Discussion

I'm finding fewer and fewer Insurers are asking for proof. Maybe they can see something on the database along the lines of insured for 20 years continuously and no claims.

Still the same variations in some companies allowing 7 years max for NCB, others 9 years and others allowing you to select the correct number of years.

Still the same variations in some companies allowing 7 years max for NCB, others 9 years and others allowing you to select the correct number of years.

I change my insurance each year in order to get the best deal (and to get the cash back for new policies).

This year I chose LV. They informed me that they'd "automatically validated" my no claim history, which was nice.

I assume there's a central database available to insurers to check one's claims history. Anyone know if that's true?

This year I chose LV. They informed me that they'd "automatically validated" my no claim history, which was nice.

I assume there's a central database available to insurers to check one's claims history. Anyone know if that's true?

This topic often crops up. Insurance company’s have different procedures. Trying to get details from an old policy can sometimes be very difficult. Motor trader, company cars, classic car policies don’t count etc etc. No matter what type of policy, if you have never had an accident or made a claim it should be simple to prove it.

Surely there should be a data base set up to find out if someone has made a claim or been convicted of a driving offence.

Surely there should be a data base set up to find out if someone has made a claim or been convicted of a driving offence.

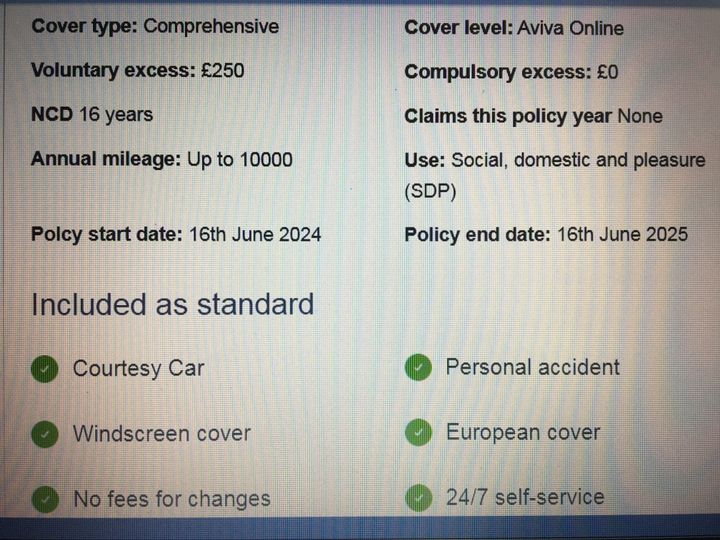

Screenshot of part of my renewal I recieved this week, I've done this for years ever since it was hard work once when I changed companies and getting proof of ncb although its a long time since I've been asked so maybe it is recorded somewhere.

Knowing this I wonder how many people claim ncb that they don't have to reduce the cost, maybe it would only be a problem in the event of a claim.

My renewal is £14 more this year, worth it just for the ability to make any changes without incurring an admin fee.

Knowing this I wonder how many people claim ncb that they don't have to reduce the cost, maybe it would only be a problem in the event of a claim.

My renewal is £14 more this year, worth it just for the ability to make any changes without incurring an admin fee.

alscar said:

E-bmw said:

It doesn't help you now, but this is exactly why I keep the one page that is the insurance certificate from each year.

Although that would only prove you had Insurance for that year and not whether you had made a claim or indeed had any NCB applicable surely ?ETA.

Sorry, I see what you mean, I answered before reading the full answer.

They allow me to prove who I was with & can at least go back to any/all if I need to for proof, plus all are online these days, making it even easier.

Edited by E-bmw on Wednesday 22 May 10:38

E-bmw said:

But the next year's would, which is why I keep them all.

ETA.

Sorry, I see what you mean, I answered before reading the full answer.

They allow me to prove who I was with & can at least go back to any/all if I need to for proof, plus all are online these days, making it even easier.

Yup , agree. ETA.

Sorry, I see what you mean, I answered before reading the full answer.

They allow me to prove who I was with & can at least go back to any/all if I need to for proof, plus all are online these days, making it even easier.

Edited by E-bmw on Wednesday 22 May 10:38

vikingaero said:

I'm finding fewer and fewer Insurers are asking for proof. Maybe they can see something on the database along the lines of insured for 20 years continuously and no claims.

Still the same variations in some companies allowing 7 years max for NCB, others 9 years and others allowing you to select the correct number of years.

They know pretty much everything anyway - I was getting a phone quote a few years ago and told them I’d had a claim in November 2016 but I didn’t know how much for. He told me. So despite asking he had the info. Still the same variations in some companies allowing 7 years max for NCB, others 9 years and others allowing you to select the correct number of years.

Similarly on renewal this year - they already knew about my SP30 and the quote was already adjusted.

Dog Star said:

vikingaero said:

I'm finding fewer and fewer Insurers are asking for proof. Maybe they can see something on the database along the lines of insured for 20 years continuously and no claims.

Still the same variations in some companies allowing 7 years max for NCB, others 9 years and others allowing you to select the correct number of years.

They know pretty much everything anyway - I was getting a phone quote a few years ago and told them I’d had a claim in November 2016 but I didn’t know how much for. He told me. So despite asking he had the info. Still the same variations in some companies allowing 7 years max for NCB, others 9 years and others allowing you to select the correct number of years.

Similarly on renewal this year - they already knew about my SP30 and the quote was already adjusted.

Gassing Station | Speed, Plod & the Law | Top of Page | What's New | My Stuff