for this year only 22/23 the other was for 21/22 and 22/23 so I clicked that one. So like you, I didn’t have the option to claim for earlier year.

Edited by CoolHands on Sunday 5th June 20:34

Edited by CoolHands on Sunday 5th June 21:27

Slightly OT but has anyone successfully claimed relief on WFH costs like fuel/electric, beyond the £6/week allowance? Given the current prices and the fact I’m permanently home based (as a full time employee, not self employed), it would be useful to claim relief on other expenses if feasible.

Edited by juggsy on Monday 6th June 09:17

juggsy said:

Slightly OT but has anyone successfully claimed relief on WFH costs like fuel/electric, beyond the £6/mth allowance? Given the current prices and the fact I’m permanently home based (as a full time employee, not self employed), it would be useful to claim relief on other expenses if feasible.

No, I thought 6 quid a week is the max? (not month?)jm8403 said:

juggsy said:

Sorry yes £6/week. This is the maximum without evidence, apparently you can claim further with evidence, but I’ve not done it as yet

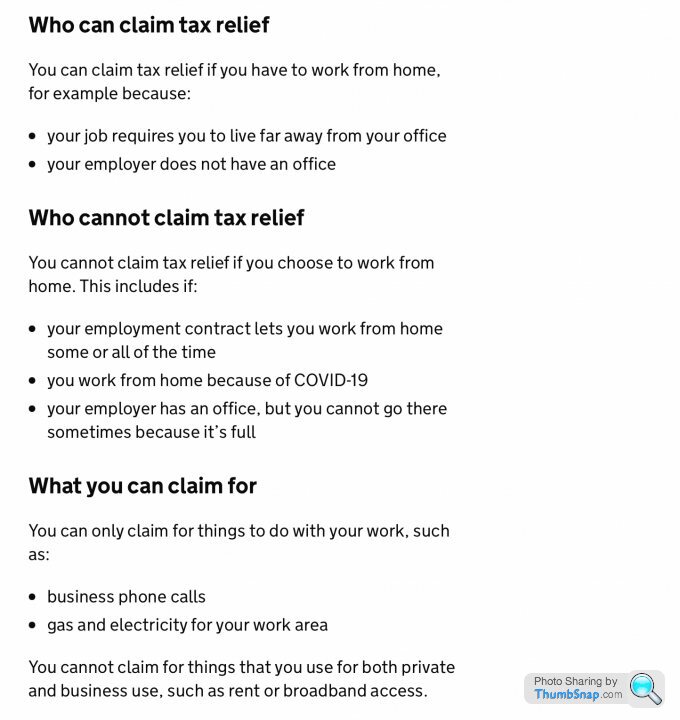

Did you read this or do you know someone who managed it?It's also made clear on the HMRC site that you can't now claim the £6 if you're working from home just because your contract allows you to, or because of Covid, or if you can't go to the office because it's too full.

You can only claim now if "your job requires you to live far away from your office", or "your employer does not have an office".

So that's quite a change from how it was for the past couple of tax years.

Link here: https://www.gov.uk/tax-relief-for-employees/workin...

PorkInsider said:

You can definitely claim for more than the £6, with evidence - it tells you on the HMRC site. Never tried it though and I WFH permanently (and have done for ~10yrs) as we have no office in the UK.

It's also made clear on the HMRC site that you can't now claim the £6 if you're working from home just because your contract allows you to, or because of Covid, or if you can't go to the office because it's too full.

You can only claim now if "your job requires you to live far away from your office", or "your employer does not have an office".

So that's quite a change from how it was for the past couple of tax years.

Seems like ive lost couple hundred quid thenIt's also made clear on the HMRC site that you can't now claim the £6 if you're working from home just because your contract allows you to, or because of Covid, or if you can't go to the office because it's too full.

You can only claim now if "your job requires you to live far away from your office", or "your employer does not have an office".

So that's quite a change from how it was for the past couple of tax years.

jm8403 said:

Seems like ive lost couple hundred quid then

You can still claim for past years working at home due to Covid, if that's what you're meaning?Just not 22/23 tax year onwards.

I added a link to my previous post: https://www.gov.uk/tax-relief-for-employees/workin...

PorkInsider said:

You can still claim for past years working at home due to Covid, if that's what you're meaning?

Just not 22/23 tax year onwards.

I added a link to my previous post: https://www.gov.uk/tax-relief-for-employees/workin...

Super - thank you. Will do it later then. That's exactly what I meant.Just not 22/23 tax year onwards.

I added a link to my previous post: https://www.gov.uk/tax-relief-for-employees/workin...

PorkInsider said:

You can definitely claim for more than the £6, with evidence - it tells you on the HMRC site. Never tried it though and I WFH permanently (and have done for ~10yrs) as we have no office in the UK.

It's also made clear on the HMRC site that you can't now claim the £6 if you're working from home just because your contract allows you to, or because of Covid, or if you can't go to the office because it's too full.

You can only claim now if "your job requires you to live far away from your office", or "your employer does not have an office".

So that's quite a change from how it was for the past couple of tax years.

Link here: https://www.gov.uk/tax-relief-for-employees/workin...

Thanks, I’m not sure what the definition of living far away from your office is, but I’ve been a permanent WFH employee for around 10 years as well as I don’t live near an office. It's also made clear on the HMRC site that you can't now claim the £6 if you're working from home just because your contract allows you to, or because of Covid, or if you can't go to the office because it's too full.

You can only claim now if "your job requires you to live far away from your office", or "your employer does not have an office".

So that's quite a change from how it was for the past couple of tax years.

Link here: https://www.gov.uk/tax-relief-for-employees/workin...

It does say in the link claiming for gas/electric in your work area, I just wasn’t sure the best way to calculate this and whether there were any other implications. Would you just claim for gas/electric during the working day? (Open question as PorkInsider I know you say you haven’t done it)

MrBig said:

I'm still trying to get my head around this. I started a new job in July 2020. Permanently home based as the office is 120 miles away. I thought I couldn't claim but wondering if that's not correct now?

You would certainly be able to claim for 20/21 and 21/22.I suppose it's a bit vague after that, given the new wording from HMRC "...requires you to live far away from the office" seems to imply that something about the job is making you live in a different place. So are they meaning, for example, when your company's office is in Newcastle but you're the area manager for Somerset and have to be in that area?

Who knows... typical HMRC vagueness!

juggsy said:

Thanks, I’m not sure what the definition of living far away from your office is, but I’ve been a permanent WFH employee for around 10 years as well as I don’t live near an office.

It does say in the link claiming for gas/electric in your work area, I just wasn’t sure the best way to calculate this and whether there were any other implications. Would you just claim for gas/electric during the working day? (Open question as PorkInsider I know you say you haven’t done it)

I did read up on it once and I recall something about estimating the total floor area of the property and then the floor area of the 'dedicated work space' - a room being used solely as an office for your work - and then apportioning a part of the utility bills based on that. I think there were caveats around things like not claiming for broadband if that's used for both work and non-work, etc.It does say in the link claiming for gas/electric in your work area, I just wasn’t sure the best way to calculate this and whether there were any other implications. Would you just claim for gas/electric during the working day? (Open question as PorkInsider I know you say you haven’t done it)

I think I gave up at the point of realising my office floor area is not a big enough proportion of the entire house to make it worthwhile.

Eric Mc said:

There is no reason why you could not include the broadband fee as part of your claim - suitably apportioned, of course.

Couldn't the taxman say well you'd have broadband anyway for home/pleasure use so there's no extra cost in using it for business too?Unless the guy can say he had to buy a more expensive broadband package due to his business needs.

PorkInsider said:

I did read up on it once and I recall something about estimating the total floor area of the property and then the floor area of the 'dedicated work space' - a room being used solely as an office for your work - and then apportioning a part of the utility bills based on that. I think there were caveats around things like not claiming for broadband if that's used for both work and non-work, etc.

I think I gave up at the point of realising my office floor area is not a big enough proportion of the entire house to make it worthwhile.

Yeah I now remember reading the same but equally gave up, with the prices the way they now are I may do some quick spreadsheet maths and figure out if it’s worth claiming.I think I gave up at the point of realising my office floor area is not a big enough proportion of the entire house to make it worthwhile.

jonsp said:

Eric Mc said:

There is no reason why you could not include the broadband fee as part of your claim - suitably apportioned, of course.

Couldn't the taxman say well you'd have broadband anyway for home/pleasure use so there's no extra cost in using it for business too?Unless the guy can say he had to buy a more expensive broadband package due to his business needs.

jonsp said:

ouldn't the taxman say well you'd have broadband anyway for home/pleasure use so there's no extra cost in using it for business too?

Unless the guy can say he had to buy a more expensive broadband package due to his business needs.

Precisely. He could always claim that the package he uses is because he needs "X" amount of broadband capability to enable him to do his job.Unless the guy can say he had to buy a more expensive broadband package due to his business needs.

Claims can also include elements of other "fixed cost" expenses, such as Water Rates, Council Tax, Home Insurance etc.

And, just a warning, HMRC does not always state its own rules correctly on its web pages.

Gassing Station | Jobs & Employment Matters | Top of Page | What's New | My Stuff