Selling Property do I need a trustee?

Discussion

We’re almost 6 months into a property sale and our solicitors and the buyer’s solicitors are deadlocked. Buyer’s demanding we need to appoint a trustee, our solicitor’s saying we don’t need one. We’re about 4 weeks from the buyer’s mortgage offer running out so we’re up against it time wise.

The house was my Mom and Dad’s owned as tenants in common. Mom died in 2020 leaving her half of the house to my two siblings and I.

Dad died in January leaving his half to my two siblings and I. We applied for probate in May and it was granted 5 weeks later. At that point we marketed the house and sold it a few days after.

We’ve had terrible service from the conveyancer. The fantastic solicitor recommended on here had retired and we didn’t know any others to go with so chose the agents recommended one. The buyers hadn’t been any better to be honest so I’m unsure who to believe as they argue this out wasting time. Does anyone know under what circumstances a property transfer uses a trustee and does it sound like we need one? I’m just looking for information to be fore armed to convince one of the solicitors to take a pragmatic approach so we don’t miss the mortgage expiry and drag this out for even longer.

The house was my Mom and Dad’s owned as tenants in common. Mom died in 2020 leaving her half of the house to my two siblings and I.

Dad died in January leaving his half to my two siblings and I. We applied for probate in May and it was granted 5 weeks later. At that point we marketed the house and sold it a few days after.

We’ve had terrible service from the conveyancer. The fantastic solicitor recommended on here had retired and we didn’t know any others to go with so chose the agents recommended one. The buyers hadn’t been any better to be honest so I’m unsure who to believe as they argue this out wasting time. Does anyone know under what circumstances a property transfer uses a trustee and does it sound like we need one? I’m just looking for information to be fore armed to convince one of the solicitors to take a pragmatic approach so we don’t miss the mortgage expiry and drag this out for even longer.

I completely agree and think we’re at that stage.

I’m just trying to understand when a trustee is required so I can either tell the buyer to get on with it or tell my solicitor to suck it up and appoint one. At the moment I’m just seeing emails bounce back and forth between he two. One side saying we don’t need one and the other saying we do. Neither actually have any substance as to why to back up their point.

I’m just trying to understand when a trustee is required so I can either tell the buyer to get on with it or tell my solicitor to suck it up and appoint one. At the moment I’m just seeing emails bounce back and forth between he two. One side saying we don’t need one and the other saying we do. Neither actually have any substance as to why to back up their point.

None of this seems to make any sense. If probate has been granted and the house is either in the names of executors or has been transferred into the names of beneficiaries it can simply be sold.

Why does anyone think a "trustee" would be involved?

It is, of course, possible the Will said the house was to be put into trust for the beneficiaries. In that case either a trustee or trustees would need to be appointed in accordance with the Will or there would need to be a Deed of Variation to change the Will.

How was probate obtained?

Why does anyone think a "trustee" would be involved?

It is, of course, possible the Will said the house was to be put into trust for the beneficiaries. In that case either a trustee or trustees would need to be appointed in accordance with the Will or there would need to be a Deed of Variation to change the Will.

How was probate obtained?

Thanks all, this is really helpful.

To answer a few questions;

At the time of my mother’s death in 2020 my late father acted as executor. He didn’t transfer mom’s part of the house into the names of the beneficiaries, my two siblings and I. Because of that we needed probate when my father died in January.

I applied for and was granted probate. My siblings and I are executors and beneficiaries of my father’s will.

My solicitor has both my father’s and mother’s will and made reference to the fact the property was in both of their names and not the names of my siblings and I.

I doubt any trust was set up for IHT, the estate is well below IHT valuation and the bulk of the estate is the property which sold for £300,000.

My father’s will does mention my sister, brother and I being executors and trustees of the will.

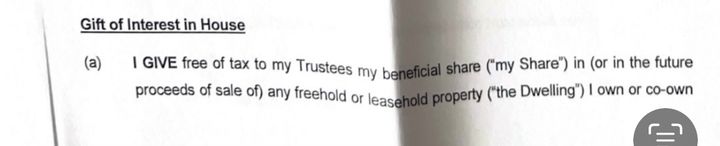

It then states;

So it may be that we need trustees as the property was never transferred to us on the land registry?

Again, thanks all for the help and advice.

To answer a few questions;

At the time of my mother’s death in 2020 my late father acted as executor. He didn’t transfer mom’s part of the house into the names of the beneficiaries, my two siblings and I. Because of that we needed probate when my father died in January.

I applied for and was granted probate. My siblings and I are executors and beneficiaries of my father’s will.

My solicitor has both my father’s and mother’s will and made reference to the fact the property was in both of their names and not the names of my siblings and I.

I doubt any trust was set up for IHT, the estate is well below IHT valuation and the bulk of the estate is the property which sold for £300,000.

My father’s will does mention my sister, brother and I being executors and trustees of the will.

It then states;

So it may be that we need trustees as the property was never transferred to us on the land registry?

Again, thanks all for the help and advice.

Was the intention that when your mother died, her half of the property be put into a trust for her beneficiaries (the picture implies that), if so it sounds like the trust was not setup and that half of property just left in your mothers name.

What happened regarding probate when your mother died and were the terms of her will followed?

Conversation with a probate specialist may yield some clarity as the buyers seem aware there should be a trust but wasn't setup.

If a trust is setup it needs to have at least one trustee plus beneficiaries, for the trust to be dissolved needs agreement of all parties including the trustee.

I would guess the buyers are assuming there is a trust in place, hence where is the trustee question because the trust needs to be disolved to allow the property to be sold.

Bit of a pickle that one.

What happened regarding probate when your mother died and were the terms of her will followed?

Conversation with a probate specialist may yield some clarity as the buyers seem aware there should be a trust but wasn't setup.

If a trust is setup it needs to have at least one trustee plus beneficiaries, for the trust to be dissolved needs agreement of all parties including the trustee.

I would guess the buyers are assuming there is a trust in place, hence where is the trustee question because the trust needs to be disolved to allow the property to be sold.

Bit of a pickle that one.

Edited by FMOB on Monday 28th October 17:22

I think this is the age old problem of people not completing all of the work at first death. The excerpt from the Will looks as if there was a trust to be formed but sounds like it wasn’t.

You should just be able to complete a deed of appointment of trustees and make those yourselves and sign anything that needs signing.

You should just be able to complete a deed of appointment of trustees and make those yourselves and sign anything that needs signing.

Thanks again all.

We spoke with a private specialist at dad’s death. They actually wrote the will and dealt with my mother’s estate on her death so I’m surprised this wasn’t picked up or dealt with properly at the time.

Either way it appears it’s our conveyancer that’s wrong and we need to do something about that.

Gives me some knowledge when I speak with her tomorrow so we can aim for pragmatism rather than battle winning.

Eta, when my mother died she left her half of the house to my siblings and I. She also left a proportion of her residual assets to us, split 50/50 between my father and us children. That was followed. What transpires is the solicitors dad used didn’t put my siblings and I on the title of the property.

We spoke with a private specialist at dad’s death. They actually wrote the will and dealt with my mother’s estate on her death so I’m surprised this wasn’t picked up or dealt with properly at the time.

Either way it appears it’s our conveyancer that’s wrong and we need to do something about that.

Gives me some knowledge when I speak with her tomorrow so we can aim for pragmatism rather than battle winning.

Eta, when my mother died she left her half of the house to my siblings and I. She also left a proportion of her residual assets to us, split 50/50 between my father and us children. That was followed. What transpires is the solicitors dad used didn’t put my siblings and I on the title of the property.

Edited by thisnameistaken on Monday 28th October 17:41

Caddyshack said:

I think this is the age old problem of people not completing all of the work at first death. The excerpt from the Will looks as if there was a trust to be formed but sounds like it wasn’t.

Yes indeed. The dangers of DIY. As you suggest, it should be a simple and quick fix with the right professional guidance although there will inevitably be some cost involved.The sooner you start, the sooner you finish.

Panamax said:

Yes indeed. The dangers of DIY. As you suggest, it should be a simple and quick fix with the right professional guidance although there will inevitably be some cost involved.

The sooner you start, the sooner you finish.

Thanks again for the help. Solicitor is on it today. The sooner you start, the sooner you finish.

For clarity, the only DIY has been me obtaining probate when dad died. When my mother died, and the trust should have been set up but wasn’t, dad used a local solicitor.

thisnameistaken said:

Panamax said:

Yes indeed. The dangers of DIY. As you suggest, it should be a simple and quick fix with the right professional guidance although there will inevitably be some cost involved.

The sooner you start, the sooner you finish.

Thanks again for the help. Solicitor is on it today. The sooner you start, the sooner you finish.

For clarity, the only DIY has been me obtaining probate when dad died. When my mother died, and the trust should have been set up but wasn’t, dad used a local solicitor.

Sorting out the mess from not having a trust setup might be less hassle!

thisnameistaken said:

Does anyone know under what circumstances a property transfer uses a trustee and does it sound like we need one?

Yes, you almost certainly will need to appoint a second trustee. I would expect that there is a Form A restriction registered against the title to the house, which reads:No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court.

This means that a sole owner cannot give a valid receipt for the sale proceeds, and it's therefore necessary to appoint an additional trustee so that the restriction is complied with.

This is such a basic rule of conveyancing that I should be amazed that your `solicitor' is even arguing about it. Unfortunately, the vast majority of conveyancing nowadays is not dealt with by solicitors but by paralegals with no qualifications or legal knowledge.

You should therefore ask your `solicitor' what legal qualifications they have. If they are actually qualified then they should be ashamed of themselves, and you should direct them to sections 2 and 27 of the Law of Property Act 1925. If they're not qualified then you need to escalate the matter to someone in the firm who is actually qualified and competent to deal with it.

Pro Bono said:

Yes, you almost certainly will need to appoint a second trustee. I would expect that there is a Form A restriction registered against the title to the house, which reads:

No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court.

This means that a sole owner cannot give a valid receipt for the sale proceeds, and it's therefore necessary to appoint an additional trustee so that the restriction is complied with.

This is such a basic rule of conveyancing that I should be amazed that your `solicitor' is even arguing about it. Unfortunately, the vast majority of conveyancing nowadays is not dealt with by solicitors but by paralegals with no qualifications or legal knowledge.

You should therefore ask your `solicitor' what legal qualifications they have. If they are actually qualified then they should be ashamed of themselves, and you should direct them to sections 2 and 27 of the Law of Property Act 1925. If they're not qualified then you need to escalate the matter to someone in the firm who is actually qualified and competent to deal with it.

They should be ashamed of themselves for not having found a way forwards, but I don’t think it’s quite as simple as you are making out. If I have picked up.OP’s comments correctly, I guess the situation is probably that there are two executors of the deceased sole proprietor, and the debate will be whether or not the purchaser buying from those two executors overreaches the trust interests in the property, or not – i.e. whether two executors of a sole deceased proprietor of the legal estate count for the purposes of overreaching, or whether (as the joint executors of the deceased sole proprietor) they do not. No disposition by a sole proprietor of the registered estate (except a trust corporation) under which capital money arises is to be registered unless authorised by an order of the court.

This means that a sole owner cannot give a valid receipt for the sale proceeds, and it's therefore necessary to appoint an additional trustee so that the restriction is complied with.

This is such a basic rule of conveyancing that I should be amazed that your `solicitor' is even arguing about it. Unfortunately, the vast majority of conveyancing nowadays is not dealt with by solicitors but by paralegals with no qualifications or legal knowledge.

You should therefore ask your `solicitor' what legal qualifications they have. If they are actually qualified then they should be ashamed of themselves, and you should direct them to sections 2 and 27 of the Law of Property Act 1925. If they're not qualified then you need to escalate the matter to someone in the firm who is actually qualified and competent to deal with it.

I can’t remember what the answer to that is of the top of my head but I have a feeling that a sale by two executors of a deceased sole proprietor will not overreach, because (in basic terms) their powers cannot exceed those of the deceased proprietor for whom they are the personal representatives.. Somewhere in the back of my memory banks, I think the answer is found in one of the Trustee acts rather than LPA 1925.

To the OP, though surely the way forward is simply to appoint an additional trustee and get the sale over the line! It’s often just a very transient thing – appointed at completion and then they just to make sure the sale proceeds go to those entitled, job done.

Thanks both. That makes a lot of sense and fits with what’s been said. As of yesterday both sides have agreed to complete without a trustee based on how the title of the property is registered meaning whilst the will requires a trustee and the buyers solicitor expecting there to be one, the property wasn’t correctly registered meaning one is not needed. My parents used the same solicitor for conveyancing of the two properties they had prior to my mothers death, LPAs and will for my mother and father and also probate and sale of one of the properties when my mother died so given this was all the same company I’d have thought it’d have been correct.

Truth be told, I’m still dubious of my current conveyancer so whilst things appear to be moving and gathering speed I’m still cautious.

Truth be told, I’m still dubious of my current conveyancer so whilst things appear to be moving and gathering speed I’m still cautious.

thisnameistaken said:

Thanks both. That makes a lot of sense and fits with what’s been said. As of yesterday both sides have agreed to complete without a trustee based on how the title of the property is registered meaning whilst the will requires a trustee and the buyers solicitor expecting there to be one, the property wasn’t correctly registered meaning one is not needed. My parents used the same solicitor for conveyancing of the two properties they had prior to my mothers death, LPAs and will for my mother and father and also probate and sale of one of the properties when my mother died so given this was all the same company I’d have thought it’d have been correct.

Truth be told, I’m still dubious of my current conveyancer so whilst things appear to be moving and gathering speed I’m still cautious.

Sounds like you might have enough grounds to challenge the bill if they've charged you for the email ping pong with the other side's solicitor. One to keep in your back pocket perhaps.Truth be told, I’m still dubious of my current conveyancer so whilst things appear to be moving and gathering speed I’m still cautious.

Gassing Station | Speed, Plod & the Law | Top of Page | What's New | My Stuff