Have you claimed on your track insurance?

Discussion

No I haven’t had an accident but wondering what the process is - I’d rather familiarise myself beforehand than have to frantically google search once my car is being loaded onto the back of a recovery truck!

I cover all my trackdays with Moris. If I ever have a major accident, are there any statements/paperwork/etc that I shouldn’t forget about?

Road policy is with Admiral - would I have to let them know?

Thanks

I cover all my trackdays with Moris. If I ever have a major accident, are there any statements/paperwork/etc that I shouldn’t forget about?

Road policy is with Admiral - would I have to let them know?

Thanks

I also use MORIS, and not had a claim yet.

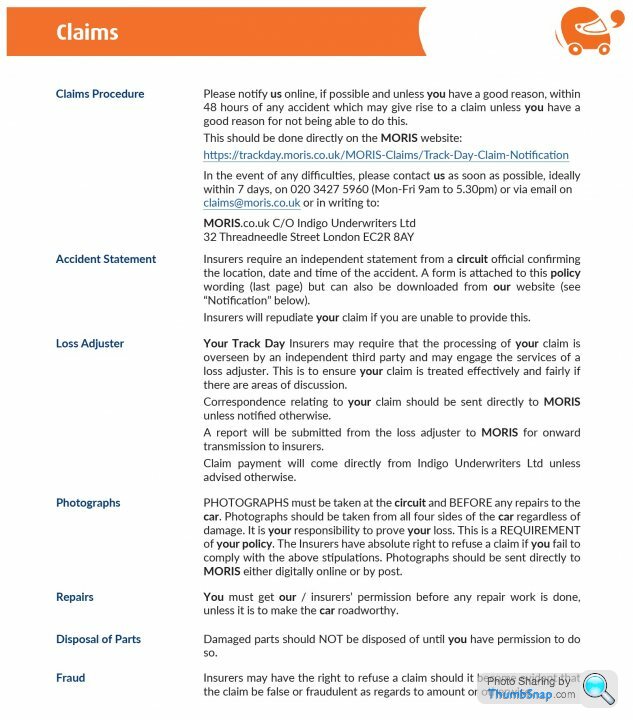

P15 track day policy wording contains a list of what you need...

There are also some 'claim' links/info on MORIS's own website... https://trackday.moris.co.uk/claims/claim-report-f...

P15 track day policy wording contains a list of what you need...

There are also some 'claim' links/info on MORIS's own website... https://trackday.moris.co.uk/claims/claim-report-f...

Edited by mmm-five on Friday 28th January 11:59

becareful about handing them any video footage, unless it is categorically as you stated. They only pay for the first bump, so if you hit the barrier front end first, then spin around and end up in the middle of the track to be bit by another car, you're only getting paid for the first hit. Although IIRC then is a clause you can add that covers all damage so make sure you tick that box

Dynion Araf Uchaf said:

becareful about handing them any video footage, unless it is categorically as you stated. They only pay for the first bump, so if you hit the barrier front end first, then spin around and end up in the middle of the track to be bit by another car, you're only getting paid for the first hit. Although IIRC then is a clause you can add that covers all damage so make sure you tick that box

Are you referring to a MORIS policy, or someone else, as I can't find anything like that in my policy documents.Dynion Araf Uchaf said:

becareful about handing them any video footage, unless it is categorically as you stated. They only pay for the first bump, so if you hit the barrier front end first, then spin around and end up in the middle of the track to be bit by another car, you're only getting paid for the first hit. Although IIRC then is a clause you can add that covers all damage so make sure you tick that box

Are you sure about this?! You hit something lightly,scratch on the bumper; continue sliding on the grass, hit hard, write off - only the first £1000 (of say tens of thousands of car value) is covered??

I claimed through Moris in 2019. It was a total loss claim for what was a £75k value and a nearly new car. Really straight forward and honest process, you just need to follow the steps that need to taken in what is an emotional and worrying time. Like house sales it can be stressful and sometimes things don't happen as quickly as you'd hope, but you do get there when all the boxes are ticked so it pays to be open, honest and proactive. If I wasn't happy with Moris I wouldn't continue to use them, but 2 seasons later I'm looking to book them to cover my 3rd.

ldn_mx5 said:

Are you sure about this?! You hit something lightly,

scratch on the bumper; continue sliding on the grass, hit hard, write off - only the first £1000 (of say tens of thousands of car value) is covered??

Yep, i almost came a cropper over this with them when I crashed my race car. IIRC there are two types of cover that you can chose and you need to chose the one that covers cumulative damage and not single damage. In your example you should be covered but in my example the secondary crash isn’t covered.scratch on the bumper; continue sliding on the grass, hit hard, write off - only the first £1000 (of say tens of thousands of car value) is covered??

ecain63 said:

Some road insurers won't cover cars that are used on track so you do risk being told you're no longer covered.

I’ve never heard that one before… Is that any particular companies?I know my road policy doesn’t cover track use but I don’t recall anything in the policy saying that if I take the car on track the policy could be voided.

What should I be looking for?

_Al_ said:

ecain63 said:

Some road insurers won't cover cars that are used on track so you do risk being told you're no longer covered.

I’ve never heard that one before… Is that any particular companies?I know my road policy doesn’t cover track use but I don’t recall anything in the policy saying that if I take the car on track the policy could be voided.

What should I be looking for?

Dingu said:

_Al_ said:

ecain63 said:

Some road insurers won't cover cars that are used on track so you do risk being told you're no longer covered.

I’ve never heard that one before… Is that any particular companies?I know my road policy doesn’t cover track use but I don’t recall anything in the policy saying that if I take the car on track the policy could be voided.

What should I be looking for?

When I was in my Alfa QF I had to change provider for exactly this reason. The wording in the Ts&Cs is not specific enough to say it is or isn't, but when I spoke to my insurer at the time (2017) they told me my insurance would be invalidated if I used it in any form of motorsport during the term of the policy. As I said above, you can always check with your provider should you wish. Lots of insurers check photo databases after a claim so they'll generally know who's been where.

ecain63 said:

The wording in the Ts&Cs is not specific enough to say it is or isn't, but when I spoke to my insurer at the time (2017) they told me my insurance would be invalidated if I used it in any form of motorsport during the term of the policy.

But track days aren't motorsport.The Ts & Cs will normally state that the car "is not covered for any form of motorsport, pace making or time trials" or something similar & if you aren't claiming on the policy for damage at a track day (because you accept the risk or cover elsewhere) then you are not in breach of them and the car is covered for road risks etc.

ecain63 said:

I spoke to my insurer at the time (2017) they told me my insurance would be invalidated if I used it in any form of motorsport during the term of the policy.

Which insurer was it, and who did you speak with? We’re you talking to the actual underwriter or their legal team?Not disputing what you’re saying at all but wondering if what you actually got was the opinion of someone in a call centre?

Edited by _Al_ on Saturday 29th January 08:12

ldn_mx5 said:

Are you sure about this?! You hit something lightly,

scratch on the bumper; continue sliding on the grass, hit hard, write off - only the first £1000 (of say tens of thousands of car value) is covered??

I was watching this thread with interest and these reports surprised me. I checked with Moris directly. Their response - if two impacts are part of ONE accident, both will (of course…) be covered. Car hits a barrier (first impact), bounces, comes to a halt in middle of track. Half a minute later another car hits the now-stationary car (second impact). Damages resulting from both impacts are covered.scratch on the bumper; continue sliding on the grass, hit hard, write off - only the first £1000 (of say tens of thousands of car value) is covered??

Different story if you have one accident in the morning and another in the afternoon.

px1980 said:

I was watching this thread with interest and these reports surprised me. I checked with Moris directly. Their response - if two impacts are part of ONE accident, both will (of course…) be covered. Car hits a barrier (first impact), bounces, comes to a halt in middle of track. Half a minute later another car hits the now-stationary car (second impact). Damages resulting from both impacts are covered.

Different story if you have one accident in the morning and another in the afternoon.

Unless it's a very long accident Different story if you have one accident in the morning and another in the afternoon.

The only damage I've had on track is from the tow chain breaking when being towed out of the gravel, and flying back towards the car...leaving a cracked numberplate and a nice dent in the boot (which the new numberplate hid quite well).

I did a few years ago at Brands.

20K with 10% excess with Morris.

Followed the claim guidelines noted above; signed report from TDO being main requirement.

Underwriter then wanted usual inspection at approved repair center to generate a repair cost.

In my case car was written off. Then the usual BS conversation with loss adjuster; We believe your car is worth x/2 etc. This was fairly easy to rebuff in my case. Payout was probably 3 weeks later.

No requirement to declare to your road policy. Also car damage is not recorded on register.

20K with 10% excess with Morris.

Followed the claim guidelines noted above; signed report from TDO being main requirement.

Underwriter then wanted usual inspection at approved repair center to generate a repair cost.

In my case car was written off. Then the usual BS conversation with loss adjuster; We believe your car is worth x/2 etc. This was fairly easy to rebuff in my case. Payout was probably 3 weeks later.

No requirement to declare to your road policy. Also car damage is not recorded on register.

phazed said:

Not on topic as such but don't forget to inform your insurer about mods to your car.

That certainly applies to your road insurance but I wonder how fussy they are with track day insurance, (how much a car is substantially modified for the track)?

One of the differences between an add-on to your road policy and a proper track policy.That certainly applies to your road insurance but I wonder how fussy they are with track day insurance, (how much a car is substantially modified for the track)?

Wouldn't matter for proper track insurance as you insure to cover a specified value and pay the premium based on that insured value.

So if your car is worth £20k, you could either decided that you'll only ever need £10k of cover to fix accident damage, and so you might pay £100/day and £1000 excess. If you decide to insure the same vehicle to its full £20k value, then your premium might be £170/day with a £2000 excess.

In the former case you'd only ever get a maximum of £9k payout (£10k minus excess), whereas the latter would get upto £18k (£20k minus excess)....and if the quote for repairs is £5k, you'll only get that (minus your excess).

Gassing Station | Track Days | Top of Page | What's New | My Stuff